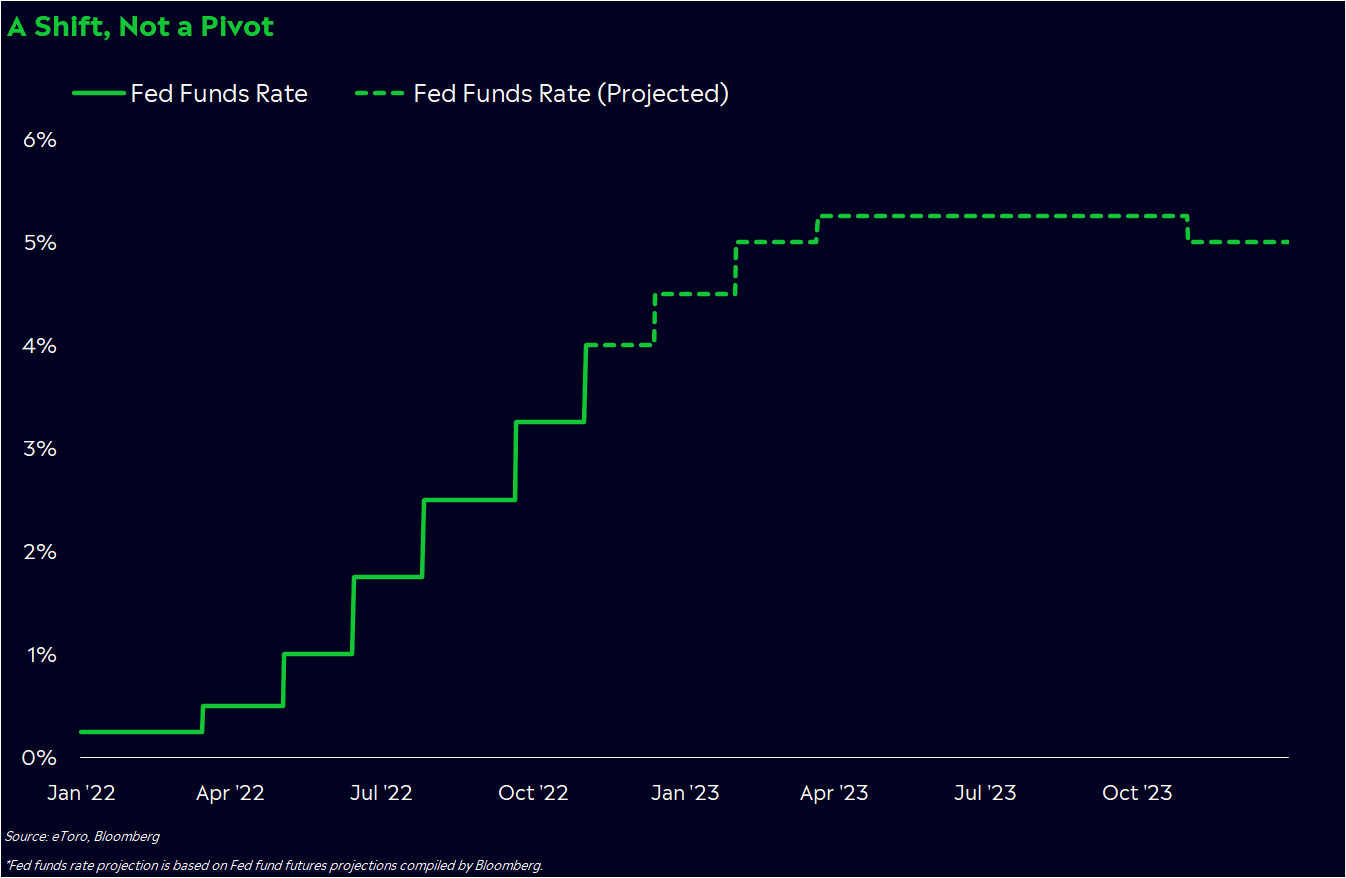

The Federal Reserve just hinted that it could slow rate hikes soon.

It’s the shift everybody was hoping for, and a change in pace is one step closer to getting out of this miserable bear market.

But here’s the awkward truth that markets are wrestling with at the moment.

