Coming off a volatile weekend, which saw Bitcoin’s price seesaw back and forth before settling around $9,600. The crypto market is set for an interesting week, which could test its popularity against mainstream markets. The sentiment varies among crypto enthusiasts, as some believe it is headed for a downturn, while others say it could go as high as $20,000 before the end of the year. A trial involving iFinex that starts today could also have an impact on markets.

Today’s Highlights

- Trading volumes on the decline

- Libra gaining popular traction

- Central banks to impact markets this week

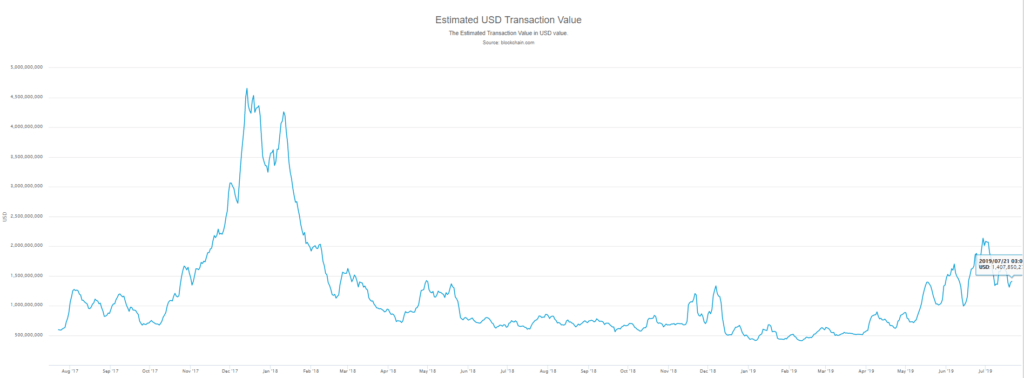

Pump down the volume

The last week’s bearish swing in crypto markets probably discouraged many of the more casual traders, as trading volumes hit lows not seen in more than a month. Despite several new announcements that placed crypto in the spotlight, such as Bakkt starting to test Bitcoin futures and Goldman Sachs owned Circle taking its crypto business global, the market was stagnant and volumes remained subdued.

Our very own Senior Analyst Mati Greenspan discussed recent market movements and the hype surrounding crypto on this Blockchain on Booze panel last Thursday.

Libra becoming a household name

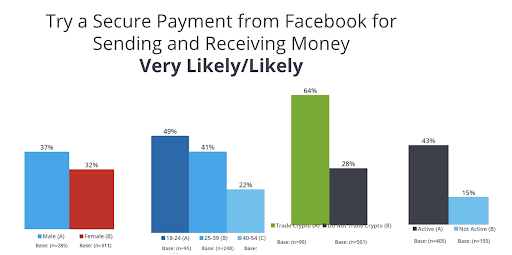

Months before its scheduled launch, Facebook’s crypto project Libra has become more recognizable than all other altcoins. Initial results from a poll, published last Monday revealed that 16% of Americans are already familiar with the name, a significant gap from the next altcoin, Ethereum, which is known only to 12%. However, Bitcoin is still the king of crypto brands, as 58% of surveyed individuals knew what it was.

The survey also revealed that many people are already primed to try Facebook’s new coin:

While not scheduled to launch until next year, it’s becoming more apparent that the new crypto could be a real game-changer.

The Week Ahead

This week will be big for financial markets, as no less than three central banks will be announcing rate decisions. Tomorrow, the Bank of Japan will be the first to announce its decision. However, most investors are waiting for the FOMC to announce its rate decision on Wednesday, which could introduce the first rate cut in more than a decade. Such an announcement will no doubt create volatility in mainstream markets and may shift focus away from crypto markets. Lastly, the Bank of England will stir the pot further with a rate announcement of its own on Thursday.

However, there will be some crypto-centric news coming this week, as the US Senate is scheduled to hold a debate on crypto and blockchain regulatory frameworks. The Libra Congressional hearings have certainly piqued the interest of US lawmakers and now they are taking a better look at the entire crypto industry.

eToro USA LLC; Virtual currencies are highly volatile. Your capital is at risk.