The Federal Reserve has been fighting inflation — and investors — for a year and a half now.

But soon, the Fed may be back on our side.

This week, the headlines were all about the Fed holding rates steady for another meeting. In my eyes, though, the more newsworthy shift has been in Fed Chair Jay Powell’s words, not his actions. By acknowledging that economic growth is becoming a risk, Powell may be reviving the notorious “Fed put,” which could help support prices if we hit a recession.

The Fed put may sound like a phrase you wouldn’t hear outside of an economist’s Halloween party.

Nerdy as it sounds, though, it could be one of the biggest stories for your portfolio in the coming months.

Why the Fed put matters

To understand why the Fed put matters, you first need to understand what the heck a Fed put is.

The “put” part of the phrase refers to a put, or an options contract that allows an investor to sell a stock at a predetermined price. A Fed put, however, isn’t an options contract — it’s a specific mindset that the Fed employs in a low-inflation environment. It’s also Wall Street’s snarky way of saying that the Fed could bail out the stock market by cutting rates when prices fall.

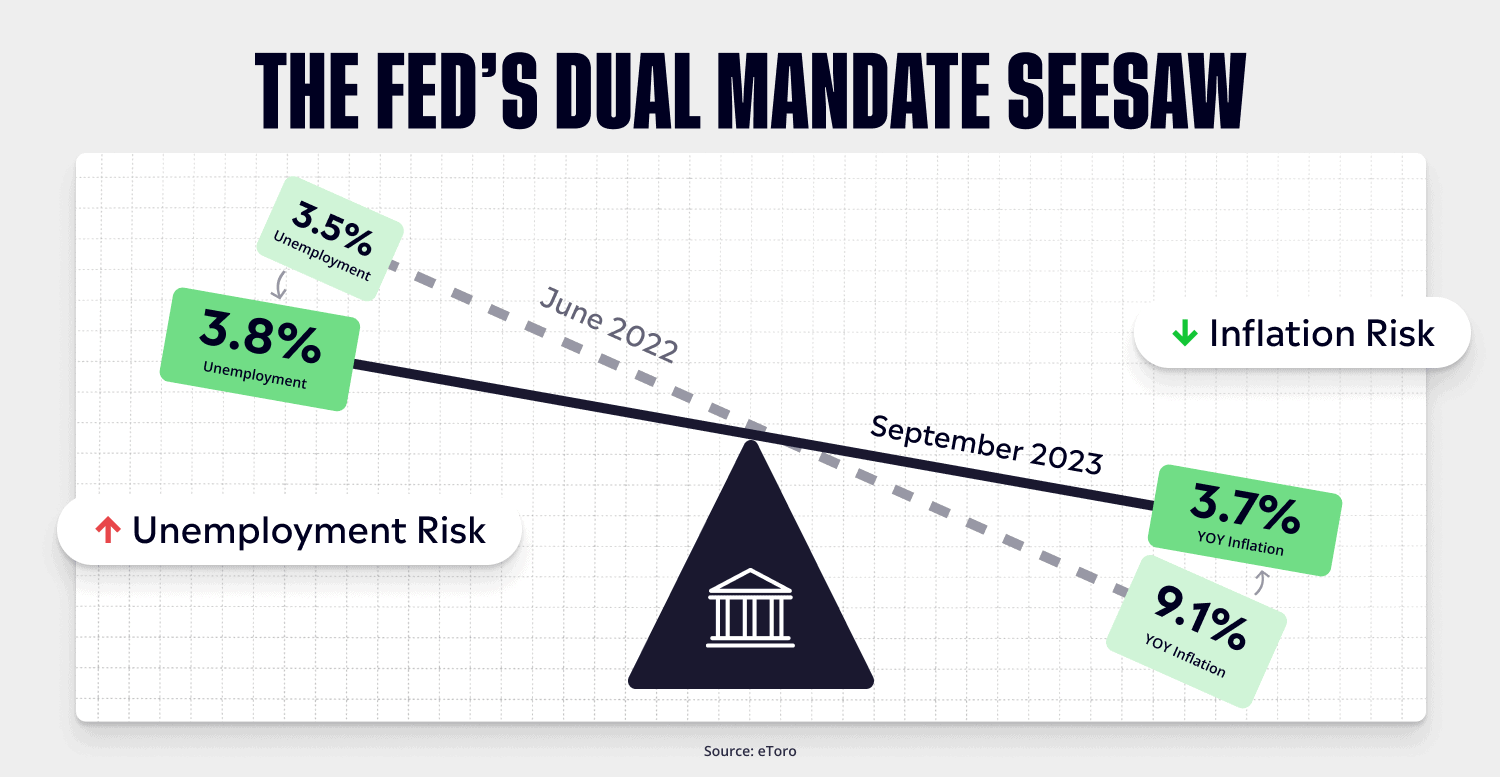

See, the Fed exists for two reasons: to keep inflation under control while maintaining low unemployment. After all, that’s the definition of a healthy economy — people are making money and they can afford to buy things.

Think of it like a seesaw: If unemployment is too low, inflation is probably too high (and vice versa).

Last year, the inflation side of the seesaw was way too high and the unemployment rate was historically low. That’s why the Fed started hiking rates and promised to defeat inflation at the sake of the economy. By the way, here’s a post I wrote on why the Fed has to hammer the job market to control inflation.

Today, we’re in a different position. The Fed has largely fixed the inflation side of the seesaw. Prices are growing at a 3% clip (instead of the 9% pace we saw last year). But even though the seesaw is coming back into balance, the unemployment side could rise.

