Housing was one of the first sectors to fall victim to rising interest rates after a decade-long boom.

And today, housing demand seems to be coming alive again, defying the slowdown we’re seeing in other parts of the economy.

It’s a good development for the economy, because housing is its largest industry. But it’s strange, nonetheless. When the job market is slowing, spending is falling, and confidence is waning, why do people still want to buy houses?

Weird dynamics

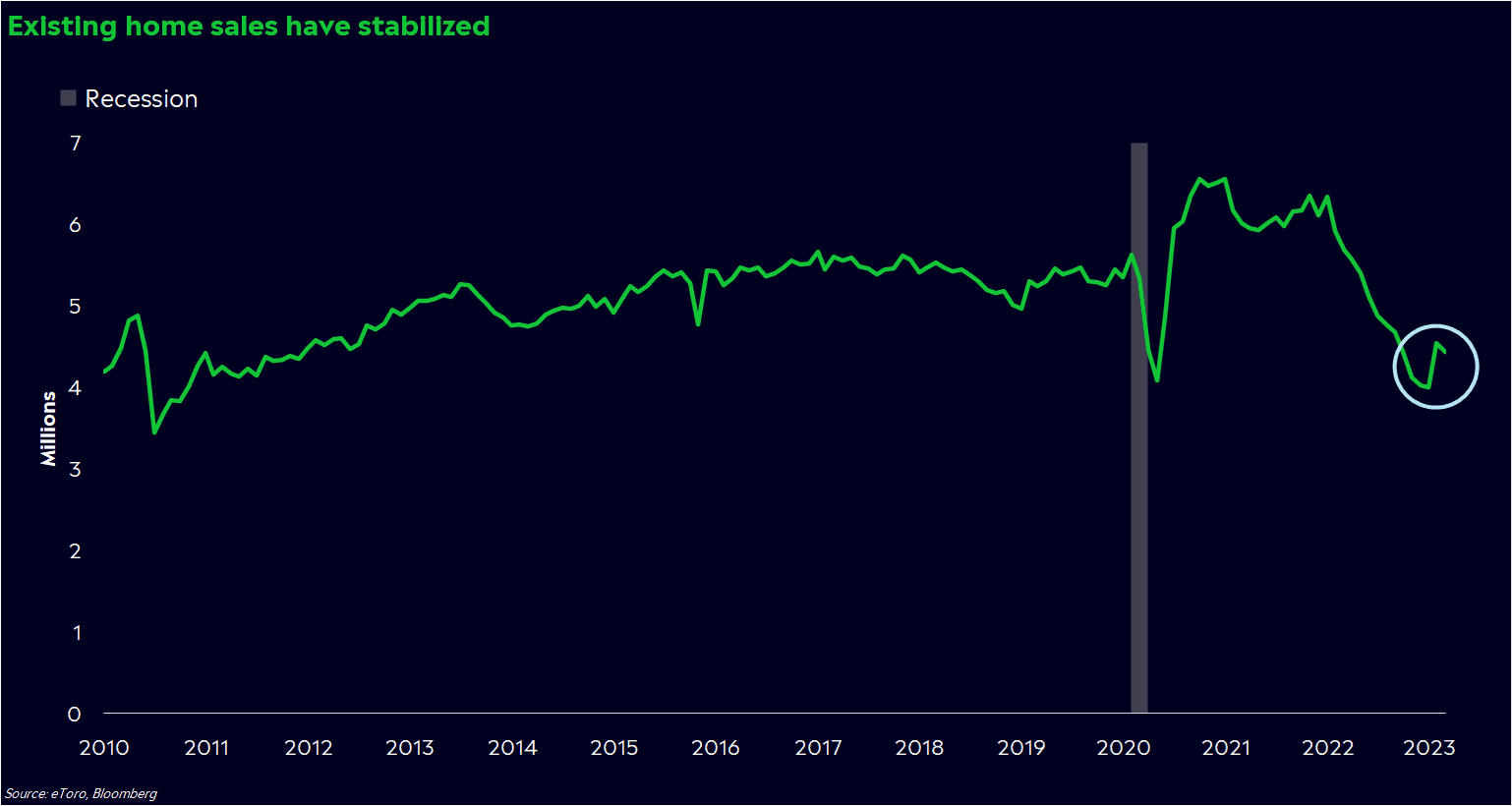

March housing data is starting to come out, and it’s becoming clear that the housing slowdown of 2022 has reversed course, at least for now. NAHB’s measures of present home sales and traffic of prospective buyers has increased for three straight months, indicating that housing demand is improving.

And they’re not just buying houses, they’re banking on housing activity increasing even more. S&P 500 homebuilders are up more than 20% this year — a bold call when other cyclical sectors are lagging behind and a recession seems to look more likely as the days pass.

To understand why, we need to sort through all the weird dynamics in today’s housing market.

To start, housing had a horrible 2022. Existing home sales dropped for 11 straight months, and mortgage applications fell precipitously compared to the fiery hot housing days of 2021. You can blame the Fed for most of this — they hiked rates from zero in March to 4% by the end of the year, catapulting longer-term yields and forcing 30-year mortgage rates as high as 7.3%. The market responded in kind, with S&P 500 homebuilder stocks dropping more than 30% in the first four months of the year.

And if the drop in demand isn’t bad enough, there aren’t many homes for sale for those who are looking, leading to bidding wars and buoyant home prices. There have been about 1 to 1.5 million homes on the market at any given point since COVID began, noticeably less than the 2.2 million average homes for sale at any month in the 2010s. If you weren’t discouraged by high rates, soaring inflation, and global conflict, the lack of inventory probably did you in.

