Manufacturing has been giving off recession vibes for a while.

ISM data shows manufacturing activity has been in decline for nine months, a streak we haven’t seen since the global financial crisis.

Yet below the disappointing data, there may be a quiet manufacturing boom brewing — one that could define markets for years to come.

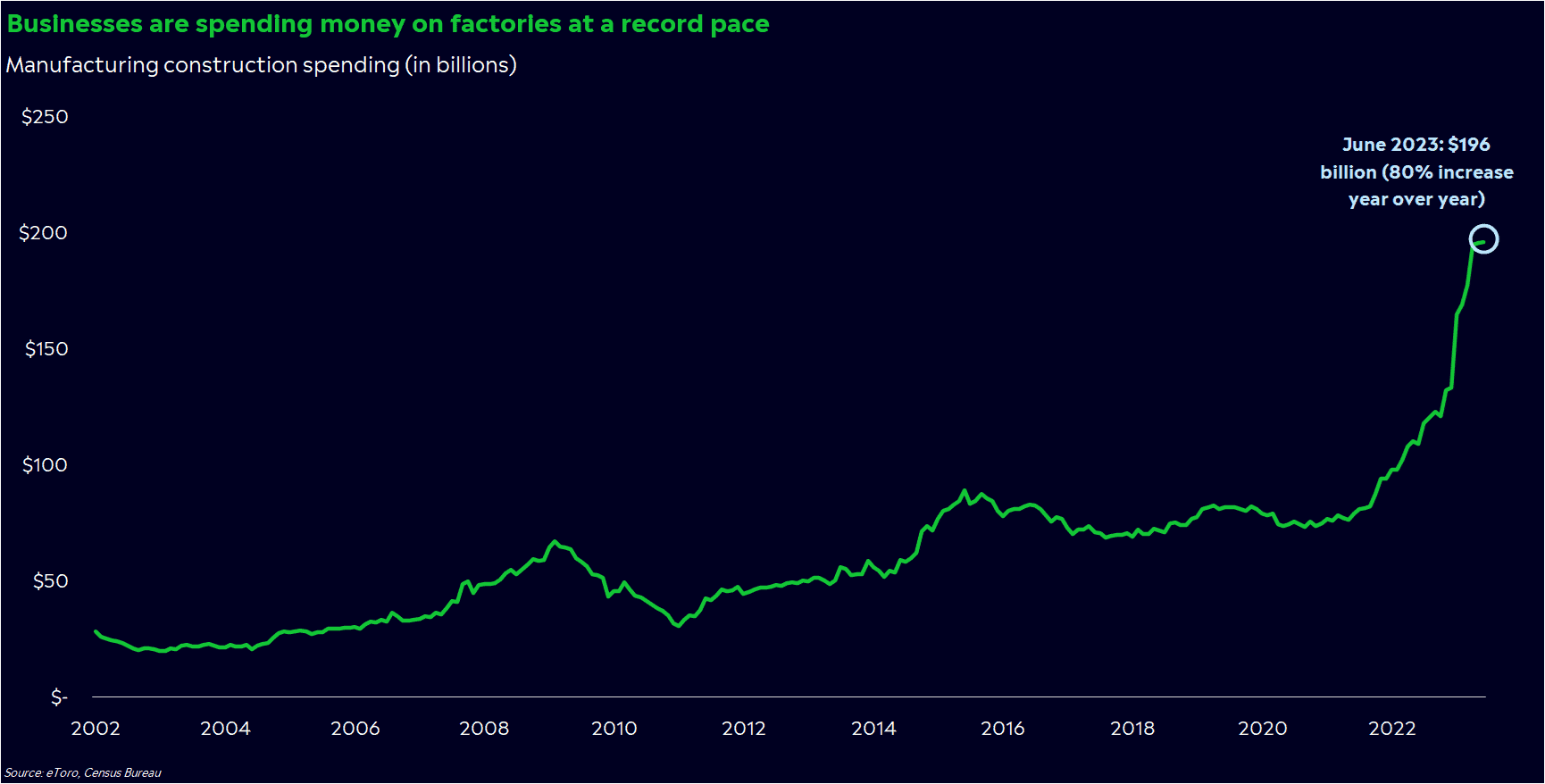

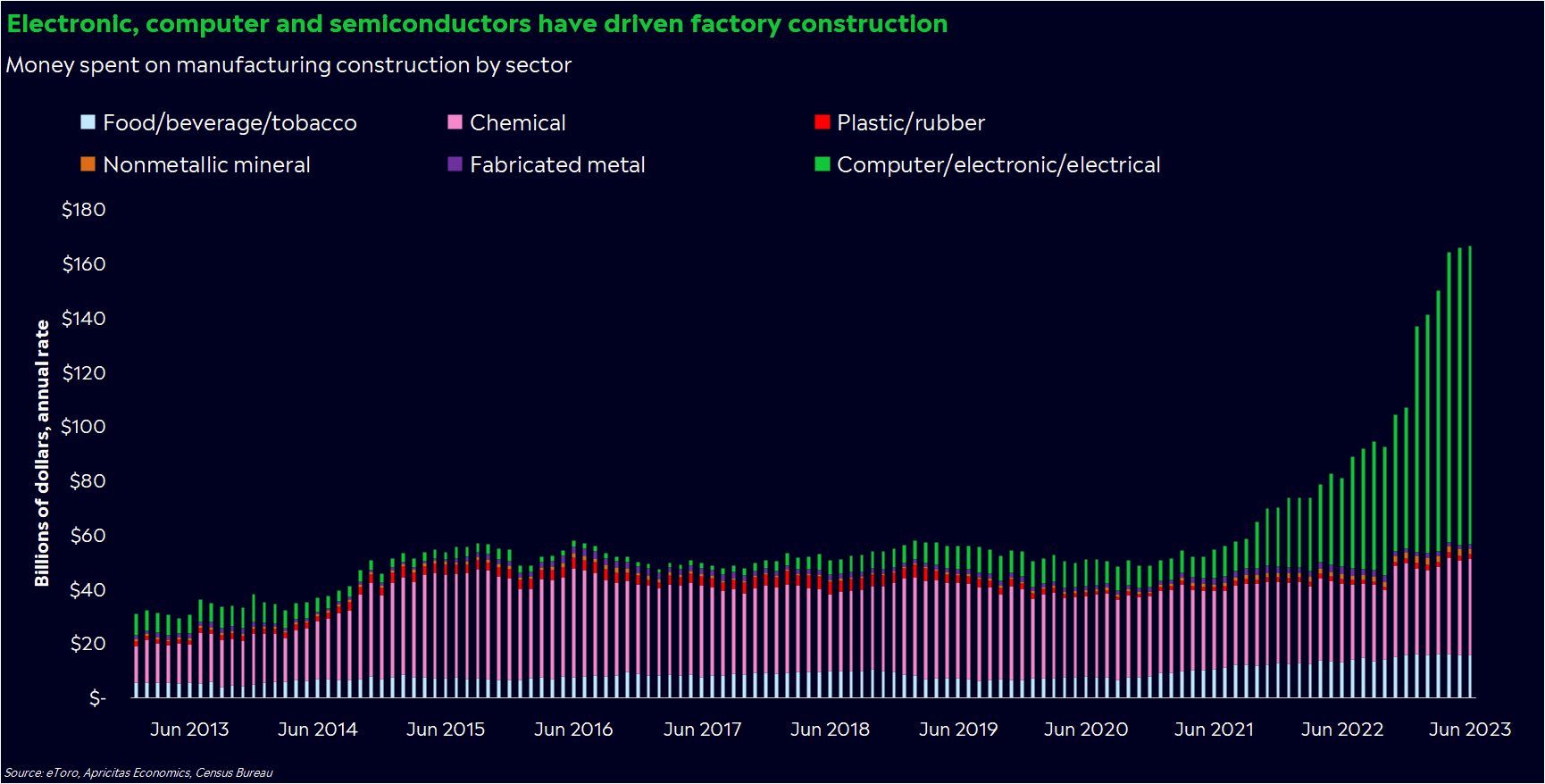

Businesses are building factories at a record pace, especially for computers, semiconductors, and other electronics.

