There seems to be one common thread weaving through all the issues the markets care about: debt.

The Fed is trying to control the economy with it, politicians are arguing over it, and banks can’t seem to manage it.

Debt is often seen as a poisonous thing — a sign of financial irresponsibility, or the avenue you turn to when you don’t have any cash on hand. When debt levels soar, we tend to see scary-looking charts and figures pop up, and Congress is launched back into tense negotiations.

Debt isn’t all that bad, though.

And right now, the fear of debt could be worse than the debt itself.

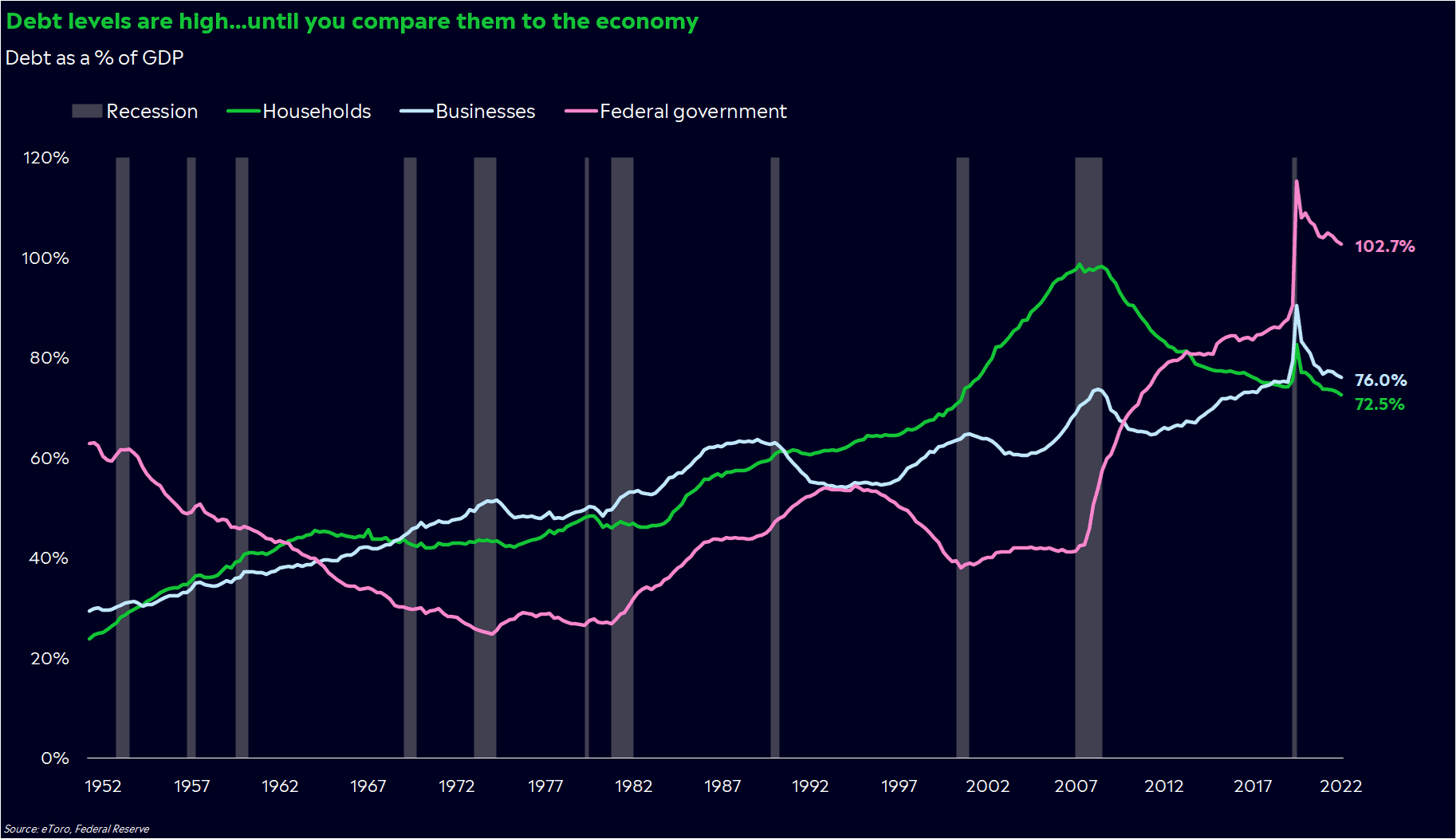

Debt levels are high… until you compare them to the economy

Fact: the federal government is sitting on $31 trillion of debt. US companies are holding about $20 trillion in debt. US households? $19 trillion.

