We’re living in crazy times.

For that, you can point to a bunch of different catalysts: the Fed, inflation, the pandemic, Russia, the crypto meltdown…it’s a long list.

But one sneaky market catalyst could be the options market. Last week, options volume reached its highest level in history, and there’s been a spike in short-term trading within options — a change that could be fueling those big stock swings we’re all processing.

Even if you don’t trade options, here’s why you might want to at least pay attention to them.

How options could move your stock portfolio

The options market is a small but mighty world. Often, options flows can turn into feeding frenzies that eventually spread into the stocks you own.

Here’s how it works. When you buy or sell options, you’re not always trading with another investor. In most instances, you’re actually transacting with a big vendor called a market maker — a firm that’s obligated to take the other side of trades, no matter what they are. Market makers exist so you can make investments without wondering if you can actually find a participant to trade with you.

Market makers have to manage their own risks, though. If a lot of people are making the same options trade and the market maker has to take the other side of their trades, the market maker may have to buy or sell stock to balance out its position.

For market makers, the stakes can be even higher with short-dated options. Daily and weekly options can be more volatile than more traditional monthly options, and investors are utilizing shorter options more often this year to hedge and speculate around events. Options data firm SpotGamma estimates that 50% of S&P 500 options volume is in daily and weekly expirations. More precise hedging is a good thing, but it can make event-driven market moves even more volatile.

And let’s not forget that people also have more information at their fingertips than ever before — including insights into options trades on individual stocks and ETFs. You have to consider how other investors are positioned when watching markets because the domino effect is real, especially these days.

It all can mix into the perfect cocktail for explosive volatility.

A wild day

Let’s rewind the clock back a few days to November 10. October inflation data came out, and markets soared. It was the S&P 500’s 15th best day since 1950, which seemed extreme considering inflation is getting better, but it’s still nowhere near normal. The reaction didn’t really match the news.