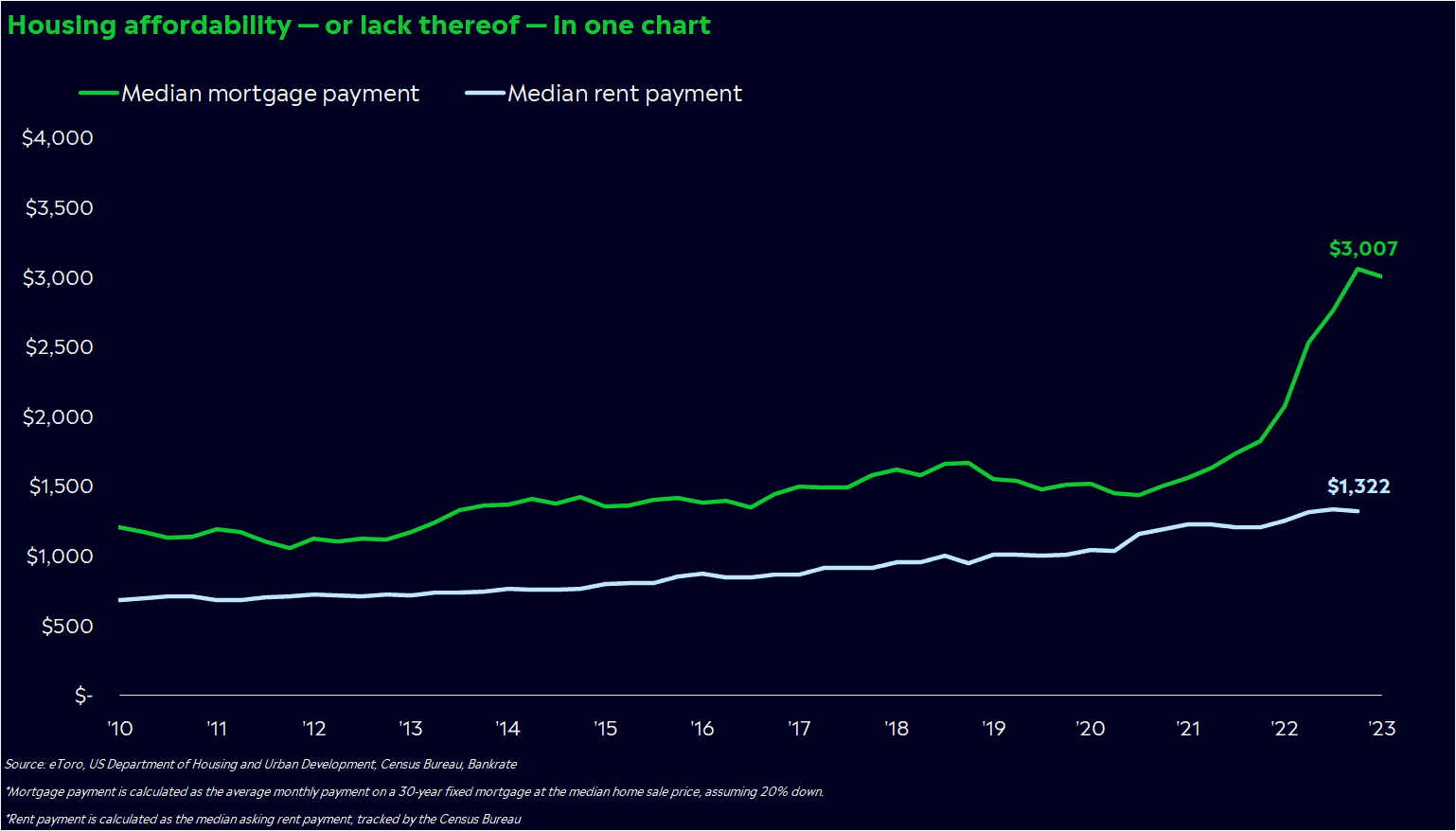

Since the fall, though, inflation and rates have both come down. And the housing market has started to thaw out, like other parts of the economy. The average 30-year fixed mortgage rate has dropped 70 basis points since October. This could’ve been enough to entice some would-be buyers back in, even though mortgage rates are still at a steep 7%. Materials costs — especially lumber — have also declined over the past several months. Buying a house has become more affordable lately, even though affordable isn’t exactly how I’d describe housing at the moment.

The millennial home-buying wave

It’s not just about the costs, though. Houses are ultimately the roof above people’s heads more than a strategic investment. People buy houses when they need them and can afford them — not necessarily when the market says it’s the right time to buy.

Keeping that last statement in mind is key when looking at this strange housing market. Part of this could be perspective — rent inflation is scorching hot, and when your lease renewal is 8% more expensive, buying a house could become more appealing.

Plus, we’ve consistently underestimated just how well-positioned Americans are to spend money. Despite today’s high rates, mortgage payments as a percent of income are at their lowest point in decades.

I’d like to propose a broader theory, though.

Perhaps a lot of Americans desperately need more space.

Therein lies one of the most underrated stories of the housing market: demographics. A large swath of Americans are getting to the point where they need a house, and some of them are willing to look past high rates and low supply to get one.

Enter the millennials. They were the largest buyer of houses from 2013 to 2021, according to National Association of Realtors research, and they comprised 28% of purchases last year. Much of this is due to a coming-of-age moment, too. Millennials — who are 26 to 42 years old at this point — are in their prime years of settling down and forming households. From 2017 to 2021, the number of American households grew by an average 1.7 million per year, more than double the annual pace of households created from 2012 to 2016 (according to Census data).

Defying gravity

The housing market seems to be defying gravity when recession fears are front and center. And if housing demand really is reversing course, it’s worth asking what that says about the US consumer and the chances of a recession.Be careful, though. People may be willing to buy houses in inhospitable conditions, but the broader view shows that there’s a serious shortage of housing with the wave of first-time homebuyers on the horizon. Don’t underestimate the power of demographics, but remember that there are a lot of weird dynamics to consider.

*Data sourced through Bloomberg. Can be made available upon request.