Cash seems to be the hottest investment on Wall Street right now.

People have been piling their money into savings accounts and money markets at a ferocious clip. And suddenly, people are talking about CDs, I-bonds, and Treasuries as if they’re the new meme stocks.

So what changed? Treasury yields are now the highest since the mid-2000s. It’s hard to pass up a relatively risk-free 5%, right?

But for too many, cash is an afterthought, when it really should be treated like any other investment in your portfolio.

Here are three strategies to make the most of your cash.

Get paid to wait

If you’re sitting in cash waiting for a good time to invest, you should at least be getting paid to wait.

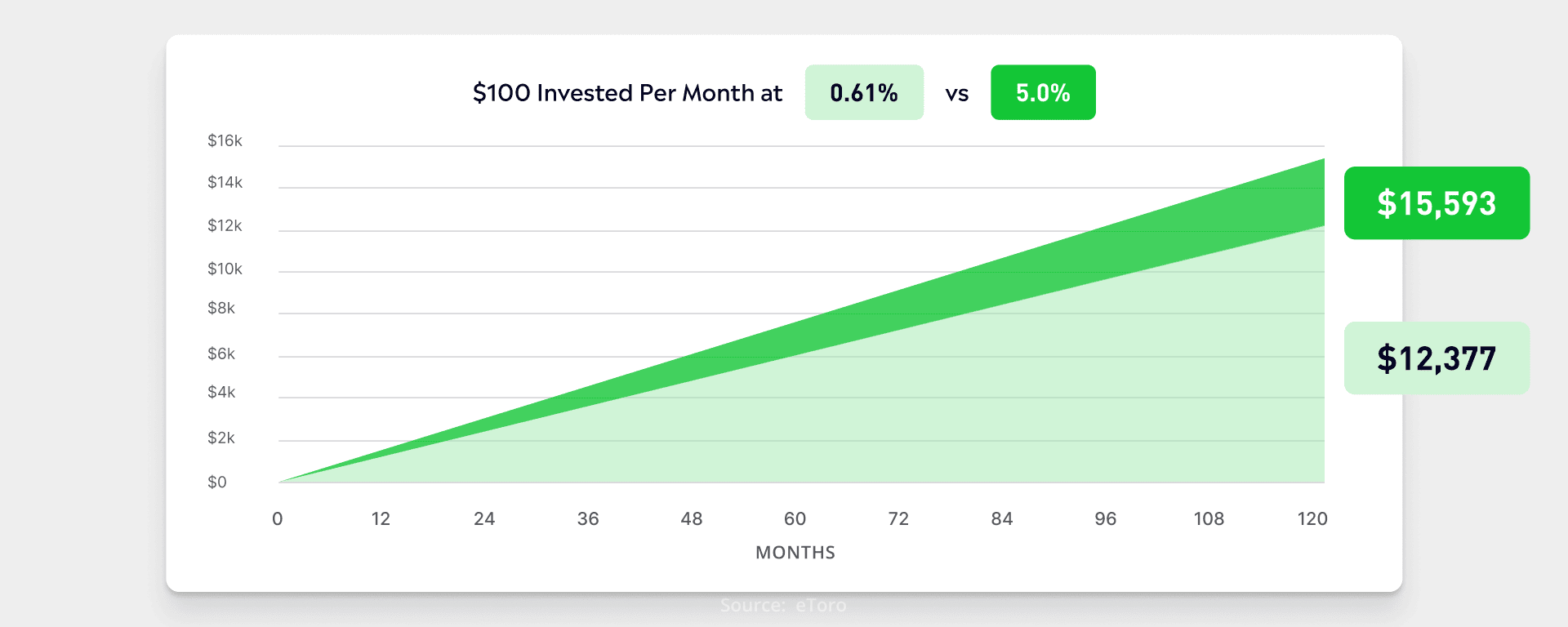

That may seem obvious, but many Americans have cash sitting in savings accounts that make pennies per year. According to Bankrate, the average rate for money market funds is just 0.61%, when 1-year Treasuries are yielding 5.3%. If you’re earning the average rate on your cash, it may be time to look for a better option. Those percentage points of lost income can add up over time.

(As an aside, eToro Options is offering 4.9%* interest on your uninvested cash — with no minimum deposit. That’s higher than the average rate, and you have cash on hand to jump on investments, if you see something you like.)

See terms and conditions. Rate subject to change. You must qualify for an options account in order to access this offer.

Why your rate matters

Rates aren’t all you need to think about, though. You need to be holding the right amount of cash, too. Save too much, and you risk missing out on gains in other markets. Save too little, and you could have to make tough decisions if you lose your source of income or your portfolio falls apart.

Flexibility matters, too. Some people love to tout CDs for their high rates, but the trade-off is that you have to keep your money there for a certain period of time. CDs could make sense if you’re sure you won’t need your money for a while, but they’re probably not the right choice if you’re waiting for the right market conditions to invest.

Selloffs can happen quickly. If you’re a buy-the-dip type of investor, you want cash on hand and easily accessible to take advantage.

