If you want a read on just how strong consumer spending is, look no further than the Eras tour.

Taylor Swift is selling out football stadiums, maxing out hotel capacities, and snarling public transit. Check any ticket resale site, and you’ll see that seats in the nosebleeds are selling upwards of $1,500 for most of her US shows.

Yet we’re still hearing warnings about a recession around the corner.

I think we need to calm down.

I’m always wary of drawing too many conclusions from anecdata — or what I see in real life versus in the numbers. But the fervor we’ve seen around Taylor Swift — and other artists touring the US — may be one of the most convincing reasons to believe in the economy right now.

‘Cause the people gonna pay, pay, pay, pay, pay

You can tell a lot about a person by the music they listen to.

I’m an alternative rock fan who has a soft spot for the classics — Tom Petty, Queen, and Led Zeppelin. And of course, I like Taylor Swift. My daily listening has been dominated by the Eras playlist for the past few months.

Just as my playlist gives you a window into my personality — pensive with an edge of grunge — Americans’ thirst for live entertainment can give you a look into the health of the economy. Concerts are a classic example of discretionary spending, or expenses that you don’t actually need to live your life. If you’re cutting your budget, those $1,000 Eras tickets will probably be one of the first things to go. .

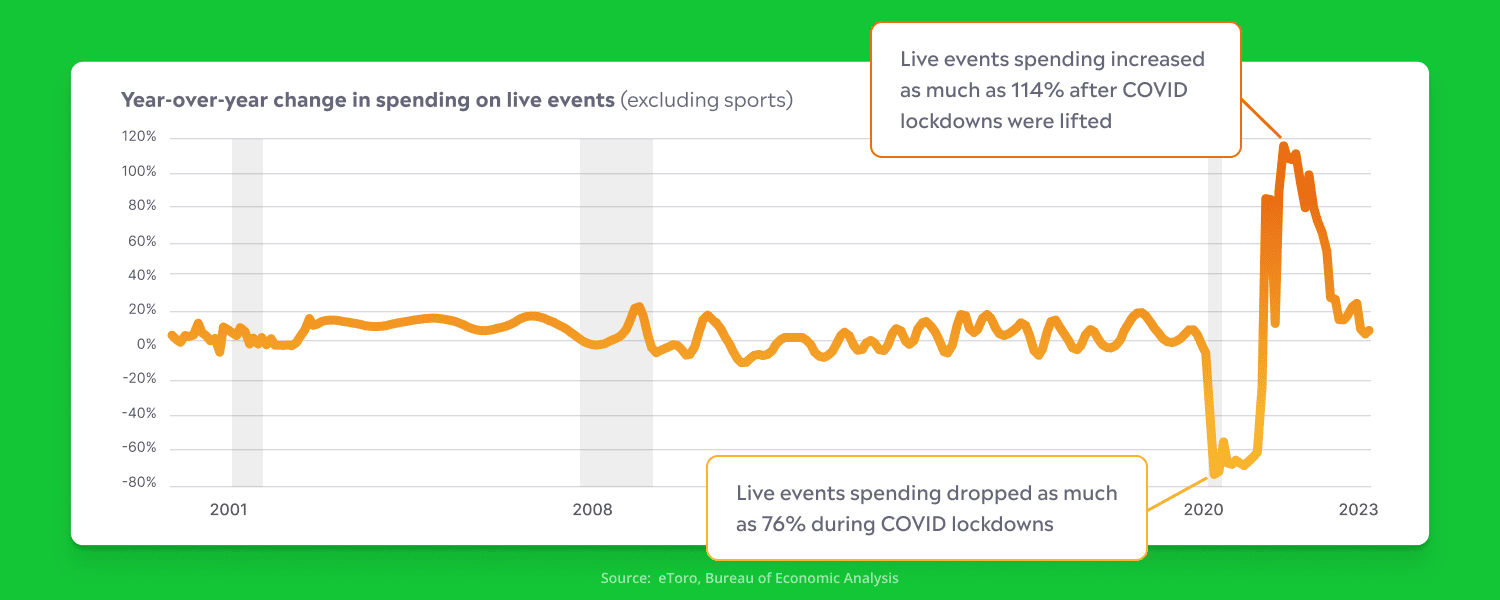

Concert spending as a whole tends to drop when the economy is in trouble. In the two recessions before COVID, spending on live events other than sports declined on a year-over-year basis when adjusted for inflation.

Making up for lost time

We aren’t seeing that right now. Concert spending actually increased 6% year over year in April, even after adjusting for inflation. That’s noticeably higher than the 2% average growth in the 2010s — a decade of economic expansion.

Concertgoers don’t just spend money on the concert, either. They drive, fly, stay, eat, and explore different cities. Airline passengers are up 10% this summer relative to last year, and hotel occupancy rates have jumped year-to-date. That’s hardly recessionary, especially when you consider that the cost to get away has soared.

This is why we can have nice things

Why are people still spending so much money? It’s simple: because they’re still earning money.

Hiring is still strong and unemployment is low — outside of a few industries, of course. Many Americans’ jobs are their primary source of income, so consumer spending typically rises and falls with the job market. Younger workers have also benefited more from wage gains and the types of jobs available, and they’re squarely in Taylor’s target demographic.

