In a few days, we could get the first confirmation that the US economy is in a recession.

I’ll let the economists argue over what a recession truly is. If you believe in the textbook definition of a recession — two straight down quarters for GDP — then you may get your answer in the second-quarter GDP report next week.

This isn’t a note about what a recession is, though. Or even if we’re heading for a recession — we could be if spending slows down and the job market weakens. What may matter most to your portfolio is how much of a recession has been priced in.

This week, it became apparent that markets see some light at the end of the tunnel.

What could be

As an investor, the way you interpret a market can depend on what could be instead of what is. Often, markets can anticipate headlines — like a disappointing earnings report or an encouraging jobs number — before they actually happen. In the end, expectations can matter more than reality.

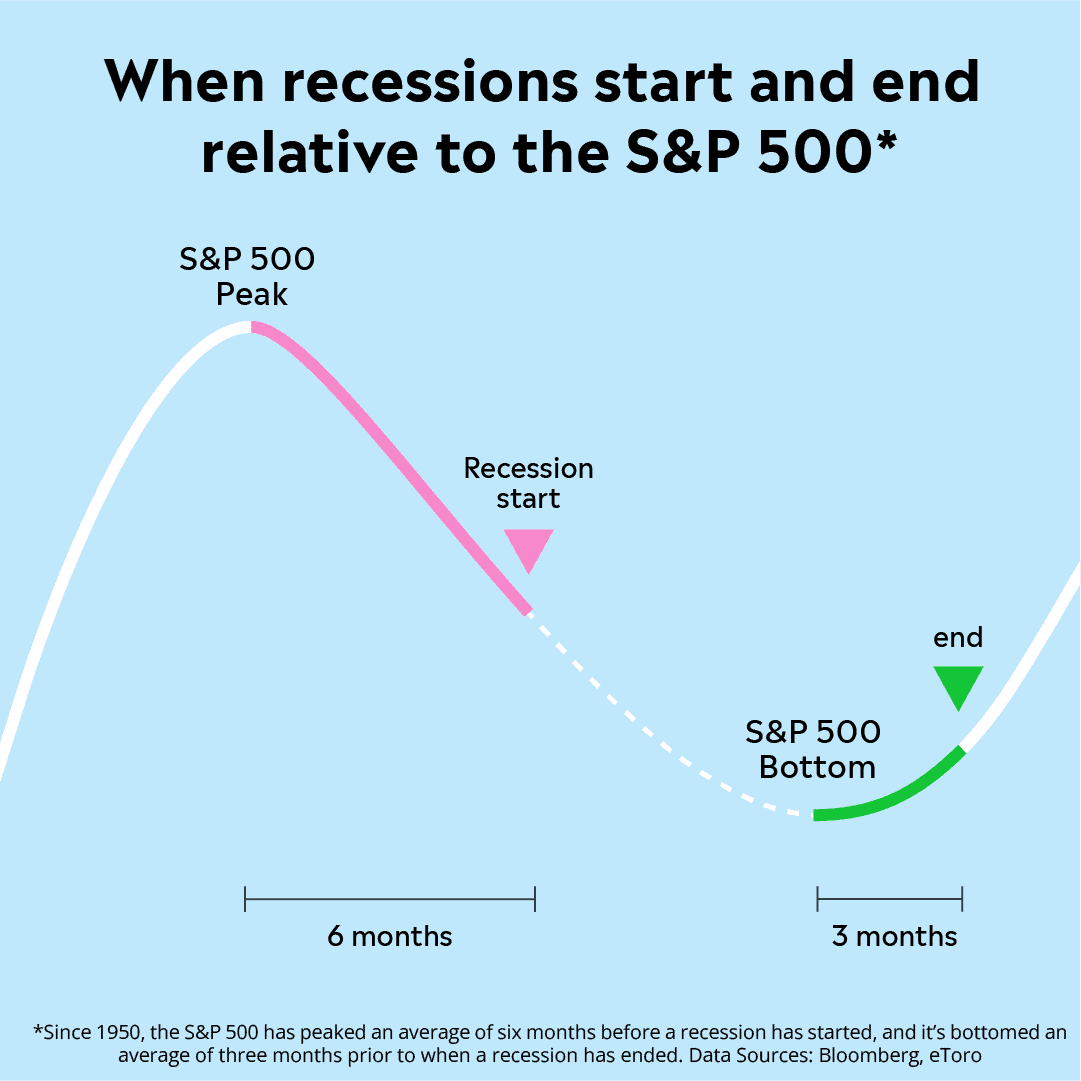

History has shown us that’s especially true when it comes to economic cycles. In the 11 recessions since 1950, the S&P 500 has peaked an average of six months before the economy has entered a recession. The same can happen on the other side, though. Since 1950, the S&P has bottomed an average of three months before a recession has ended. Often, when the environment feels extra painful, the market is already looking ahead.

Just take a look back at headlines from March 2009, when the S&P 500 bottomed after the financial crisis. The unemployment rate was near 10%, the stock market had already been cut in half, and then-Fed chair Ben Bernanke warned that “more would need to be done” to stabilize the financial system. Still, that’s when the S&P 500 started its historic 11-year bull market, and, in hindsight, it was a generational buying opportunity if you stayed the course.

A break in the bear’s rage

Today, we find ourselves facing higher fear, yet seemingly lower stakes. The biggest question on Wall Street is if a recession is on the way, and if so, just how bad it could be. We haven’t seen the job market or earnings crumble like we have in past crises. The main worries are about inflation and the Fed’s ability to tame it through aggressive rate hikes and sharp messaging.