Prepare for a change

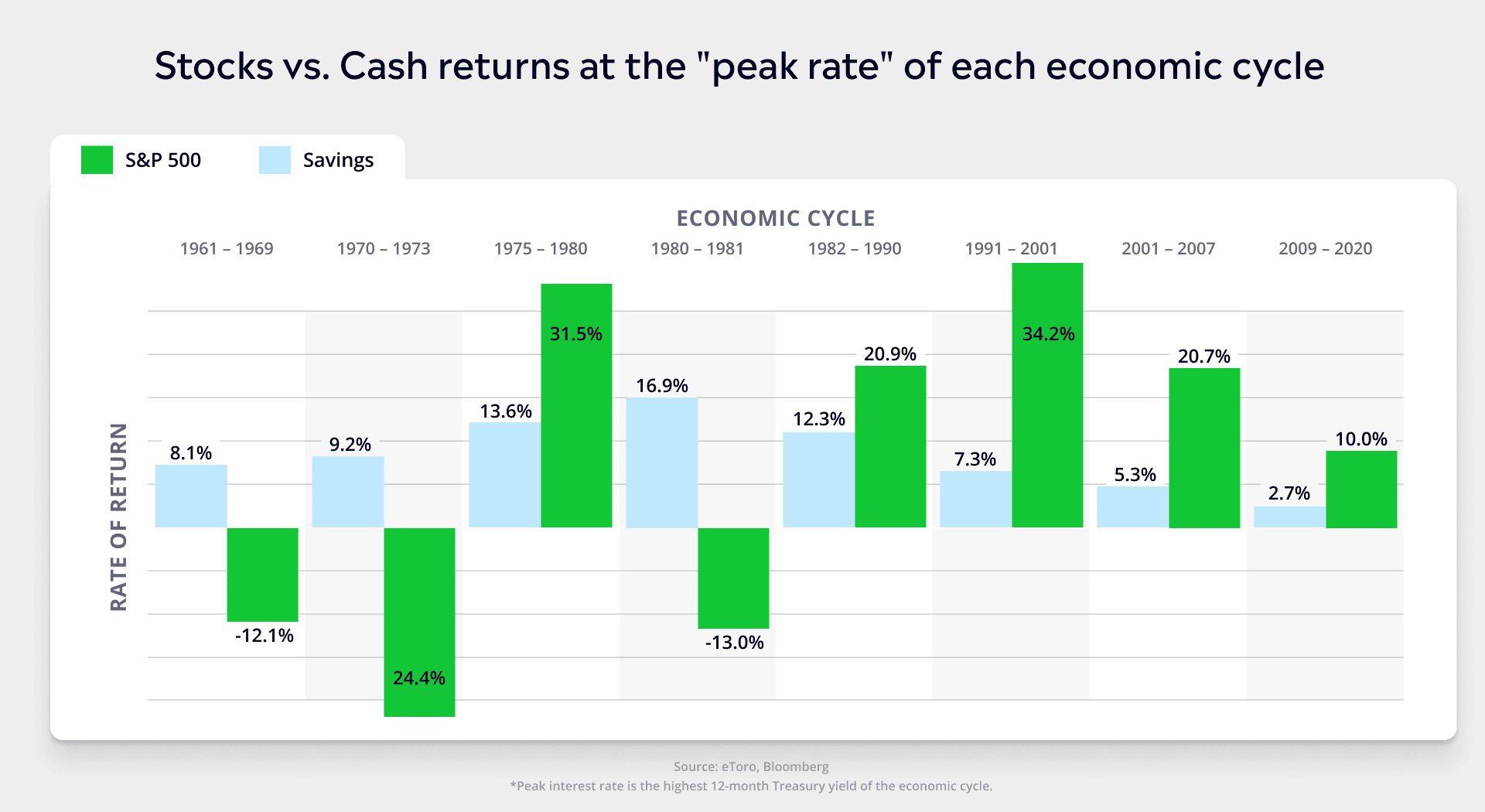

High rates are nice for your bank account, but they don’t last forever. Rather, rates — like the economy and the stock market — move in cycles. When the economy is slowing and things are uncertain, rates tend to fall — and the opposite is true, as well.

This is important to understand, especially at this moment. Rates are high in part because the economy has been resilient this year. Just look at the third-quarter GDP report that boasted 4.9% growth. The economy was on fire last quarter, but it’s unlikely that pace of growth will continue.

If the economy slows and inflation retreats, the Fed could change from hikes to cuts, and those 5% rates could disappear. According to Fed projections, rate cuts could come as soon as May of next year.

If you’re saving up for a short-term expense, it may make sense to lock in these rates while you can. But if you’re investing for a long run, look for the silver lining in a slowing economy. Lower rates tend to stoke stock market gains, even if they initially overlap with difficult periods for society.

Remember your goals

Cash can feel safe and comfy, but it can come with a big cost: your goals.

