What started as a controlled burn may be turning into a forest fire.

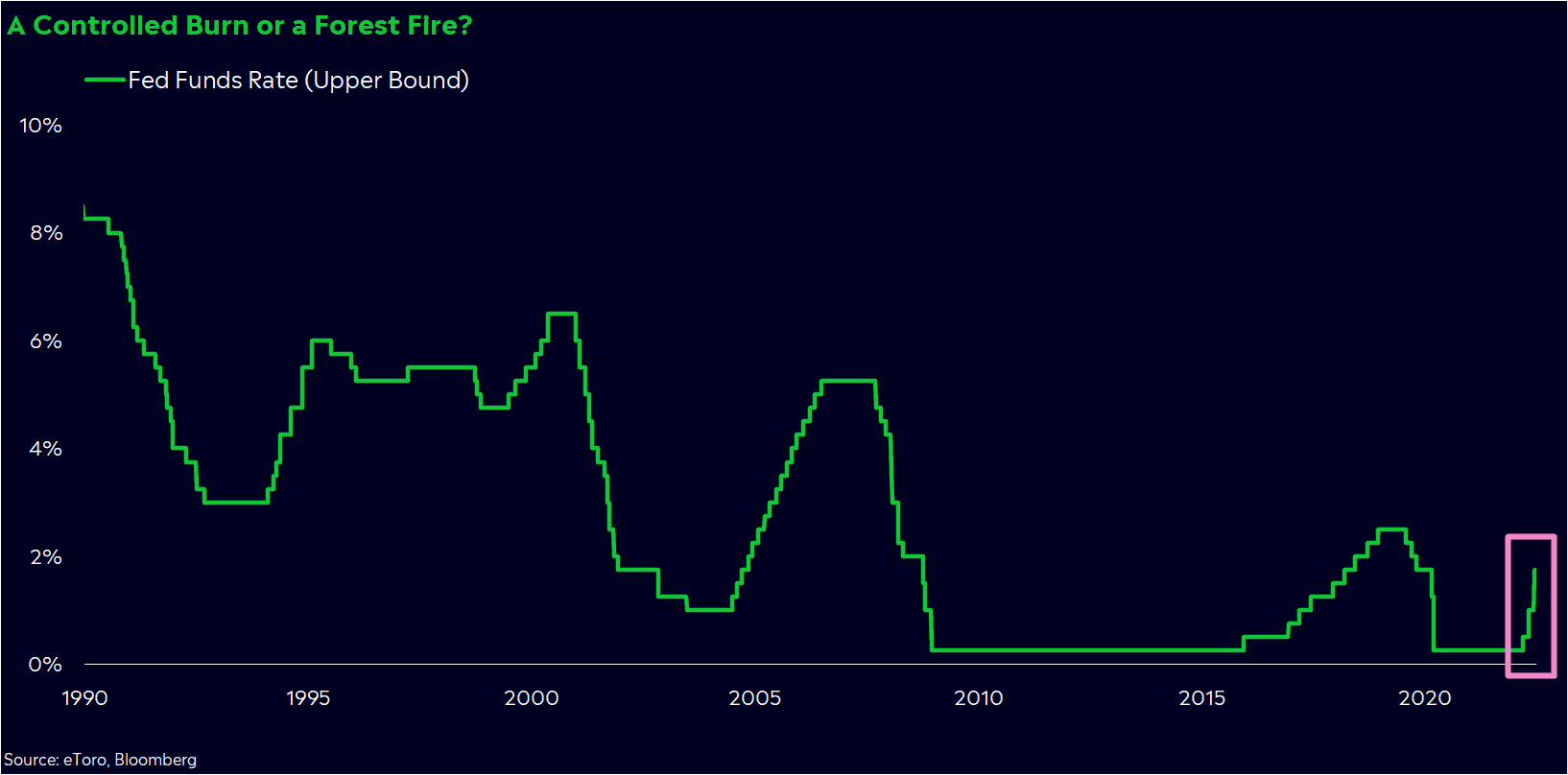

The Federal Reserve seemed happy with telegraphing rate hikes to nudge yields higher and remove some froth from the market. But now, the gloves are off, with the Fed leveling its biggest hike in almost 28 years to fight inflation, while simultaneously telegraphing that growth could slow and unemployment could rise.

