We may have just witnessed the last Fed hike of this cycle, according to some investors.

But what happens after the hikes? We could be overlooking a key detail: When rates stop rising, they don’t necessarily start falling. Sometimes, they just stay put.

A Fed pause on rate hikes is monetary policy’s version of cruise control. It’s a sign of progress, yet it’s still a restrictive environment that could choke growth. And it may be what Fed chair Jay Powell and his colleagues are planning for the year ahead.

Why a pause matters

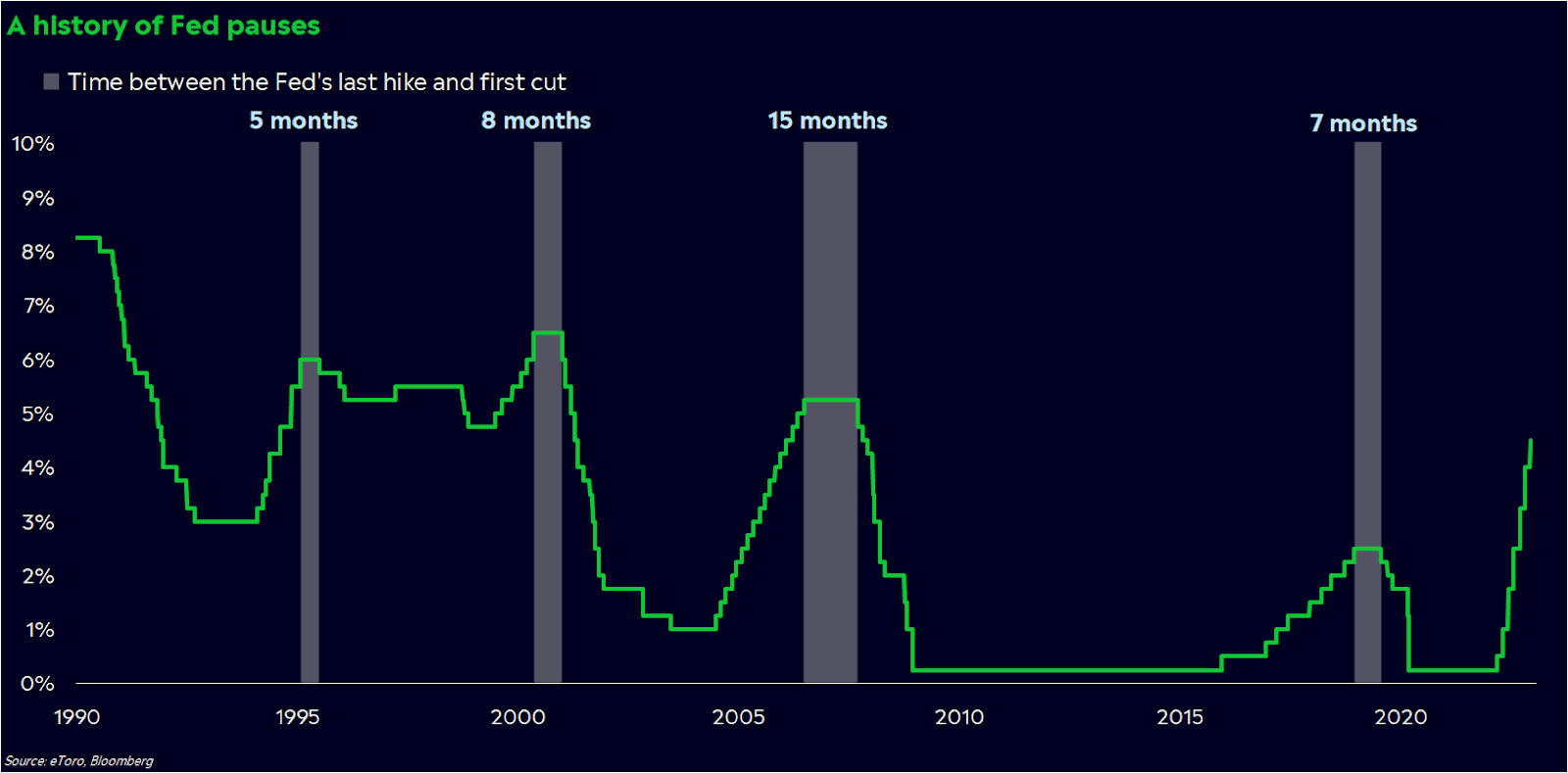

The Fed manages the economy by moving its policy rate up and down, but there have been stretches of time when it’s done nothing. Since 1970, the Fed has averaged four months between its last hike and first cut in a cycle. After the last three hiking cycles, the Fed has paused for at least seven months.

Even though rates stay the same, aggressive policy is still working behind the scenes through tighter borrowing conditions and a smaller money supply. And these days, when policy vibes penetrate markets at the speed of light, a pause can help the Fed guide investors through other tools — like its megaphone and its balance sheet.

The Fed sounds a little more hopeful than just a few months ago. But in all the excitement over a potential soft landing, I think we’ve skipped a few steps. Powell isn’t ready to declare victory yet (his words, not mine), and he said just this week that he doesn’t see the Fed cutting rates in 2023. In other words, we could be stuck at 13-year high rates for the next 11 months.

Things can change quickly, and we’d expect the Fed to concede and cut rates if the economy fell into a recession. But as long as data stays resilient, the Fed may have an argument to keep rates high until inflation is significantly lower.