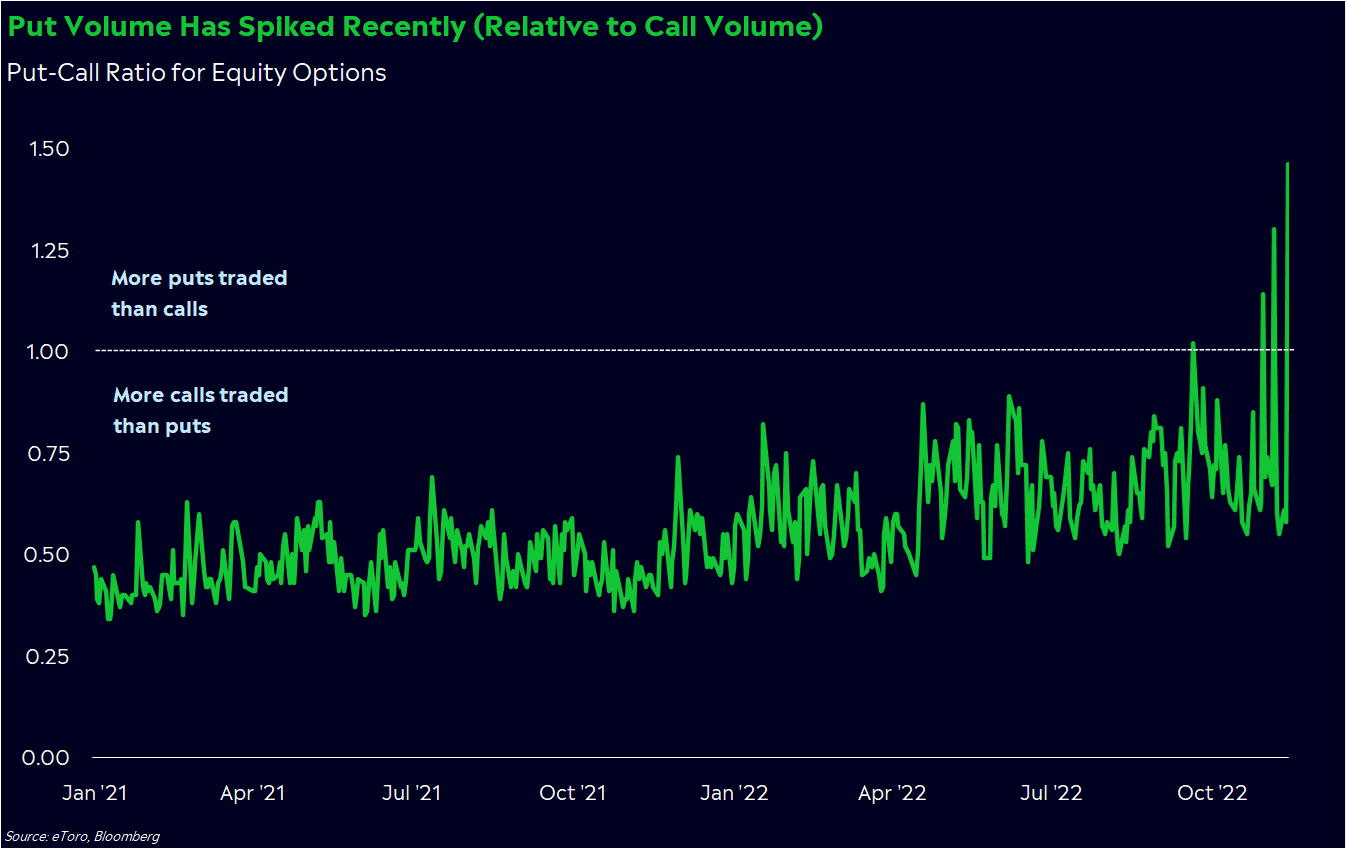

There was a lot going on underneath the surface, though. November 10 was the fifth-biggest day for options volume in history. Put volume jumped relative to calls in the days beforehand, a signal that people were loading up on hedges in anticipation of something.

When the CPI report came in better than expected, those people likely unloaded their hedges all at the same time, causing a chain reaction of market makers adjusting their own positions. According to the CBOE —one of the biggest options exchanges — 19 out of the 20 most active options that day were set to expire on Friday.

To be clear, some of this could be a self-fulfilling prophecy. That day, people started trading options en masse because of the inflation data. But after a while, the market’s meteoric rise likely pushed others to re-adjust their own positions, and it snowballed.

This re-positioning phenomenon may be a boon on big up days, but it can be just as dangerous on down days. On January 21 — the biggest day for options volumes this year — the S&P dropped 2% in the last five hours of the day.

It’s also hard to tell when options volume will move in your favor or not. Consider October 13:the day that September inflation data was released. Options volume surged that day as the S&P fell 2% in the first five minutes of trading, then rallied 5% through the end of the day. That kind of swing hadn’t happened since October 2008.

How to handle the swings

Markets are extra crazy these days for reasons beyond the actual headlines.

So how do you handle your own portfolio in such an unpredictable environment?

Check the vibes. Remember when I said we have a ton of information at our fingertips? You can use that to your advantage. The VIX is the market’s fear index, and it can signal how much people are using one-month S&P 500 options to protect their portfolios (although short-term options are rendering it less useful).

Put-call ratios — the number of puts traded relative to the number of calls over a given period of time — can show when there’s a surge in short-term emotion or hedging activity. And open interest — a measure of how many options contracts have been bought and held on a particular stock — may give you clues as to what time periods and future prices options traders are bracing for.

Understand the moment. Many investors seem to be worried about the Fed’s plans for rates. Well, the Fed has said repeatedly that it’s using economic data to gauge what to do next. Unsurprisingly, that means there’s a lot of market speculation around events, especially inflation and jobs data.

It may be like this for a while, too. We’re deep in a bear market and may be teetering on the edge of recession. Under these circumstances, crazy days may be more of a feature than a bug.

Make a plan. You can’t control the market, but you can control how you react to it. Think about how big market moves impact your decision-making and goals, and how you can manage your own emotions in the process. It’s rarely a good idea to time the market, but today, it’s more difficult than ever to feel confident about what the market could do next.

*Data sourced through Bloomberg. Can be made available upon request.