Investing isn’t just about what you buy. It’s about how you think.

Over the past decade, we’ve learned a lot about how your emotions and impulses affect your decisions, especially with money.

In a way, psychology has defined the evolution of the retail investor. Individual investors are usually stereotyped as naive traders looking for a quick buck. The “dumb money,” as some people like to say.

Now, we’re dealing with a whole different retail crowd, according to our survey of 1,000 US investors. They’re smarter than you think.

Leaning in

The past decade and change has been a mental battle like no other for the everyday investor. The Great Financial Crisis wiped out portfolios and sowed distrust in the financial system. Then, the Federal Reserve swooped in with low interest rates and bond buying that led to a historic bull market in stocks.

And when COVID rolled around, it appears individual investors decided they wouldn’t get fooled again. They bought the dip… again, and again, and again. Fast forward nearly two years, and the S&P 500 doubled from the March 2020 lows.

Over the years, retail investors have learned to lean into the market, focusing on their goals instead of the swings. It’s a form of risk compensation: When your brain tells you to run, you fight the urge because you know volatility is likely only temporary. It’s been a largely successful strategy, too. Since the Great Financial Crisis, no big S&P 500 pullback has taken longer than seven months to recover.

This year, about 14% of survey respondents are expecting a drop in the S&P 500 greater than 5%. And 65% of people surveyed expect the Fed to raise interest rates, a change that could alter the risk-reward formula for the stock market. Never mind that popular retail investments like high-growth tech stocks and IPOs are selling off hard at the moment.

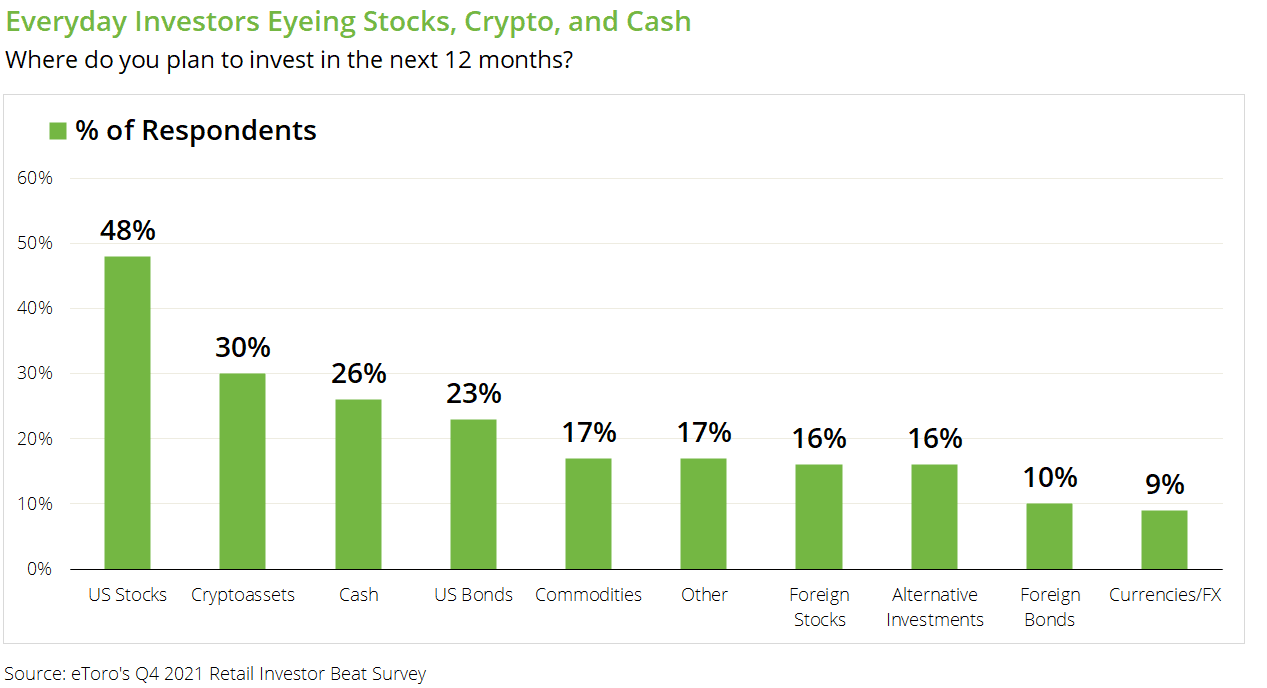

Investors aren’t backing down, though. 49% of investors haven’t re-positioned their portfolios, and 48% are planning to invest more in US stocks over the next 12 months. If that’s not enough, 41% of investors see tech as the best buying opportunity of any sector.

Checking blind spots

How has the everyday investor stayed so resilient?

Education and accessibility have helped them stay the course. These days, the information moat between Wall Street and Main Street is shrinking, and investors have a wealth of education at their fingertips.

The average retail investor has a long-term focus, too. More than half of our survey respondents have been investing for 11 years or more. Only 24% of them trade more than once a month. Many everyday investors don’t fit the stereotype of a hot stock chaser. They just want to build a nest egg, and they’ve learned the importance of small steps in goal planning.

