The past week was negative overall in crypto markets, as the majority of cryptocurrencies registered losses. Over the weekend and this morning, some cryptos showed a recovery, including XRP, which led the top 10 with gains of more than 5% as of the time of writing. Several developments over the past week have impacted crypto prices and this week promises to have some major financial events that could also promote volatility.

Today’s Highlights

- Bitcoin below $8,000

- EOS settles with SEC

- The week ahead

Bitcoin Falls Below $8,000

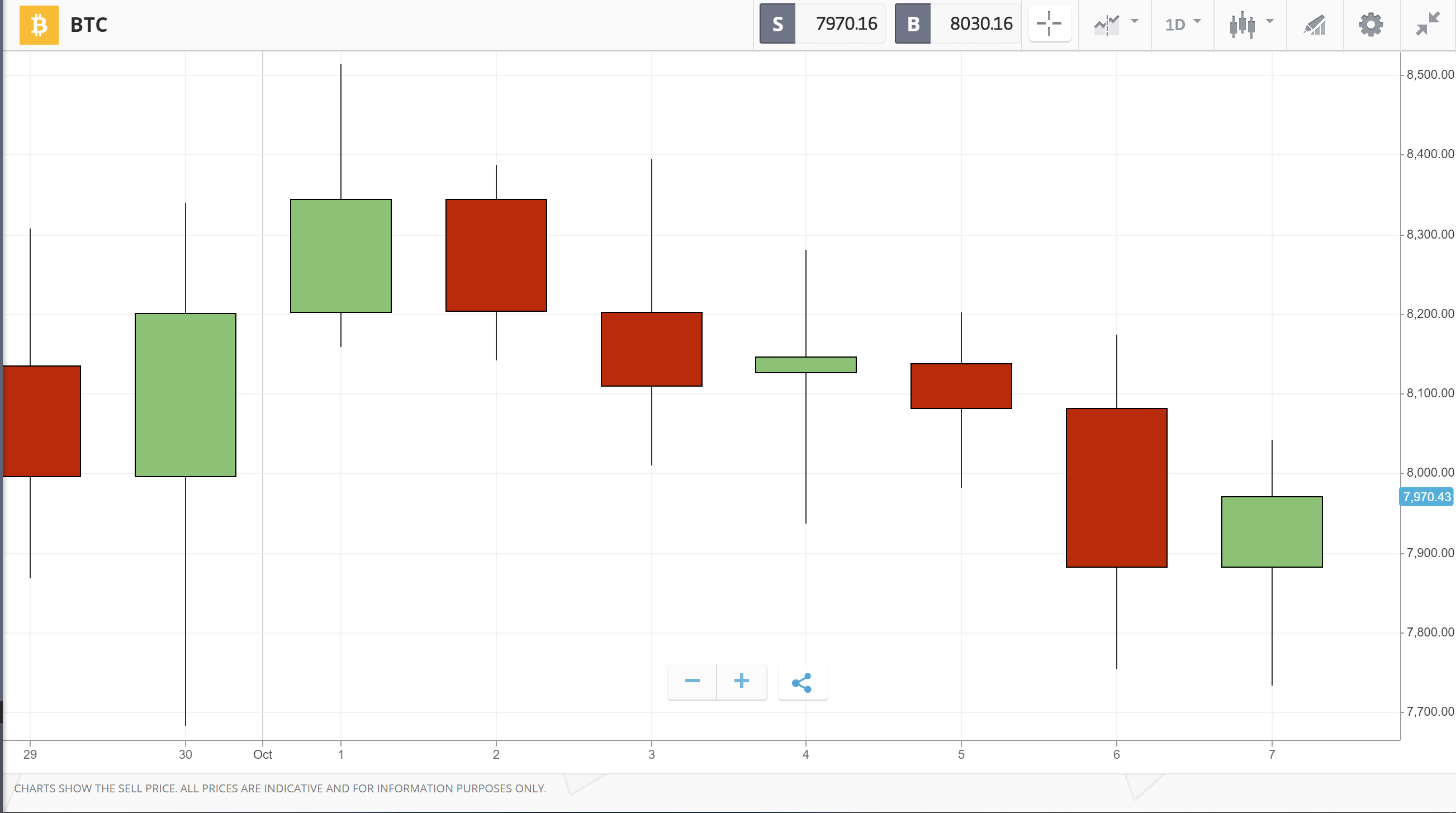

For the third time in the past two weeks, the world’s largest crypto by market cap dropped below the $8,000 mark. Bitcoin fell below the price level yesterday and has been seesawing above and below it ever since. Technical analysts are now watching closely, as technical analysis shows that slipping to $7,120 could open the door to a bear market.

However, currently, Bitcoin has recovered some of the losses recorded yesterday, staying away from the ominous price level.

EOS Settles with SEC

Last week started with some relatively good news for Block.one, maker of EOS. The blockchain developer, which is currently also working on a blockchain social network, was charged by the SEC with the sale of unregistered securities following its ICO, in which it raised $4.1 billion. As part of a settlement, Block.one was slapped with a $24 million fine. However, the sum is still just a fraction (0.58% to be exact) of the total money it raised.

The settlement announcement was followed by a spike. However, EOS remained volatile throughout the week, as the graph above suggests. And yet, at the time of writing, EOS was up around 6% for the week.

The Week Ahead

The eyes of the world will turn to the trade talks between the US and China, which will resume this Thursday. While the consequences of these talks are more prone to impact mainstream markets, cryptos may also be affected, as the negotiations could cause volatility, or induce calm, depending on their outcome. Moreover, Fed Chair Jerome Powell will be behind a microphone no less than three times this week, and if he provides clues regarding future monetary policy, or even crypto specifically, this could impact markets. In addition, minutes from the latest FOMC meeting will be published on Wednesday, potentially providing the same kind of clues and generating volatility.

eToro USA LLC; Virtual currencies are highly volatile. Your capital is at risk.