Those are big numbers, and they can look scary at first glance. But what if I told you that they’re actually low compared to historical standards?

They are, if you view the numbers in context of how much the economy has grown. Business and household debt has dropped dramatically when compared to gross domestic product. That’s not typically what we see before recessions — in fact, we see the opposite as the economy slows and people turn to debt for financial support.

These data points hold a lot of weight when you think about the durability of the economy. And this is another reason why the debt ceiling is so controversial, considering the fact that the national debt has now exceeded GDP.

The debt ceiling is an arbitrary limit on how much debt the federal government can take on. There’s no context on the value of assets and cash that the government has on hand, the economic value that’s created from taking on debt, or its ability to use debt as a tool because it has plenty of willing borrowers.

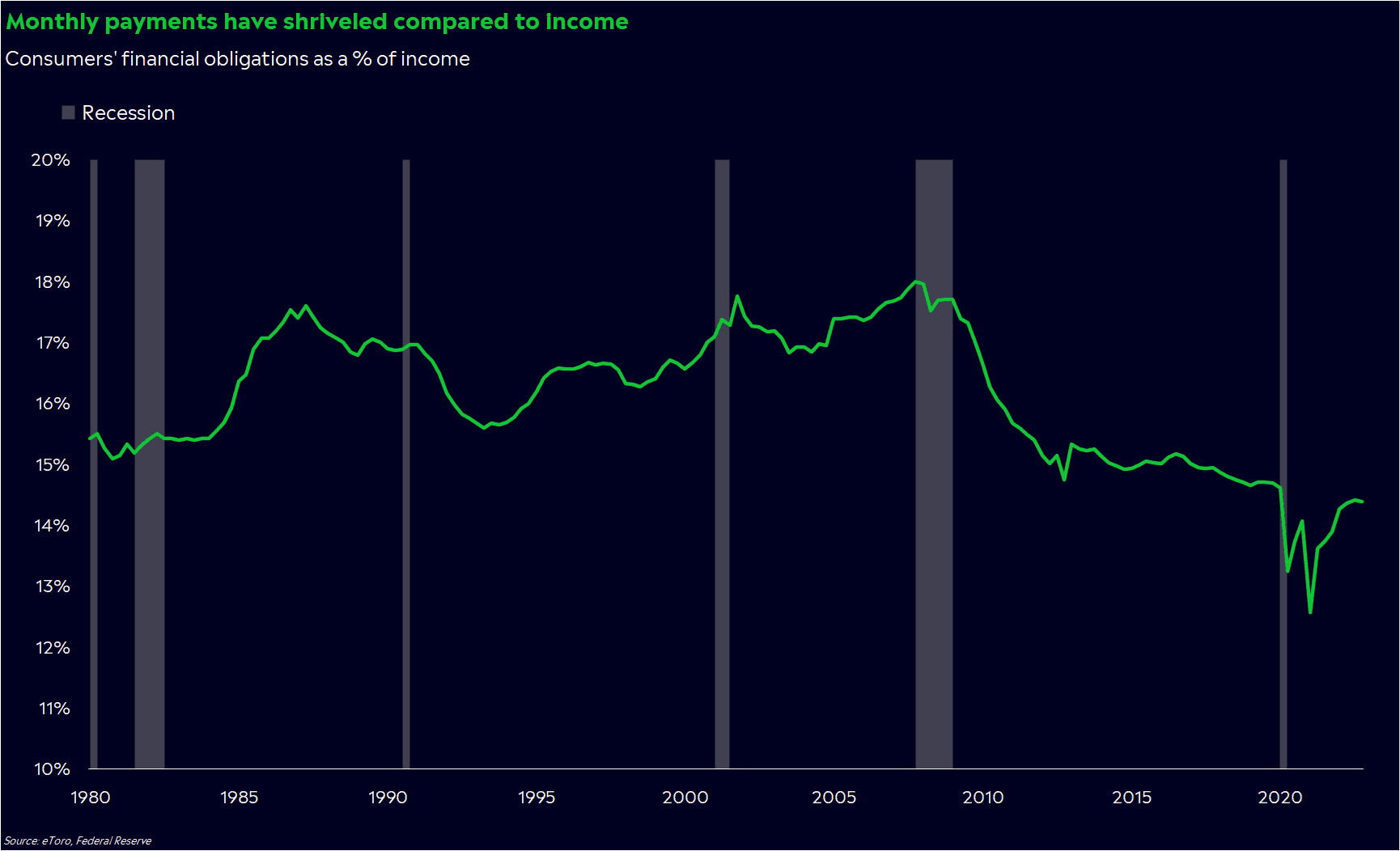

Businesses and consumers are using debt responsibly

Debt among households and businesses has dropped when you compare it to economic growth. But more importantly, debt levels have shriveled when compared to incomes. Americans are making more money, and they’re spending less of it on our debt payments.

Consumers’ financial obligations are the smallest share of their income since at least the 1980s. Mortgage and credit card delinquencies are the lowest in decades. Same with businesses: S&P 500 companies’ debt interest payments are just 8% of earnings, the lowest percentage in eight years.

Much of this is due to the wild rate environment we’ve experienced. Rates were low throughout the 2010s, with the 10-year yield rarely crossing above 3%. Then, the Fed cut rates even further in response to the COVID pandemic, sparking one of the biggest debt binges among households and companies in history.

But it was clearly more strategic than desperate. Incomes grew as well, and people saw the chance to capitalize on low rates. Now, their incomes are higher across the board, but their debt payments have largely stayed the same.

You can also thank the banks for this — they’ve become much more picky about who and what companies they loan to since the global financial crisis.

It hasn’t been easy for everyone. Credit card balances and delinquencies have risen for lower-income consumers, according to New York Fed data. They’ve been hit harder by inflation, even though their wages have grown at a relatively quick pace.

But in retrospect, the desire to borrow at low rates helped build a strong financial foundation that’s helped us weather a storm of rate hikes and scorching inflation. And if we do tip into recession, moderate debt levels could help keep it fairly tame.

Speaking of rate hikes…

Rate hikes matter less when debt isn’t an issue