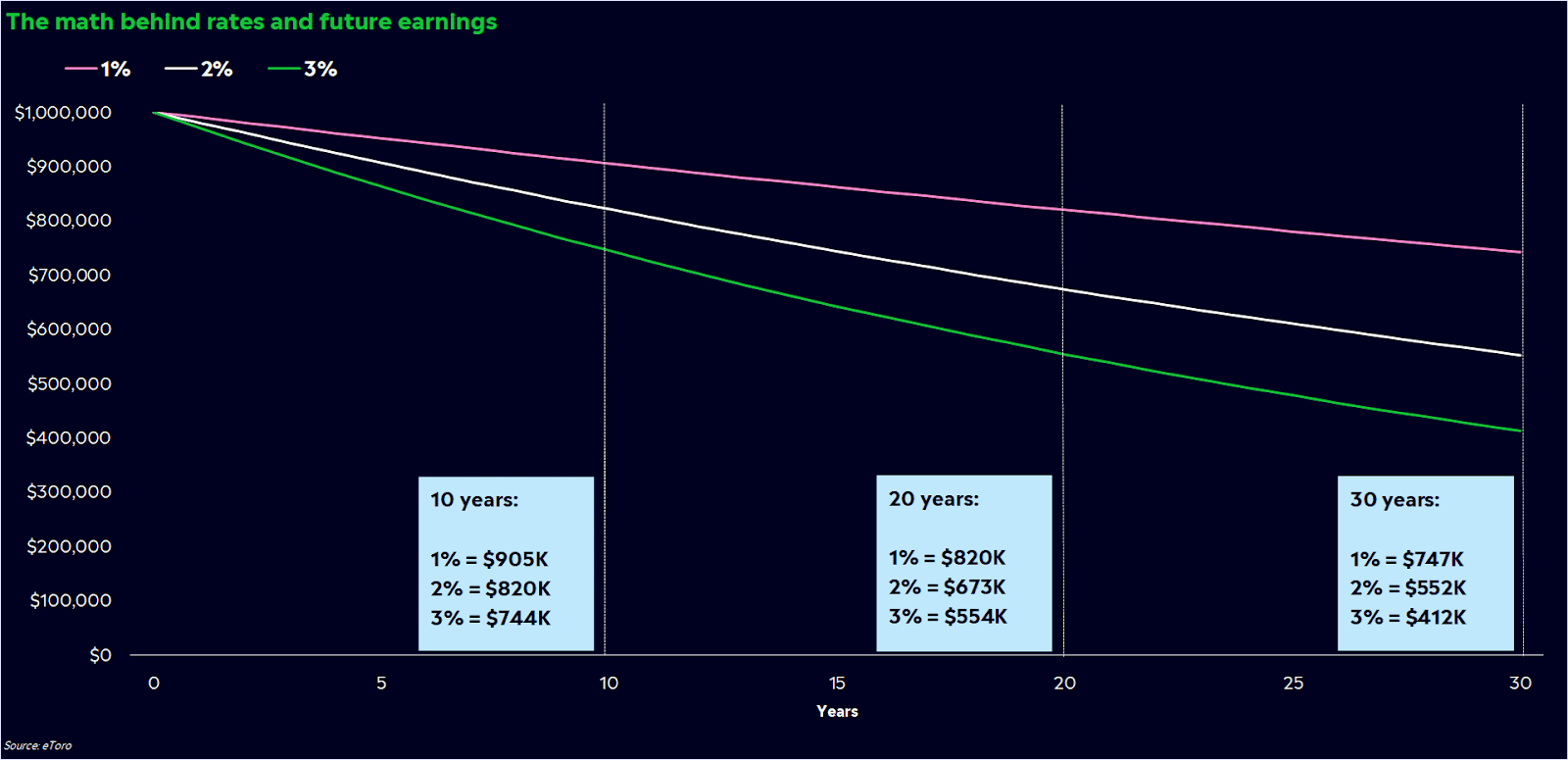

This is where the market’s strong start to the year gets a little awkward. When rates are high, people tend to focus on what’s working now (instead of what could work in the future). Why? Because the value of a future dollar decreases as rates increase.

Growth-focused companies tend to struggle when rates are high and capital is scarce, yet speculative names have led the market higher this year. The tech-heavy Nasdaq 100 index rose 10% in January, overshadowing the S&P 500’s 6% gain by the widest margin since June 2020. And 28 of the Russell 3000’s top 50 best-performing stocks in January were unprofitable over the past 12 months.

Some of this rally makes sense. Markets are seeing the light at the end of the tunnel. The economy is still powering ahead, the global picture is improving, and the world feels slightly more manageable in the new year. Long-term rates, like the 10-year Treasury yield, have moved dramatically lower, and that could warrant a shift into growth.

Even still, high short-term rates could keep the market stuck in purgatory. Sure, we may be past the lowest point of the market selloff. But it may not be easy to get back to record highs, either. The Fed and the markets are still stuck in a standoff, and the Fed ultimately controls the levers.

Portfolio purgatory

Portfolio purgatory can feel excruciating. But a Fed pause doesn’t necessarily mean you have to pause your portfolio as well.

Look for value. With rates this high, it makes sense to be especially focused on which companies have strong balance sheets and ample cash flows. Scan for the companies with the lowest prices relative to earnings estimates in each sector, then understand their business models and how they’re making money. Here’s a hint: Big, brand-name companies typically have a size advantage when it comes to financial strength.

Embrace the pause. You have two choices: Wallow in the purgatory, or take advantage of it. A high-rate environment can be painful, but it could also allow you to earn meaningful yields while taking less risk. Yes, the 2010s were great for the stock market, but they also forced many of us to prioritize growth over other parts of our portfolios. Yields and steady income have their place in investing, especially if you have goals you’d like to achieve over the next year or two.

There are also options strategies you can use to capitalize on a range-bound market (if you have the risk tolerance and timeframe for them, of course).

Keep your spirits up. The Fed is doing what it set out to do: get inflation down. And so far, it hasn’t harmed the job market too much. This is good news!

But as Powell said, it’s not time to call the W on inflation yet. We still have work to do, and a recession isn’t out of the question.

However, we’re all starting to realize that the Fed could actually pull this soft landing off. That’s the best-case scenario for everybody.

*Data sourced through Bloomberg. Can be made available upon request.