Move over tech. We may be witnessing the return of the old economy.

“Made in America” makes a comeback

Take a road trip across the US, and one economic trend is abundantly clear: Manufacturing is way past its glory days.

In many major cities, you’ll find old mills, abandoned factories, and empty plants that have been transformed into apartments, restaurants, and breweries. Services industries — tech, travel, financial services — have taken the reins on growth and employment, while production has largely moved overseas. In fact, manufacturing comprised just 10% of economic growth last quarter.

However, as we’ve all learned these past few years, catastrophic events can change the trajectory of society. Even in the corners that we never thought would see light again — like factory towns and the “Made in America” sticker.

Today, we could be seeing the early stages of a manufacturing revitalization.

It’s not evident in most economic data sets yet, like the ISM Purchasing Managers Index that most analysts cite. But other, less-watched metrics show there’s a change underway.

Take the money spent on factory construction, which increased a whopping 80% year over year in June. Or manufacturing’s share of total business investment last quarter, which was its highest in 30 years.

From several different angles, it looks like businesses are spending more money on building factories than they have at any time in recent history.

The story of the bull market

So why is there suddenly so much interest in reviving a dormant part of the economy?

First, COVID broke our supply chains and forced businesses to think about operational resiliency over profit. For many companies, that’s involved moving their offshored manufacturing closer to the US, so the final steps of assembly are closer to home.

By the way, I wrote more about this trend in this year’s eToro Investors’ Almanac.

New policies incentivized domestic production even more. The Inflation Reduction Act offered tax credits for manufacturers involved in renewable energy production, while the CHIPS Act encouraged investment in US-based semiconductor manufacturing.

These two moves are undoubtedly making a difference. After all, the growth in manufacturing-related construction spending has been concentrated in computer and electronics factories, as Joey Politano of Apricitas Economics pointed out.

And then there’s AI. The excitement around AI feels like it’s reached a fever pitch, but it may be forcing some American companies to explore the technology as an avenue for future growth. There seems to be an AI angle for everything, and factories are no exception.

Now, we probably won’t see smokestacks take over city skylines any time soon. This new wave of manufacturing investment could take years to play out, and the cost savings for outsourcing production could still be enticing.

But if you’re looking for the story of the next bull market — or just a reason to feel hopeful for tomorrow — you may want to take a look at what’s happening in the old economy. A new-age manufacturing boom could touch several different industries, from transportation to machinery and natural resources. Right now, a lot of those stocks are trading at a steep discount relative to their growth counterparts, too.

This is a good development for the economy as well. Companies prioritized cost-cutting and financial engineering for most of the last decade. Now, high rates and supply chain friction have forced them to invest in better systems. Eventually, better systems can lead to higher productivity — or output per hours worked — and a more resilient economy.

The 2010s were all about tech, growth, and innovation. The 2020s could be about the picks, shovels, bulldozers, and factories that bring that tech, growth, and innovation to life.

So what does this mean for me?

Do your research. Listen closely to management commentary on earnings calls and keep an eye on headlines to understand which companies are spending on projects like new factories and supply chains.

Look for opportunities. Manufacturing-related sectors like industrials and materials could come under pressure if growth slows down — and that scenario looks likely. But a selloff could present an opportunity for a long-term investor willing to wait on a compelling economic story.

Stay afloat. Take a moment to ask yourself why you’re investing and how long you’re willing to hold your positions. Markets trade on headlines and emotions each day, but over time, they tend to reflect economic trends. If you’re investing in a story, make a plan to check your portfolio regularly and think about implementing hedges if they help keep you sane and invested.

*Data sourced through Bloomberg. Can be made available upon request.