With so much going on in the crypto space — from the Bitcoin ETFs that started trading in January, to last month’s halving — there’s a lot to keep track of. And although it can be easy to get lost in the short-term shuffle, it often pays to zoom out and remember the bigger picture. With that in mind, let’s look at a few of the recent developments in crypto, and expected changes yet to come.

It’s been a bumpy run since the Bitcoin halving in mid-April. While Bitcoin and Ethereum hit their highs in mid-March and are now lower, they are still up 54.5% and 31.5% year to date, respectively, and 139% and 64% in the past 12 months.

The price action on these major cryptos has been volatile more recently, but remember, it’s healthy to see an asset price consolidate after a big run. Markets are cyclical, and consolidation often sets the stage for upcoming movements.

Is the Bitcoin halving over?

Since Bitcoin completed its halving on 4/20, there seemed to be some post-halving boredom settling in, with the crypto asset price hovering consistently around $62,000. That said, its recent move to the $65,000 range following Wednesday’s inflation report showed the crypto asset’s sensitivity to key market indicators.

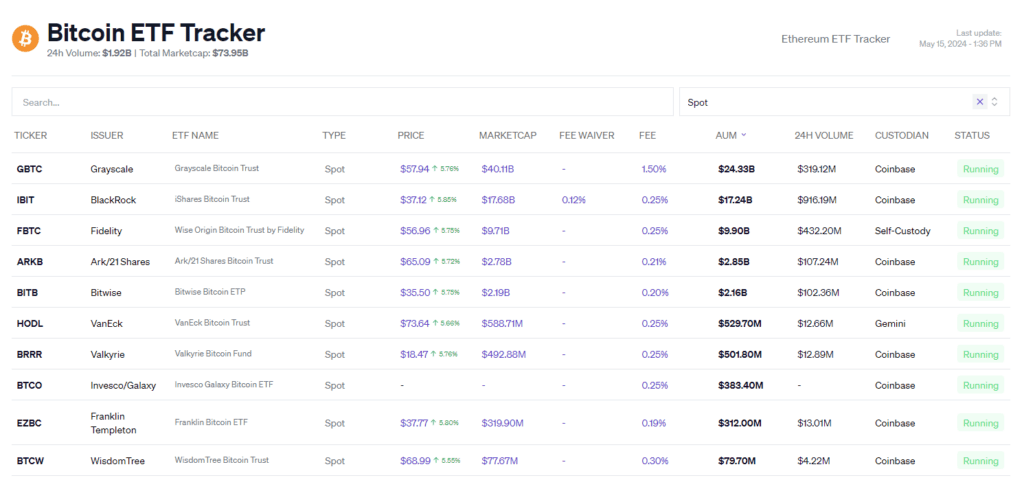

For their part, BTC ETFs enjoyed massive, consecutive days of inflows leading up to the halving event, but there have since been record outflows from the relatively new BTC ETF class.

However, many longer-term crypto investors remain hopeful, expecting a post-halving rally that would follow the patterns of Bitcoin’s historic post-halving price moves. As illustrated below, Bitcoin has rebalanced to new all-time high within several months of past halving events.

But is the regulatory landscape blocking a new breakout for crypto?

Regulatory Heat

Over the past few years, government agencies have been increasingly leveraging the US legal system in an attempt to curb bad actors in the nascent crypto industry.

The Department of Justice successfully prosecuted several high-profile cases against large industry players, including Binance, FTX and Terra. Binance CEO Changpeng Zhao, commonly known as CZ, was recently sentenced to four months in US prison. FTX’s Sam Bankman Fried was sentenced to 25 years for fraud. And Terra’s Do Kwon, whose failed stablecoin project ‘Terra Luna’ is seen to have set off a wider crypto collapse in 2022, was found guilty for fraud as well.

The U.S. Securities and Exchange Commission, or SEC, has filed lawsuits against several large crypto companies, including Coinbase, Kraken, Binance, and Ripple.