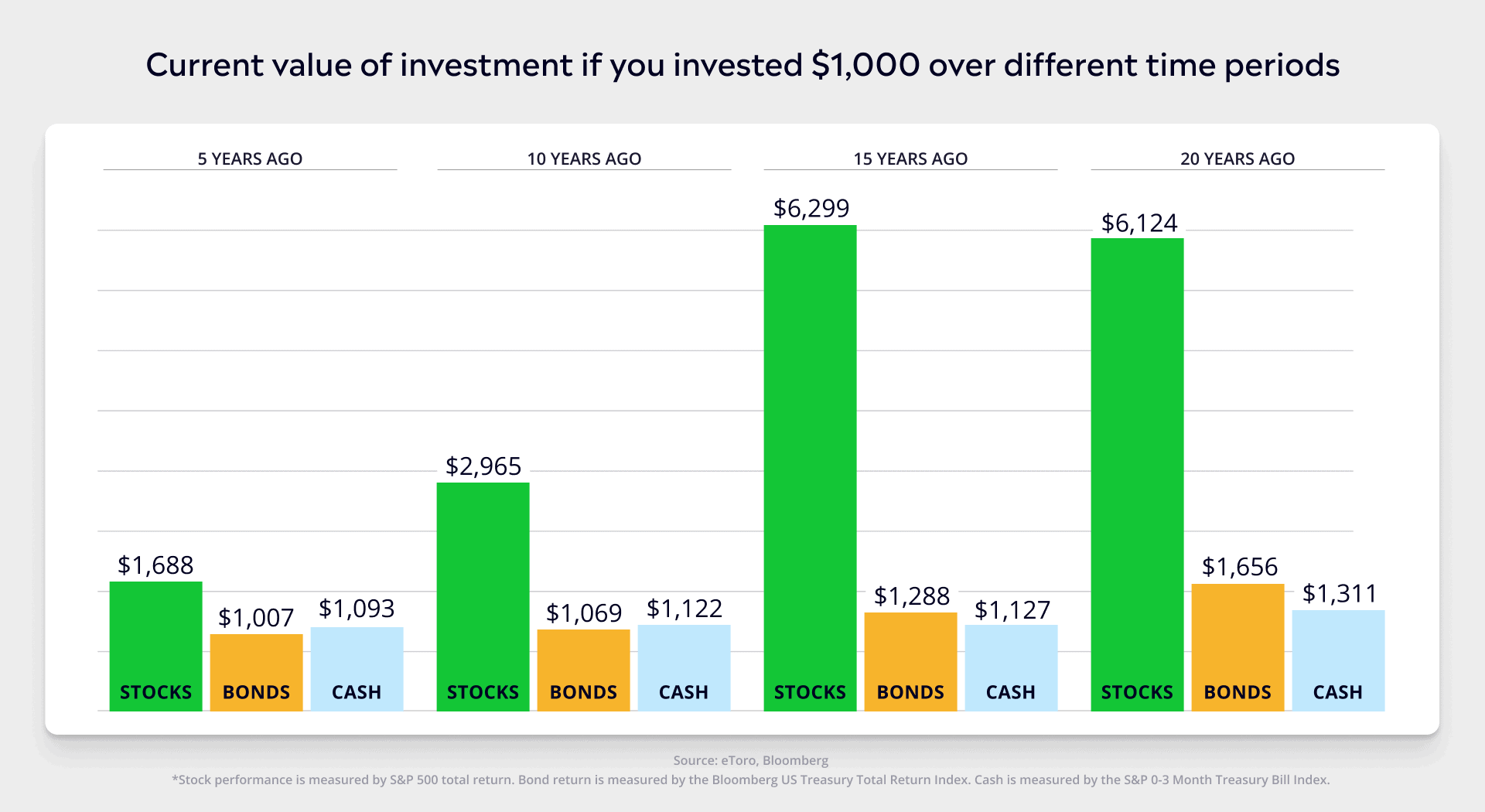

Many of us invest for retirement and long-term security, which implies we have years ahead of us to reach those goals. But when you sit in cash for extended periods of time, you’re actively investing less than you could. Missing out on market returns can be costly, as we’ve seen over history.

Stocks and bonds have boasted strikingly better performance than cash over long periods of time. Yes, other assets are riskier by nature, and they can go through gut-wrenching selloffs from time to time. But if you have big goals like building a nest egg, buying a beach house, preparing for retirement, you probably need to invest to reach them.

So how do you know when you’re holding the right amount of cash? I’ll boil it down to three simple questions.

Your cash cheat sheet

Do you have enough cash for…

Your emergencies? If you lost your job, would you have savings to fall back on? If not, it’s probably a good idea to put three to six months of expenses in an easily accessible cash account.

Your backup plan? What would you do if stocks fell 5, 10, or 20%? Many people can’t just sit tight during steep declines. If you’re an investor looking 5-10 years down the road, it’s made sense in the past to buy stocks when prices are falling. But to do that, you need cash at the ready.

Your sanity? Your emotions aren’t a good guide for what to do with your money. But if your portfolio keeps you up at night, maybe it’s time to change up how much cash you’re holding. No investment is worth your sanity.