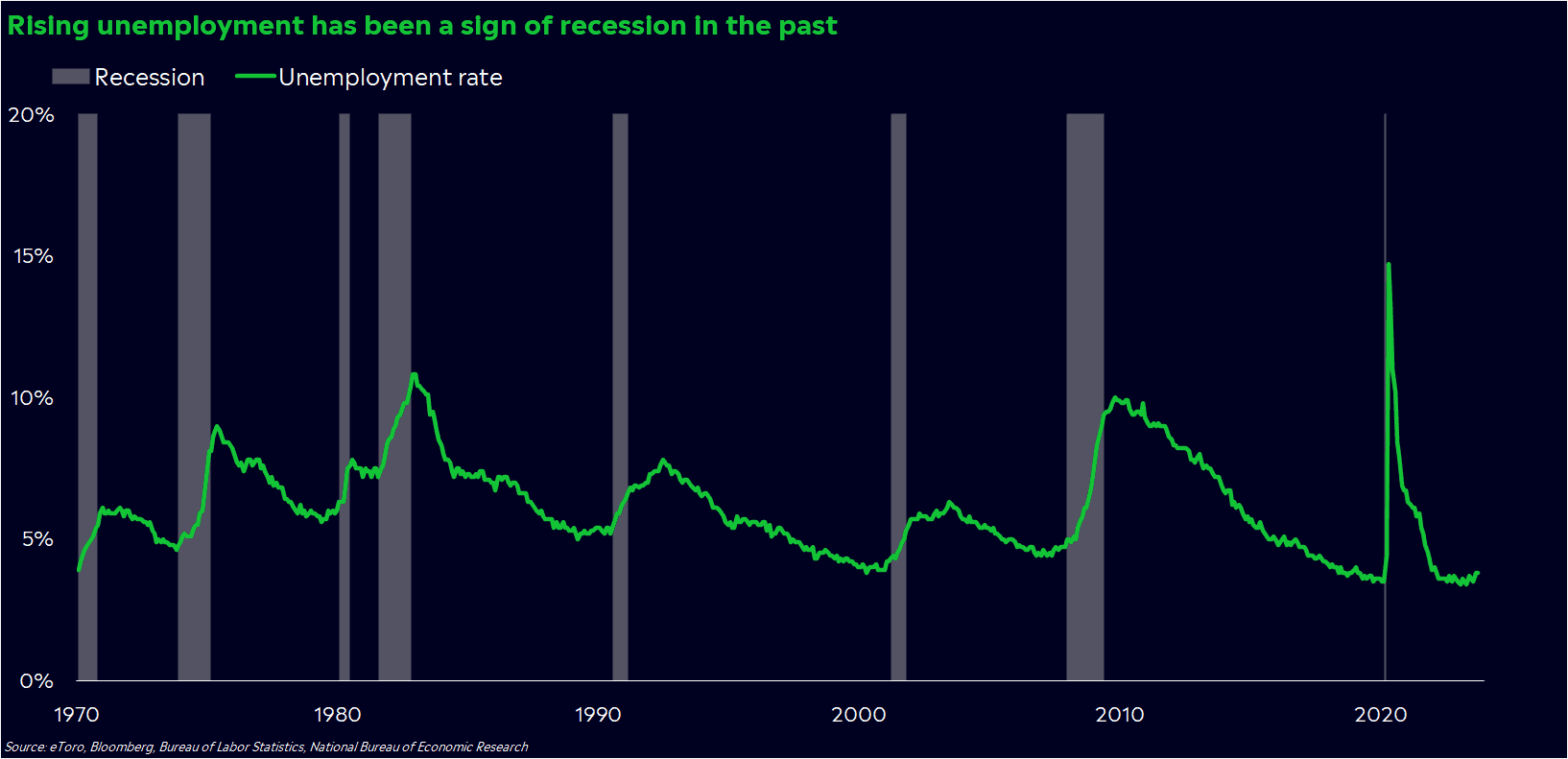

If unemployment starts to climb, people could pull back on spending en masse. And if you consider that about 70% of the US economy is fueled by consumer purchases, a recession could come quickly. In the past, a spike in unemployment has almost always correlated with a recession.

Right now, when a recession is an especially big risk, the Fed may feel compelled to cut rates if things go south. Cuts can increase demand within the economy through lowering interest rates, but they can also help support investor confidence.

That’s the Fed put in action — medicine for the economy, and a potential cushion for the stock market.

Reality, or a fever dream?

The Fed put doesn’t seem to be a bullish fever dream these days, either. Powell has now mentioned in three straight post-Fed press conferences that growth and inflation risks have become more balanced. In Wednesday’s press conference, Powell even talked about how the Fed may be erring on the side of “doing too much” in regards to rate hikes while praising the supply-driven progress we’ve seen in taming inflation.

At any rate, it looks like the Fed’s hiking may be finished, even if Powell isn’t willing to say that outright. The bond market is preparing for one more rate hike, but it’d be hard to imagine that happening, absent a material increase in inflation.