Most recently, Robinhood received a ‘Wells notice’ early last week, indicating intended regulatory action. The company’s share price rebounded after a short dip, showing that its investors aren’t overly concerned about this development for now. But with other crypto firms also reporting similar Wells notices, it seems the SEC intends to continue in this direction.

Will the breadth of legal action involving the crypto industry scare off new investors and prevent industry growth? Or will these court cases help refine the industry’s policies and lead to more wide-scale adoption?

The jury’s still out.

The Case for an Ethereum ETF

Since the SEC’s approval of the Bitcoin ETFs in January, industry eyes have been on what’s to come next. Several providers have ETH ETF applications under review by the SEC, with a decision expected by end of May. But the SEC, who responded to Bitcoin ETF applications with multiple questions and clarifications, have been uncharacteristically silent ahead of their decision deadline.

And this past week, Grayscale withdrew their application for an ETH ETF, without waiting for the SEC decision due in less than two weeks. Now, many analysts are predicting that we may not see an ETH ETF until after the presidential election.

But an ETH ETF already exists – in Hong Kong.

The ‘other’ ETFs

ETH and BTC ETFs were recently approved and debuted in Hong Kong, but the reaction wasn’t as bullish as investors would have hoped — particularly given the way Bitcoin traded ahead of the SEC’s approval for Bitcoin ETFs, and the subsequent rally in Q1.

The Hong Kong-based BTC ETFs posted $8.5 million in volume, with the ETH ETFs pushing $2.5 million – well below initial expectations for more than $100 million in volume. This disappointing debut has been explained by the difficulties faced by international investors in passing the local KYC (know your customer) requirements, which often reject users who don’t have local ID cards.

Meanwhile, US-based bitcoin ETFs are showing over $70 billion in market cap. So despite current availability abroad, a US-based ETH ETF would be expected to have a much more significant effect on the crypto asset’s price.

Interest rates as a potential catalyst

Investors continue to keep an eye on interest rates, as they can have a significant impact on stocks, bonds, currencies, and crypto.

When the Fed raises rates, that’s considered to be a tightening of financial conditions. Conversely, when the Fed cuts rates, they are in effect loosening financial conditions, by making it cheaper to borrow money and therefore increasing liquidity.

Increased liquidity is generally viewed as a positive for riskier assets like stocks and crypto. And with the Fed on watch for a potential rate cut following cooling inflation reports, we may see increased liquidity sooner than expected.

The presidential election

Over the course of the past two years, crypto has moved from being seen as an apolitical, cross-party issue to one where Republicans are seen as more favorable to crypto, and Democrats less so.

That said, the SEC has come under fire from both Democrats and Republicans in Congress, as well as other government agencies such as the Commodities Futures Trading Commission (CFTC), for what is perceived as regulatory overreach.

A Trump win may be seen as being better for crypto — particularly as he recently endorsed Bitcoin, a sharp reversal from his prior stance.

In the case of a Biden victory and re-election, there are those that wonder if he will make changes to the SEC leadership that has been active during his current presidency and led to a chilling environment for crypto in the US.

There’s no doubt that the crypto markets will react to the upcoming elections, but it remains to be seen which presidential candidate will actually create a better environment for crypto innovation.

The bottom line

It can be easy to get lost in the news and day-to-day price action, especially when it comes to investments in the crypto space. The industry has seen a lot in the last few months — from court cases to new ETFs — and still faces new catalysts on the horizon.

The Bitcoin halving cycle has only just begun, with its new ETF volume increasing overall demand and allowing for institutional investors to get in on the action.

ETH ETF approvals on the US side would help spike demand for that crypto asset, too. While demand from Hong Kong has been disappointing thus far, the ETF approval there is a step in the right direction.

With the halving expected to weigh on bitcoin supply, this dynamic — higher demand and lower supply — may be a positive for BTC over the longer term, and eventually ETH as well.

Do your crypto investments reflect your expectations for the future of these assets? How do recent events affect your outlook? Share your thoughts in our feed and check your portfolio to make sure your holdings match your crypto strategy.