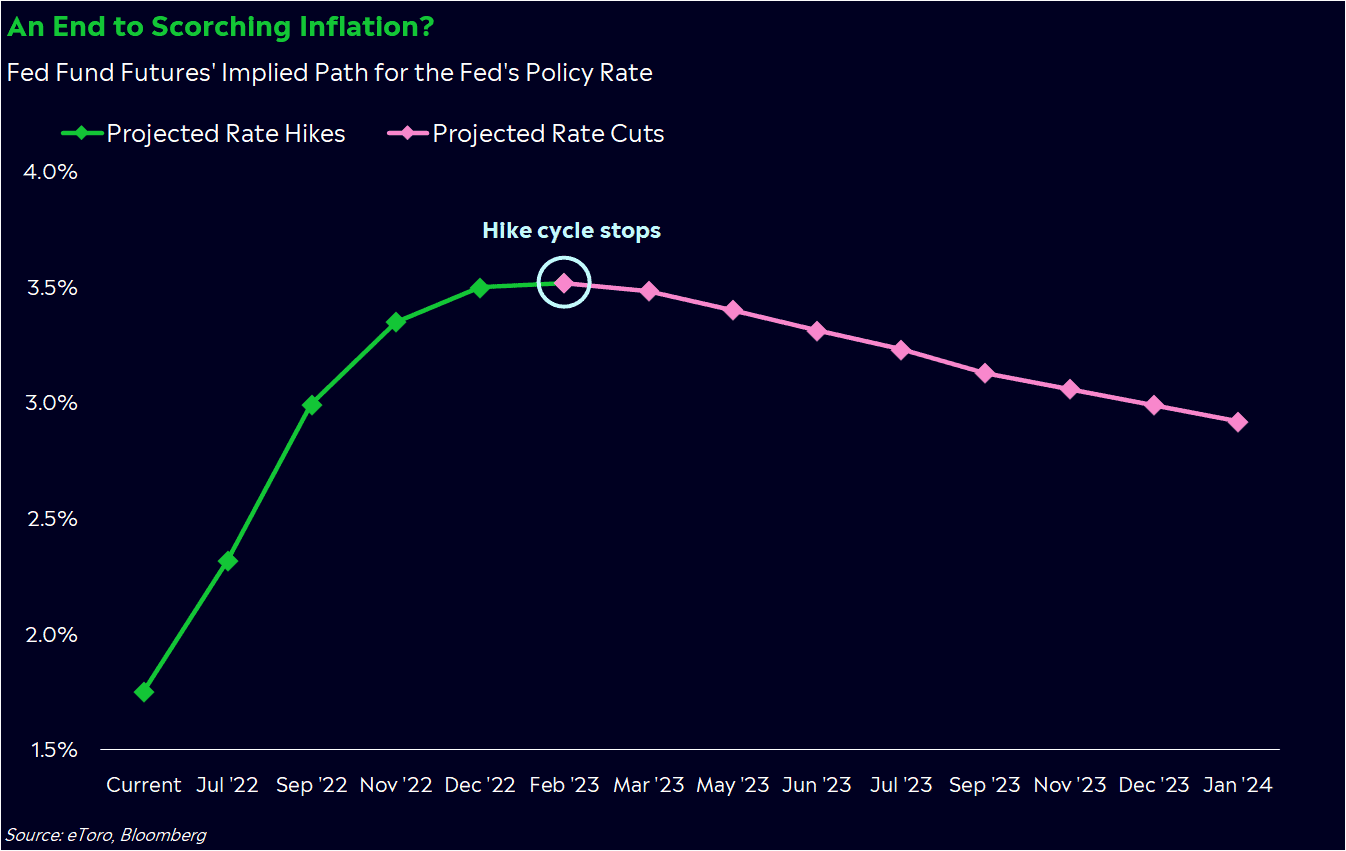

But we may finally be seeing a break in the bear’s rage, even if the economic story could get more painful from here. Institutional investors are now positioning for the Fed to start cutting rates around March of next year, according to Fed fund futures.

Presumably, the Fed would need to cut rates to boost growth, which means we could be in for weakness. Maybe even a recession. Still, markets see this expectation of rate cuts as a nod to the end of scorching inflation — or what started this selloff in the first place. We may be in the thick of an economic crisis, but investors see a light at the end of the tunnel.

Now, don’t get me wrong — recessions are incredibly painful periods for the economy, markets, and humanity. There are often layoffs, missed debt payments, and business closings. We’ve seen a bit of that already, and I don’t want to make light of what could happen. If we’re not in a recession now, we may be on the precipice of one, so make sure your financial house is in order.

However, parts of the market may have already accounted for this pain. Tech companies have owned most of the layoff headlines, and the tech-heavy Nasdaq 100 has dropped as much as 33%. Retailers, one of the most susceptible industries to an economic downturn, have fallen as much as 35%. The weakness could spread into other sectors — in fact, that’s one of the biggest risks the market faces right now. But if tech has already taken a recession-sized hit, could it be the first sector to signal that the selloff is over?

It’s a good question, especially after what we’ve seen so far this month. Tech stocks and crypto have perked up, even though the economy continues to weaken and Wall Street’s mood reaches its lowest in over a decade. Investors aren’t acting as surprised by negative news — even if it’s a historically high inflation reading. And this week, the S&P 500, Nasdaq 100, and the Dow broke above their 50-day moving averages, an important technical line that may act as support for the indexes. This could be a bear market rally, especially if inflation stays high. But even if it is, consider it a test run for what a true market turn could look like.

Stock market ≠ economy

Gross domestic product data coming out next week could confirm that the economy is in recession (although I like to wait for the National Bureau of Economic Research to call a recession before I’m convinced). If that’s the case, we could be in for more layoffs, muted spending, and potentially a decline in corporate earnings, if past recessions are any guide. Even the realization that we’re in a recession could be a risk to the economy.

But it may be time to put the semantics aside. The stock market isn’t the economy. Therefore, the stock market often doesn’t move with the economy. In fact, it’s usually a few steps ahead. Today may not be the time to brace for recession, but a chance to start thinking about what a market recovery could look like. If you’re acting too defensive in this environment, you may miss the early days of the rally.

*Data sourced through Bloomberg. Can be made available upon request.