Also, you can’t overlook the fact that people are still making up for lost time during COVID. It’s an interesting psychological shift that’s led to more spending on experiences than goods. People aren’t necessarily cutting their spending significantly, but they are spending their money on different things.

This affects what we see in economic data and what we hear from companies. You might get worried because manufacturing activity has been in decline for seven straight months. But if you look at the services sector, you’ll see that it’s been growing for six out of seven months. You have to be especially careful about what assumptions you make when it comes to demand.

And believe it or not, we still haven’t returned to pre-COVID levels of services spending — or what we pay for things like haircuts, meals out, vet bills, and concerts. Before COVID, services made up 69% of consumer spending. Today, that figure is closer to 66%.

Seems small, but that’s a $550 billion difference — or about 370 million nosebleed tickets — that could be out there in pent-up demand.

Champagne problems

The Eras tour’s success is good news for everyone. Except for Jay Powell.

One, because Jay apparently prefers classic rock like Dead & Company, according to a photo from last week.

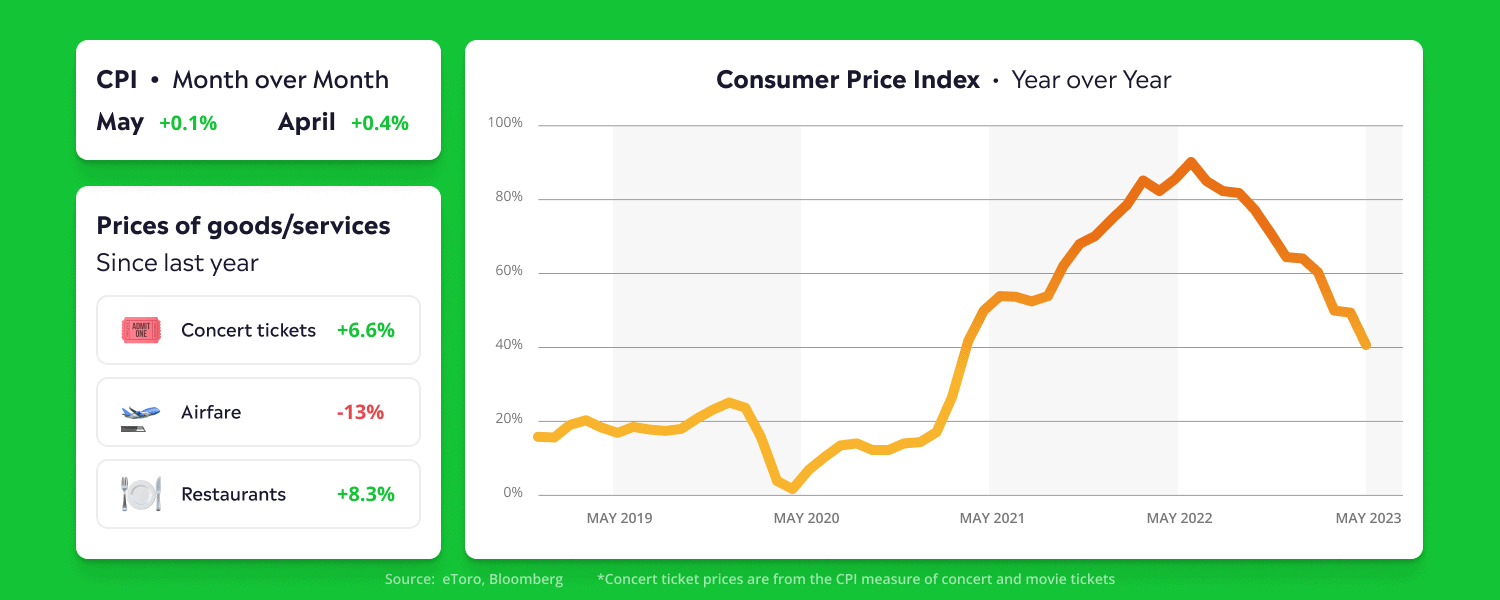

But also because the Fed is desperately trying to fight inflation, especially among experiences. Powell actually called out “non-housing services inflation” in his press conference this week, saying that it’s the kind of inflation the Fed is focusing on.

Inflation needs to calm down

For good reason, too. Services prices tend to be stickier — or change at a slower rate — than goods prices, and they tend to rise and fall with demand. Strong services inflation puts more pressure on the Fed to hammer the economy through rate hikes in order to bring spending down.

Inflation is in the eye of the beholder, too. Travel prices may never fall back to pre-COVID levels, even if overall inflation gets back down to 2%. When it comes to sky-high ticket prices, Swifties may be able to shake it off. But the economy — and your portfolio — may have a harder time doing so.

So what does this mean for me?

Check your assumptions. Consumer spending is the bedrock of a growing economy, and Americans are spending their money on more discretionary items like travel. Have you considered how consumer spending could impact your opinion on the economy — and your investments?

Think about your sectors. If you want to invest in the services spending surge, remember that the stock market isn’t the economy. Services make up a majority of Americans’ spending, but services-based companies are only 45% of the S&P 500. Demand for goods is floundering relative to a few years ago — and that could impact certain industries differently than others.

Oh, and hit me up if you want to sell any Taylor Swift tickets at face value.

No matter which investment strategy you ponder, we wish you a safe and pleasant long weekend. Happy Juneteenth!

*Data sourced through Bloomberg. Can be made available upon request.