The Russia-Ukraine situation has roiled the markets.

And now, it may be coming for your gas and grocery bills.

Since Russia invaded Ukraine, the average price of a gallon of unleaded gas has reached a 13-year high, inspiring memes and jokes about how expensive it’s become to fill up your gas tank.

Of course, rising prices are no joke from an economic perspective. Many Americans are fed up with the economic friction of everyday life, and some older consumers are getting flashbacks to 1970s-era stagflation — the combination of high inflation and low growth.

It felt like the economy was at a tipping point even before the Ukraine invasion. Will this push us over the edge?

Commodity price shock

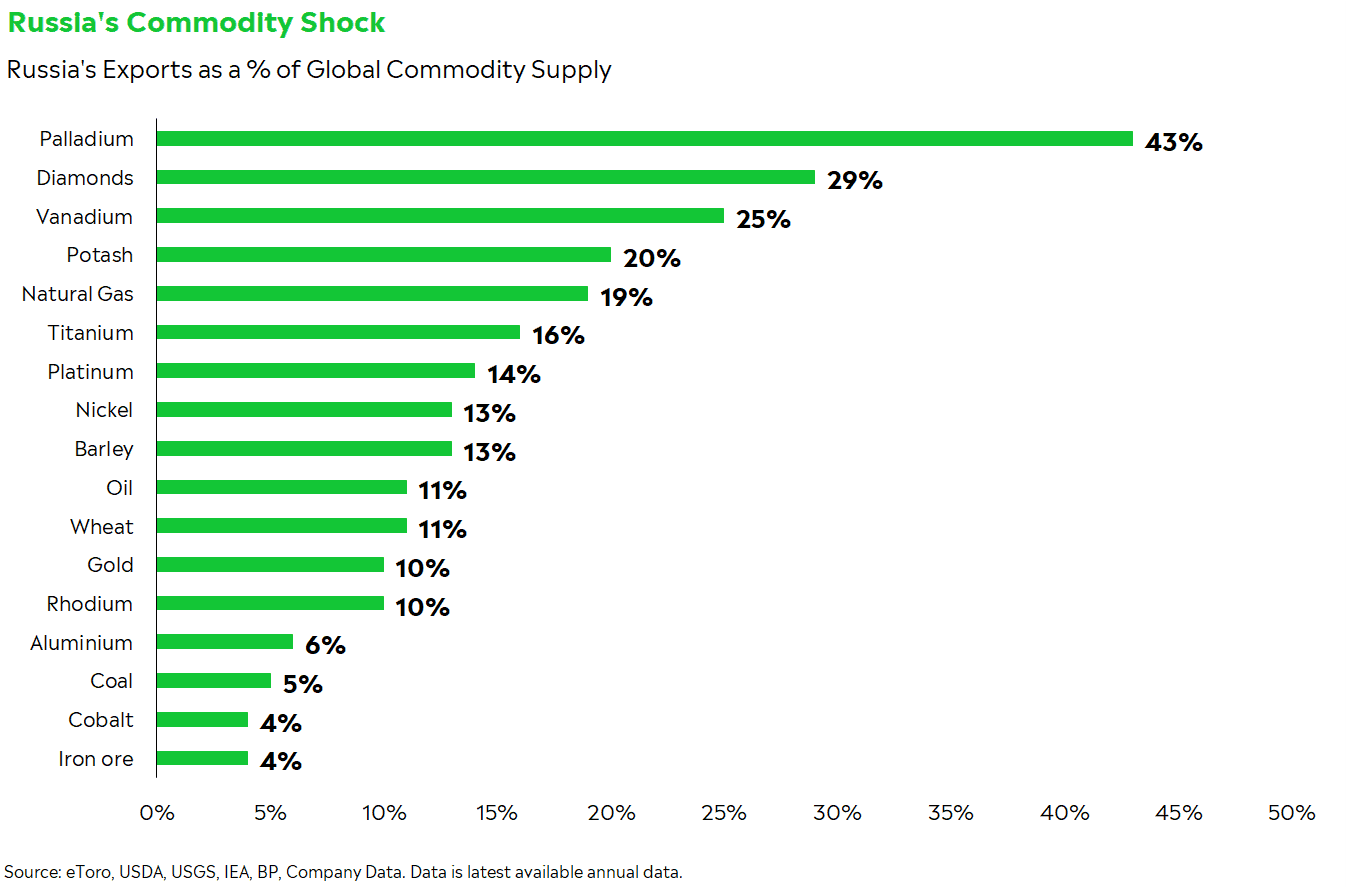

While Russia’s economy is a small player in the global economy, it has one important bargaining chip with other countries: commodities. Russia is one of the world’s largest exporters of oil, and it provides a significant amount of the world’s fuel, metals and agriculture. With Russia and Ukraine increasingly out of the global trade picture, the world is digesting what could be another major disruption on top of a historic shortage.

Consumers around the world are beginning to feel the strain of higher oil prices. And this week, the US announced sanctions on Russian oil, and Europe stated its intentions to wean itself off of Russian oil and gas needs.

America is somewhat isolated from this issue, with Russia only supplying about 8% of US energy consumption. But Russia accounts for 45% of Europe’s oil needs. Europe also depends on Russia for about 40% of its natural gas. Pivoting could be a long, rough journey for Europe.