Rates are still at a 14-year high, and they’ll probably stay this high for a while.

The Fed has pulled the societal lever from innovation to conservation. Until they pull the lever back to innovation via rate cuts, we’re stuck in a persistently high-rate environment that could look a lot different than what we’re used to.

What the Fed just happened?

This year has been an epic standoff between the Fed and the markets. Markets want the Fed to stop hiking rates, and the Fed wants markets to back off so they can get inflation down.

Now, it looks like the Fed is blinking first. The Fed said it’s keeping an eye on the cumulative weakness in the economy, signaling a shift in rate hikes could be coming. For many people, it’s about time: goods prices are dropping, CEOs are turning pessimistic, and rent prices seem to be slipping (even though Consumer Price Index data hasn’t reflected that yet).

But this shift isn’t a pivot to rate cuts. What seems like semantics — two words with five letters that both kind of sound the same — is actually a big difference. On Wednesday, Fed chair Jay Powell maintained that rates could be high “for some time” and the peak in rates could be higher than previously thought. Stocks plunged on the news, and Fed fund futures now project the Fed will hike its policy rate above 5% by March.

For now, we’re still climbing a mountain, even if that mountain is a little less steep at this point.

Here’s what that could look like.

In your portfolio: the conservation premium

Over the past decade, the level of innovation in society has been marveling. Electric vehicles, cloud technology, decentralized finance, genomics research, social media, mRNA vaccines — they’re all products of the 2010s and early 2020s.

While we can chalk most of this up to human ingenuity, low rates were also a big factor. After the Global Financial Crisis, the Fed cut interest rates to zero and leaned into bond-buying to turbocharge growth through cheap interest rates. They pulled their lever back to innovation for nearly a decade, and the world did what it does best — built.