Up until now, the Fed’s strategy has been painful, but effective. Tightening financial conditions were a calculated effort to keep inflation under control so the economy could return to a happy equilibrium.

But now, it may be struggling to contain the fire it started.

A controlled burn

First, let’s talk about why the Fed set this fire.

To foster new forest growth, firefighters will often perform a controlled burn: a tried and true method of stimulating germination and building a healthier forest in the long run.

The Fed does something similar. And much like a controlled burn, it can seem destructive and chaotic. When inflation grows faster than paychecks, the Fed has to intervene by raising rates to discourage demand and take some froth out of markets — two common catalysts of higher prices. There are unfortunate side effects, but the Fed believes inflicting a little bit of controlled pain through rate hikes could ultimately bring supply and demand back to homeostasis.

The Fed’s goal this year has been to restore balance in an unbalanced economy. And up until now, it’s made some progress through the megaphone strategy, or by talking the market into expecting a barrage of rate hikes.

Fed Chair Jay Powell and crew started this fire to tame inflation, and now they’ve made it clear that it’ll keep burning until inflation is subdued. The market believes they’ll succeed, too, with 5-year breakeven rates — the bond market’s gauge for future inflation — trading around 3%.

Yet inflation is still stubbornly high for several different reasons, some the Fed can’t control.

A forest fire

Just last month, Powell said hikes bigger than 50 basis points were off the table, and he seemed content on the larger-but-steady approach to hikes in order to keep the burn well-managed.

Then, Consumer Price Index (CPI) data showed inflation reached a new high in May. It wasn’t an extremely surprising report, even if it caused some heartache in markets. However, the Fed has since sprung into firefighter mode. On Wednesday, officials surprised the market with a bigger hike than expected, an even more aggressive tone on inflation, and a conclusion that unemployment would probably rise before we see results.

Look — the Fed is data-dependent, and it’s allowed to change course. And inflation is a serious problem. But the quick switch on strategy with little public preparation shows it may be desperately fighting the flames of inflation while turning a blind eye to what’s become a marked slowdown in demand. The Fed seems to have no intention of slowing down, either. Fed officials’ latest projections even show it expects to enact seven additional 25-basis point hikes this year.

