This week, we’ve witnessed a horrific situation unfold in the Middle East.

After so much global disruption, this could feel like a breaking point — both in your life and in your portfolio. After all, we’re processing strikes, political struggles, high interest rates, and economic uncertainty. And now, an unspeakable tragedy.

Change and uncertainty are two constants in the world of investing

In times like this, you have to honor your emotions while staying grounded in your financial goals.

Easier said than done, but hopefully I can offer a few encouraging thoughts.

A cold truth

We’ve lived through — and mourned — significant tragedy over the past few years, yet we’ve had to learn one of the coldest truths about investing: Markets tend to follow the trajectory of the economy and earnings over time.

That’s why the stock market has almost doubled since the depths of 2020. If you sat out of the market until the world felt settled, you would’ve missed that entire rally.

So as we navigate another set of tragic headlines, it’s important to state this up front.

Your feelings are valid, and the economic impact will likely dictate where stock and crypto prices go next. It’s a difficult — yet important — dynamic to grapple with as you balance your humanity with your investing goals in these dark days.

Here’s what you should consider on that front:

The US economy is incredibly resilient right now. Jobs are abundant, unemployment is low, and inflation is slowing. Not only that, but corporate profits could have already recovered from this year’s dip, if Wall Street’s estimates prove correct. There’s a lot to be optimistic about, even though the pressure on the economy is immense.

Geopolitical events can have an impact on markets, too. This week, we’ve seen a small jump in oil prices, which makes sense given that 26% of global oil supply comes from the Middle East. Higher oil prices could mean we pay even more at the pump, which could impact Americans’ spending patterns.

We may also see investors flee to the most conservative corners of markets, like bonds and gold. And international tensions could theoretically make the Fed more cautious, which may be a relief to those worried about the sting of higher rates.

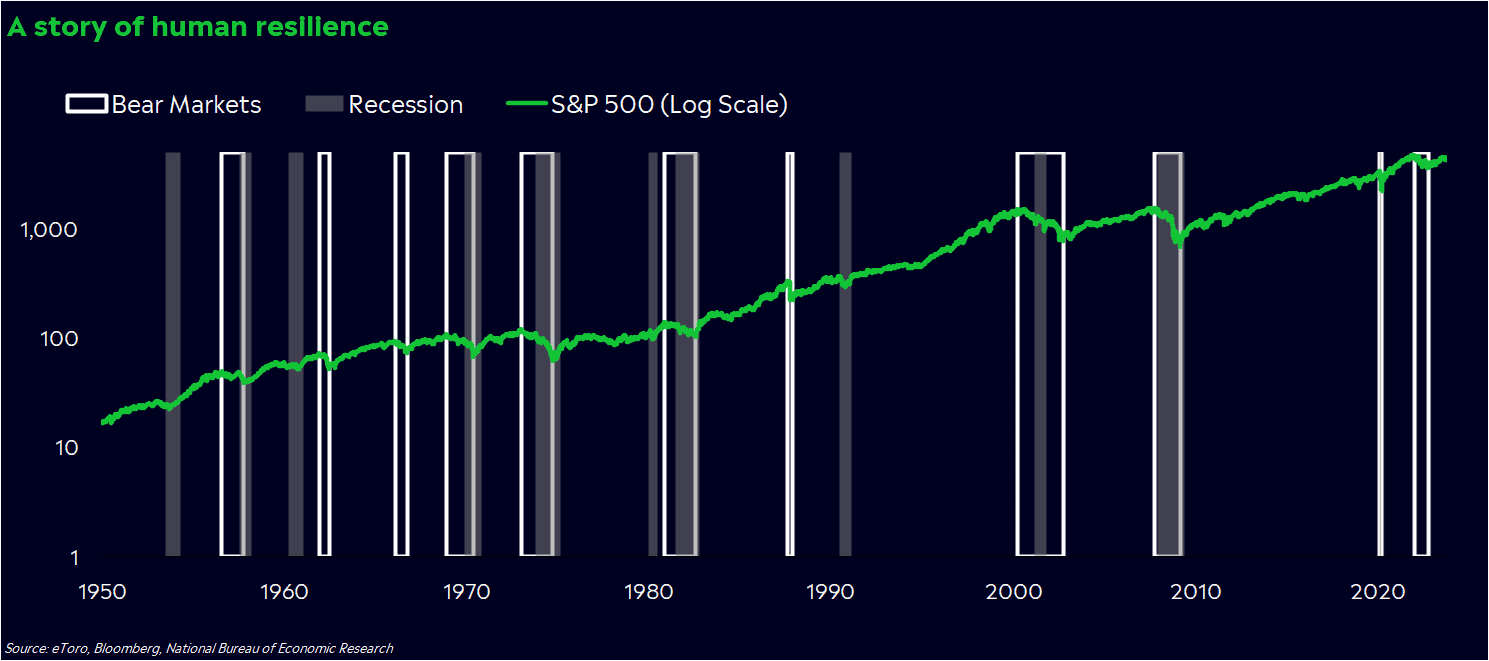

A story of human resilience

For now, though, the economic cost looks limited, even though the human costs are unfathomable. That’s why stock and crypto markets seem so out of touch with reality.

But it’s important to remember that the stock market is a story of human resilience. Cycles of joy and pain have been the heartbeat of the stock market for decades. Humans innovate, businesses adapt, profits rise, shares increase. Then, a crisis hits. We react, we mourn, and then we rebuild.

The numbers tell the story. Even though the S&P 500 has grown about 8% per year since 1950, there have been 33 drops of 10% or more, and 11 drops of 20% or more. Over that time, society has made its way through countless wars, financial crises, and humanitarian disasters. Yet stock prices made it out higher every time.

Yes, society is in the thick of what seems like another insurmountable tragedy. Still, it’s crucial to separate your feelings from your financial needs.

Risk requires stepping into the unknown. It rarely feels like a comfortable time to invest, yet the market’s track record speaks for itself.

In periods of uncertainty, we learn to control what we can control, and let go of what we can’t. One way to take the emotion out of investing is through a dollar-cost averaging approach, in which you invest a set amount of money on a regular basis — not on feelings or headlines.

If you’re worried about the future and have short-term goals, it might be time to move into cash or less risky investments. No risk is worth your sanity.

Most importantly, remember that you — and your portfolio — are more resilient than you think.

*Data sourced through Bloomberg. Can be made available upon request.