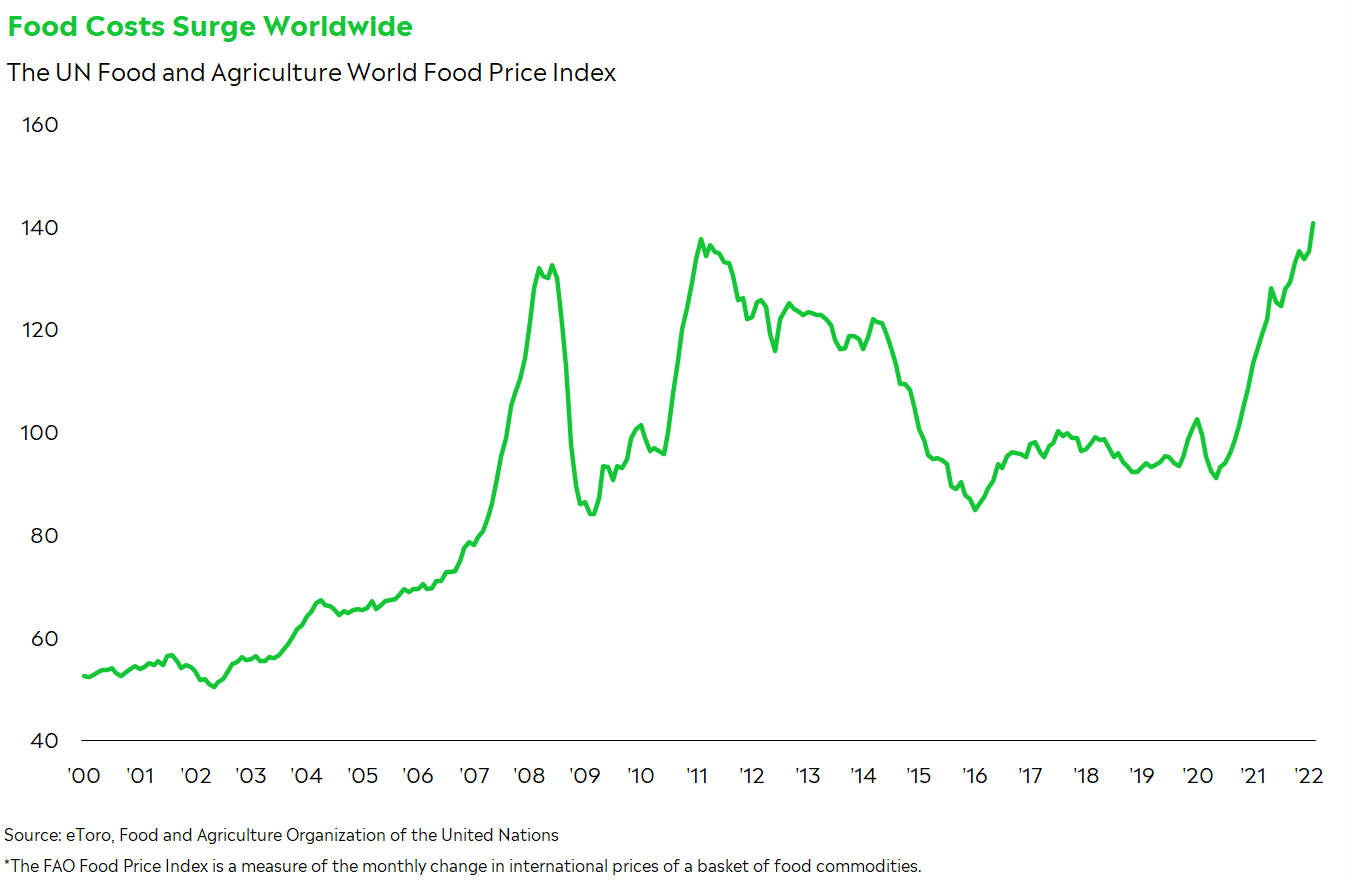

Oil has made headlines, but another risk could be building underneath the surface: food security. Many emerging-market countries depend on imports of basic food supplies — wheat, corn, and barley, for example — and both Russia and Ukraine are major suppliers. While many of us take food costs for granted, they’re a bigger percentage of income for consumers in third-world economies. Food costs have even been the subject of political uprisings such as the Egyptian bread riots and the Arab Spring.

How much is too much?

Russia-fueled price shocks are a much bigger problem for the global economy. America is fairly self-sufficient, even if it’s not fully shielded from the commodity crunch. However, the US economy could be skating on thin ice. Growth is slowing, and inflation is at a 40-year high. Higher commodity prices could exacerbate both of these issues, and the Federal Reserve may not be able to rein in supply-driven inflation.

But don’t scream “stagflation!” just yet. The data shows that the job market is strong and consumer spending hasn’t been significantly impeded by higher prices, overall. Higher oil prices could also increase interest in alternatives like clean energy, electric vehicles, and solar power.

The difference with oil is its prominence in society. In some ways, gas is the real-world poster child for the state of the economy. When gas prices are rising, it’s all over the news and in your face as you drive down the highway. Many Americans haven’t seen $5 gas in their lifetimes, and gas price shocks in recent years have only lasted a few months. This particular shock could be more permanent.

Plus, it’s important not to lose sight of how much higher prices can strain wallets, especially for those in middle- and lower-income households. These consumers were also hardest hit by the pandemic. And even if US consumers absorb these higher prices, the US economy may not be able to shoulder a weakening global economy.

What happens next

What happens next with prices is anyone’s guess. Oil’s moves seem to depend on the headlines of the day. On Wednesday, oil sold off nearly 13% on signs of compromise between Russia and Ukraine. Commodity prices may depend on how drawn out this conflict becomes.

For now, higher gas prices don’t look as threatening to the US economy. Fossil fuel usage has become an increasingly small part of our lives. Oil prices may not drag on growth as much as they did a few decades ago, but it may be worth keeping an eye on consumer data to gauge just how impactful higher oil is. The global economy may be a different story if higher oil and food prices hit spending in other economies.

And remember: the market tends to be forward-looking. If investors feel oil prices have gone too far, they may start pivoting to inflation-sensitive sectors like airlines, retail, and restaurants. We’ve seen a small pivot this week, with S&P 500 airlines rallying almost 10% over the past three days. If you’re looking to capitalize on the commodities rally, it may have already passed you by.

*Data sourced through Bloomberg. Can be made available upon request.