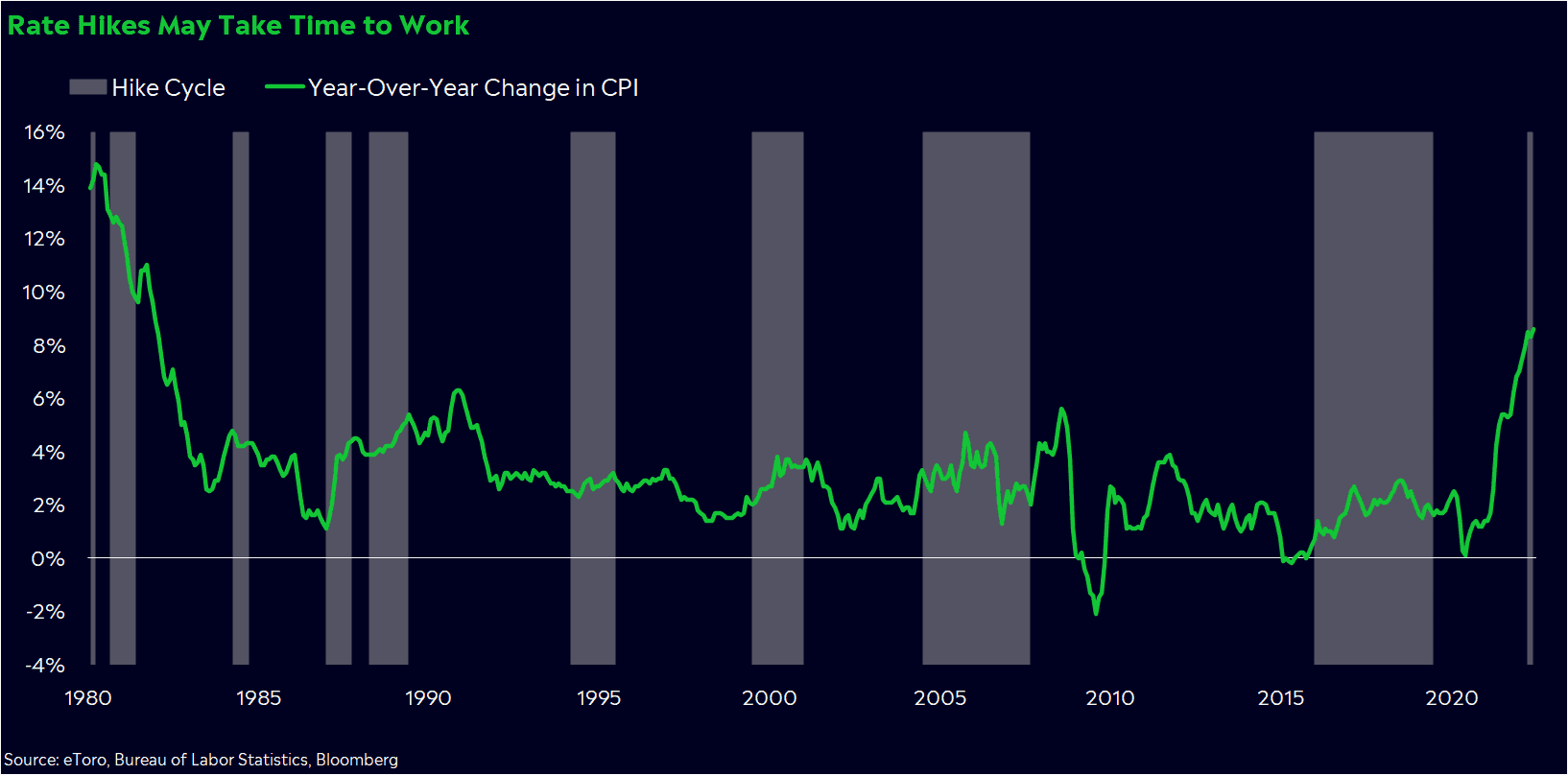

These goals of controlled inflation and healthy demand aren’t mutually exclusive. Demand is still relatively solid, but it has tailed off recently. Lower demand may eventually help bring inflation down, even if history shows it may take a while.

CPI growth usually takes more than a year after the first rate hike to peak, based on the Fed’s hiking cycles since 1970. Still, in the push and pull between a hot and cold economy, the Fed seems more willing to raise recession risks now to regain credibility and control in the fight against inflation.

Worst of all, the Fed’s surprise mega hike may erode the market’s confidence in its power at a time when officials need to retain their credibility. If the economy really is on the edge of recession, the Fed needs to preserve its ability to guide the public through a crisis. Now that Powell has gone back on his word, it’s tough for investors to take any forward guidance seriously.

Fighting the flames

The Fed may have a grander plan here, and the goal of taming inflation without a recession may still be possible. But if this is a controlled burn that’s turned into forest fire — as the Fed’s desperation suggests — this may be another wave of angst in the stock and crypto markets. Even if we avoid a recession, it seems more likely that growth could keep slowing, which could make the future difficult for high-growth assets.

Long-term investors may need to focus extra hard on staying invested according to their goals. Short-term investors, on the other hand, may need to start thinking about what their plans are if we see prices fall further. While the S&P 500 is 20% below its highs, the index has dropped an average of 39% in every recession since 1970.

But after a long post about a forest fire, I’ve got some good news. While these next several months may be difficult, remember that crises are only temporary. Society has historically recovered from every economic downturn, and the stock market has followed suit. The US economy has been in recession in just 13% of days since 1950, and bear markets have historically proven to be buying opportunities.

You just have to be willing to wait long enough.

*Data sourced through Bloomberg. Can be made available upon request.