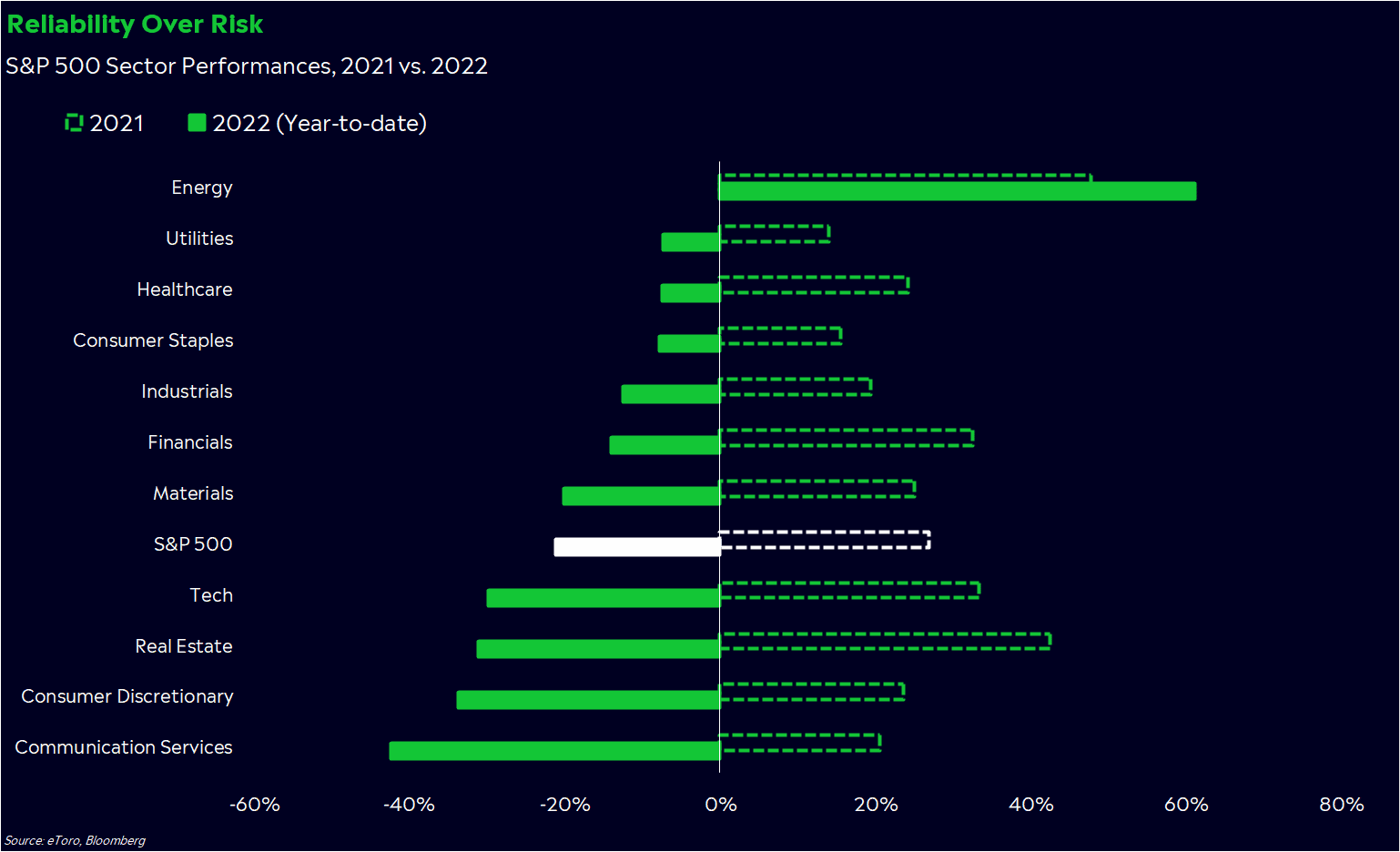

Investors rewarded innovation, too. Tech stocks were the leaders of the 2010s, with price-earnings ratios at multi-decade highs because people were willing to pay a premium for innovation.

Then, the boom times got out of hand, and the Fed started hiking rates to manage uncontrollable inflation. Powell pulled the lever back to conservation by making borrowing and investment more expensive, slowing growth. Now, we’re more inclined to value prudence over boldness. The innovation premium has turned into the conservation premium.

Lately, we’ve seen a bit more optimism in markets, but an air of caution still lingers. Just last week, Meta stock fell 25% after its earnings release showed it ramped up spending on its metaverse project. You know, investing in bold, new ventures like tech companies do. But the stock got punished, because execution tends to beat out ideation when there isn’t as much capital to go around.

You might find yourself acting a little more cautious, too. Savings account rates are rising — finally! And more people are focusing on building up their cash reserves now than in the past. Higher rates can make bonds and cash more attractive, and they force investors to think about reliability over risk.

Defensive stocks — your boring utilities, manufacturers and pharmaceuticals — are leading the market this year, while recent IPOs are down more than 50% on average. The top 10 Nasdaq performers last year? They’re down an average of 39% year to date.

That’s the conservation premium in action.

In your life: more friction, more change

High rates also change our perspectives of money, and consequently, the world around us.

Those social media feeds your eyes are glued to? A product of low rates. That instant gratification lifestyle you’ve become accustomed to? Also a product of low rates. Your success as an Instagram influencer hawking beauty products and sports supplements? A product of hard work, but also low rates.

Before you say I’m a doomsdayer, let me be clear: the world isn’t imploding. But the way we’ve lived life has changed dramatically since COVID, and it’s likely going to keep transforming as we navigate persistently high rates. Why? Because many of the nice things we enjoy in life today came about because business and consumers had access to a system awash with cheap cash.

For millennials, it could mean waiting even longer for that first house and paying for those social media apps we’re all obsessed with. For city folk, it’s longer delivery times because your go-to grocery startup can’t afford a bigger workforce. For entrepreneurs, it could mean waiting to launch that cool business you’ve daydreamed about because you can’t get the funding. For conscious consumers, it could mean fewer shopping options because your favorite local brand went out of business.

The reality

Earnings and the economy may determine how low stocks go, but the future path of rates could dictate how tough this recovery is. We may need to get comfortable with the idea of markets not doing their best for a bit, even if they don’t fall much further from here.

Innovation comes and goes, and this bust could be setting the foundation for the next boom. Necessity is the mother of invention, after all. But for now, we may have to deal with the not-so-direct cost of high rates: more friction in our everyday lives.

*Data sourced through Bloomberg. Can be made available upon request.