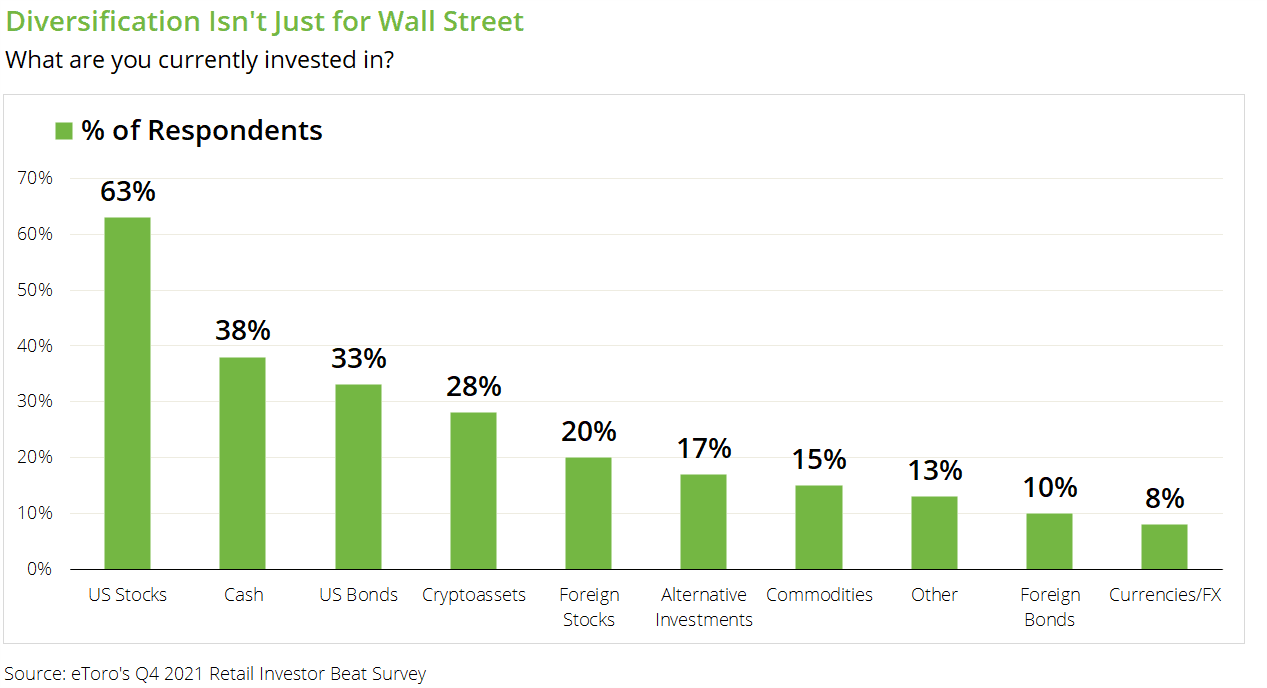

They’re also thinking holistically about return and risk. Diversification — or the concept of spreading your money out across multiple assets to manage risk — isn’t just for the pros. A good chunk of everyday investors are hedged, holding a mix of mostly stocks and bonds. In fact, stocks and cash are the two most-held assets among surveyed investors.

Yes, there are still plenty of people who hold riskier investments, like crypto (28% of respondents, to be exact). Nearly half of young investors (ages 18 to 34) have been investing for two years or less, and they may have the stomach for high-risk holdings. But on the whole, this crop of investors has learned to check their portfolio’s blind spots, balancing risk and reward in their investments.

Diversification can be extra prudent in uneasy market environments. Yes, the S&P 500 has dropped 5.5% this year, but bonds (measured by the Bloomberg Barclays US Aggregate Bond Index) have only fallen 1.3%. If you understand that market storms are temporary, the natural next step is to learn how to hunker down and weather the storm. It seems like a swath of individual investors are doing just that.

Buying the dip

Retail investors haven’t been scared by the selloff in tech. But as the pandemic progresses and the policy situation gets trickier, they may start losing faith. And this could spell trouble for the market, considering the everyday investor holds double the amount of stocks today then they did pre-COVID (according to Fed data).

About 64% of investors we surveyed aren’t feeling confident in the global economy’s prospects, even though an overwhelming majority of them feel confident in their portfolios. To be fair, it’s a confusing time to be an investor, and the upcoming year could be a preview of the rest of this economic cycle. Plus, the market is looking ripe for a reset, according to historical standards. The S&P 500 has gone through a 10-20% pullback every two years on average since 1950. Our last was in March 2020. If individual investors start selling en masse, the market impact could snowball quickly.

Right now, the current selloff looks a little dramatic for the scenario at hand. The market has tensed its stomach in preparation for the Fed’s next moves, and we think it may be overreacting a little.

Even so, it looks like this retail crowd is here for the long haul. Stock selloffs are becoming shorter and rare, and inflation has upped the pressure to put money to work. The biggest risk to the retail investor may be the drop in high-growth areas of the market. But they’re more emboldened than ever, with lots of cash on hand.

This may just be another storm that can be viewed as a generational buying opportunity.