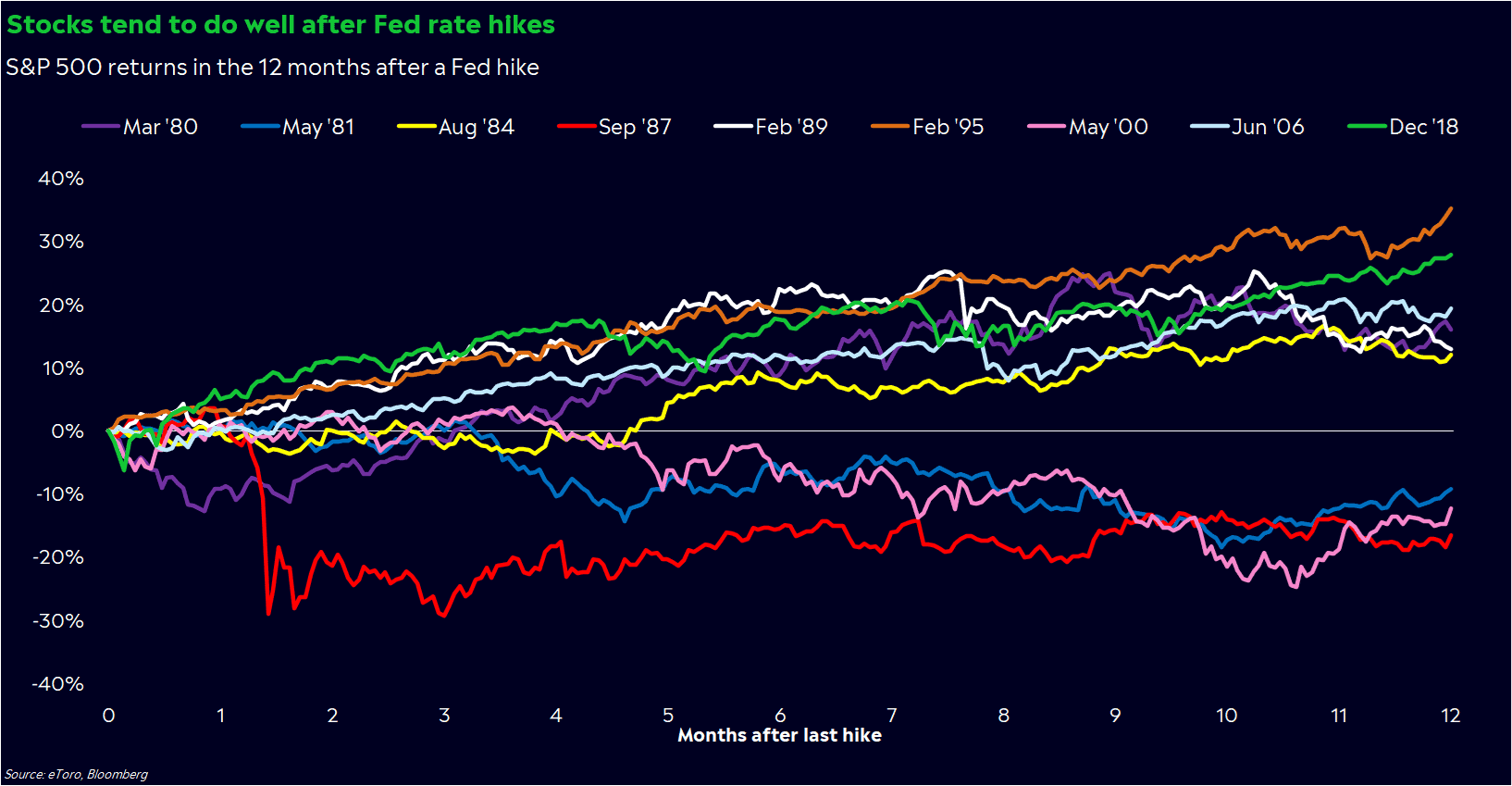

Put all the pieces together, and you may have a few more reasons to be optimistic about markets today than earlier in the week. Contrary to popular belief, stocks tend to do well after the Fed finishes hiking. In fact, the S&P 500 has been higher one year after six of the last nine hiking cycles.

Still, it may not be the time to pile back into risky investments. Even if the Fed cuts rates soon, it’s unlikely that rates will go to zero unless we hit a crisis. Persistently high inflation is still a possibility, and the Fed could keep rates elevated until that fire is fully extinguished. Yes, regardless of what happens to the stock market.

A recession also isn’t out of the question. But if you’re expecting a deep bear market on the back of a vicious recession, I’d start tempering your expectations.

So what does this mean for me?

Think on a sector level. These days, short-term opportunities may lie in sectors — not necessarily the overall market. Rising yields have put utility, REITs, and dividend stocks under immense pressure — even the highest quality names. Even a little relief on the rate front or a slowdown in growth could trigger a rush into rate-sensitive and recession-proof stocks — like big tech, real estate, and consumer staples — similar to what we saw earlier this year.

Remember the hidden risk. The past few years have taught us all valuable lessons. One I keep coming back to is how long-term views only work if you can survive short-term moves. There are plenty of reasons not to invest in this market. But there’s also a risk in sitting out of the market: The Fed may be eliminating your shot at drastically lower prices.

*Data sourced through Bloomberg. Can be made available upon request.