The US economy — as a whole — is less reliant on debt, even though borrowing has risen since COVID began. It’s great news for the economy, but it makes the Fed’s goal of controlling inflation much harder to achieve.

Why? Because a good portion of outstanding debt is fixed at lower rates for a long time. According to Corelogic, 99% of US mortgages are fixed with rates below 6%. That’s significant, considering mortgages comprise about 70% of total household debt. And about 95% of corporate debt is fixed, with an average rate near 4% and an average maturity of 10 years. If your main tool is squeezing demand through borrowing channels, you need borrowing demand to use it.

Of course, the Fed has more tools at its disposal, and its efforts are working. Look around you — they’ve slowed the economy and cooled inflation. But it’s taking a lot longer than some thought, and the sheer amount of fixed debt could be why.

Debt can still stress markets out

Unfortunately, this statement feels all too familiar these days. This week, Treasury Secretary Janet Yellen warned that the federal debt limit could be reached by June 1, giving Congress about a month to negotiate the debt ceiling.

Small banks are increasingly falling under duress, and that could impact your ability to get a new loan. Fed chair Jay Powell noted on Wednesday that officials are paying special attention to borrowing conditions, and businesses have started noticing stricter loan requirements. Tightening lending conditions could eventually lead to layoffs and lower profits.

And honestly, it’s getting a little tense in markets. Gold prices are up 13% since March 8, and 3-month Treasury yields are a full percentage point higher than 1-month yields. It seems like debt ceiling and bank fears are converging into one massive ball of unquantifiable risk — one that could hit our portfolios soon.

Debt is a reason why the U.S. is a powerful player in the global economy, and it’s critical to preserve the U.S.’ creditworthiness. It’s not just spending at stake — it’s jobs and consumer confidence over a number with little context. And for what it’s worth, debt to GDP is actually falling because of inflation.

So what does this mean for you?

Evaluate your opinion on the economy. Debt could be the root of all the angst in markets. But should it be? On the whole, businesses and consumers are managing their debt loads well.

Prepare for more debt ceiling drama. Congress has a knack for taking things down to the wire, and markets’ reaction to debt ceiling headlines could get more intense as we get closer to the deadline. The S&P 500 dropped 17% in the 2011 debt ceiling crisis, so it’s worth thinking about what you’d do if stock and crypto prices fell from here.

Focus on quality companies and investments with rates this high and economic obstacles on the horizon.

*Data sourced through Bloomberg. Can be made available upon request.