A year of market turmoil, recession fears, and solvency crises has us questioning everything we know about money.

Where do you keep your money? What do you do with your money? Can you trust who stores your money? What even is money?

While some of these are deeper, philosophical questions that I can’t answer in one article, it’s fair to say that the financial system we’ve become accustomed to is changing right before our eyes. Decentralized finance is compelling, yet somehow, 2022 proved that basic premises of traditional finance work best when the world feels shaky and uncertain.

Last year was all about getting back to the basics. But in a way, we took a few steps forward by understanding how both types of finance shine.

Speed vs. friction

There seems to be a lot of friction when you do things with money. And let’s be honest, it’s annoying. If you’ve opened a bank account, taken out a mortgage, invested your money, or just bought something recently, you know exactly what I mean. Trades take days to settle, bank transfers could require a phone call, and loans require a mountain of paperwork.

But some of this friction is intentional. Financial firms want to understand who they’re doing business with and what risks they’re taking by handling your money. While due diligence takes time, it can ultimately lead to a safer, more secure experience for all parties involved.

Zero-bound interest rates and an instant gratification society allowed us to think more about return and less about risk. Now, we’re learning why discretion matters on both sides. Fintech firms are starting to pull back on staffing and spending in order to shore up their finances, and we’re all starting to feel the after-effects of our COVID-era spending binges.

To be clear, speed still matters. One of the best aspects of decentralized technology is its ability to break down barriers, and situations like the Ukraine crypto drop taught us the power of quick and efficient transactions in moments of dire need.

But as we build out the future of money, we can’t overlook the need to slow down and check the appropriate boxes before making a decision.

The dollar’s dominance

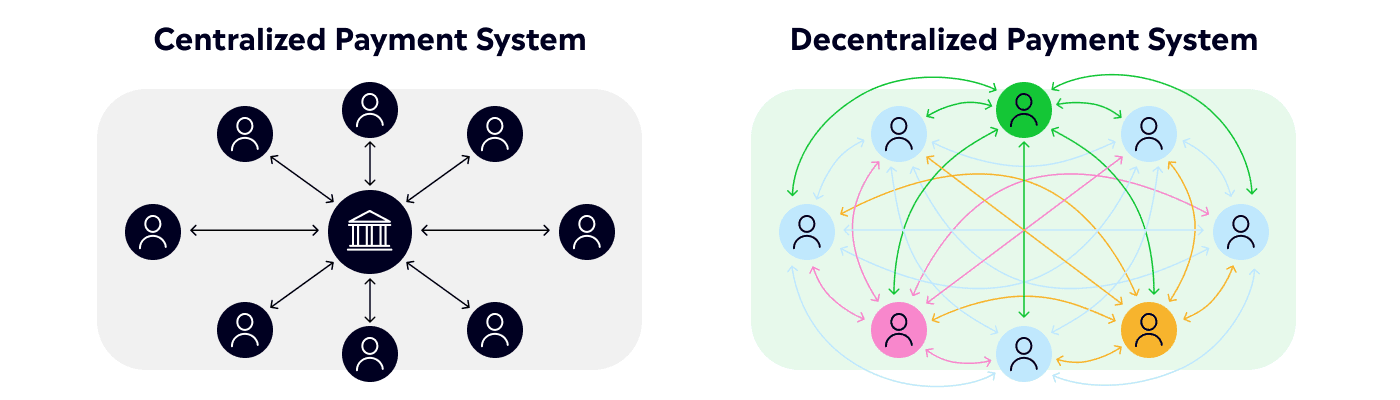

You’ve probably heard of the power of network effects — or when a concept gains value just because more people use it. With money, a strong network is crucial. After all, money is just an acceptance of some form of payment between multiple parties.

At one point, there was a lot of talk about Bitcoin dethroning the US dollar as the reserve currency of the world. But 2022’s chaos sent us back to the dollar, backed by an extensive system of assets and central bank support. According to International Monetary Fund figures, about 60% of all central bank foreign exchange reserves are denominated in dollars. The New York Fed estimates that about half of all cross-border loans, international debt and trade invoiced are done in dollars. In consumers’ minds, you couldn’t get any safer than a piece of money you can hold in your hand. Thus, the rush into dollar-denominated assets.

Crypto’s network effects are blossoming, but 2022’s selloff taught us the importance of a currency’s economic value — namely assets, cashflows, and government support. So far, no digital currency has been able to come close to the amount of acceptance and reliance we’ve seen for other major currencies. And when crypto prices slid, other currencies barely shrugged. Cryptocurrencies may need to build that same economic foundation for wider acceptance.

Trust issues

Trust is the bedrock of a healthy financial system. And boy, have we had some trust issues lately.

Over the past few decades, many people have lost trust in the traditional finance system (for a number of understandable reasons). Crypto promised to fix TradFi trust issues by utilizing the blockchain. By definition, transactions executed on the blockchain are trustless because the system verifies every action. There’s no intermediary in the process, just code.

But the past few years have shown that trustless finance may not be easily trusted, either. Crypto is notorious for security flaws, and recent events have proven that bad intentions can seep into any system. And with 2022’s volatility, we realized the value of centralized systems. Transactions on a centralized platform can be cheaper and more efficient because there are more parties to trade with. Plus, there’s a sense of security you can get from using a larger, more regulated firm (if you’re willing to trust that particular firm). After all, FDIC and SIPC insurance exists for savings and brokerage accounts, but only at regulated firms.

Today, trust comes with tradeoffs.

What happens next?

2022 was painful for both traditional and decentralized finance, and it reminded us of the importance of friction, foundation, and trust. But in a way, it encouraged me more that both systems could co-exist together, instead of one superseding the other.

Crypto has some growing to do, and it may be too soon to call it a true currency. But decentralization — the primary tenet of crypto — is as alive as ever before. Inflation was historically high, geopolitical ties were severed, and global regions grew further apart. Yet in a year of turmoil, crypto allocations steadily grew, according to our Retail Investor Beat global survey (which included 1,000 U.S. investors). People want a better solution, and they see the potential in decentralized finance.

To get there, we may just need to free ourselves from zero-sum thinking. The new system may be both traditional and decentralized instead of one or the other.

And that arrangement could be best for everyone.

*Data sourced through Bloomberg. Can be made available upon request.

**The Q4 2022 Retail Investor Beat was based on a survey of 10,000 retail investors across 13 countries and 3 continents. The following countries had 1,000 respondents: UK, US, Germany, France, Australia, Italy and Spain. The following countries had 500 respondents: Netherlands, Denmark, Norway, Poland, Romania and the Czech Republic.