The Daily Breakdown looks at Walmart after the firm delivered a top- and bottom-line beat and looks set to open at record highs.

Thursday’s TLDR

- Inflation continues to cool.

- Walmart stock could be set for a record open.

- 13F filing reveals new positions for Warren Buffett’s firm.

What’s happening?

Wednesday’s inflation report was mostly in-line with expectations, showing that inflation continues to cool.

CPI grew 2.9% year over year, the lowest figure since March 2021, highlighting that the Fed’s higher-rate environment is helping to slowly but surely chip away at inflation.

Late last month, Fed Chair Powell said the committee needs to see a continuation of the data we’ve been receiving — essentially, data that’s in-line with expectations or better — in order to justify a September rate cut.

After a weaker-than-expected jobs report a few weeks ago and now this report, the bond market is fully pricing in a rate cut next month. The only debate seems to be whether it will be a 0.25% or 0.50% cut.

Today’s attention shifts to the retail sales report, due up at 8:30 a.m. ET. The report will give investors an update on the health of the consumer.

Earlier in the year, we needed the economy to soften a bit in order to help inflation move lower. However, a strong retail sales number today will help investors feel more confident in the economy — which would be a good thing given the recent labor market concerns.

However, a weak number will likely increase investors’ recent economic concerns.

Want to receive these insights straight to your inbox?

The setup — WMT

Walmart is trading higher by more than 5% in pre-market trading after reporting a top- and bottom-line beat for its Q2 results. Revenue grew 4.7% year over year and management raised its full-year outlook.

Coming into today’s session, shares are up 30.6% on the year. If the stock were to open with its current pre-market gain, it would be trading at all-time highs — and adding to those year-to-date gains.

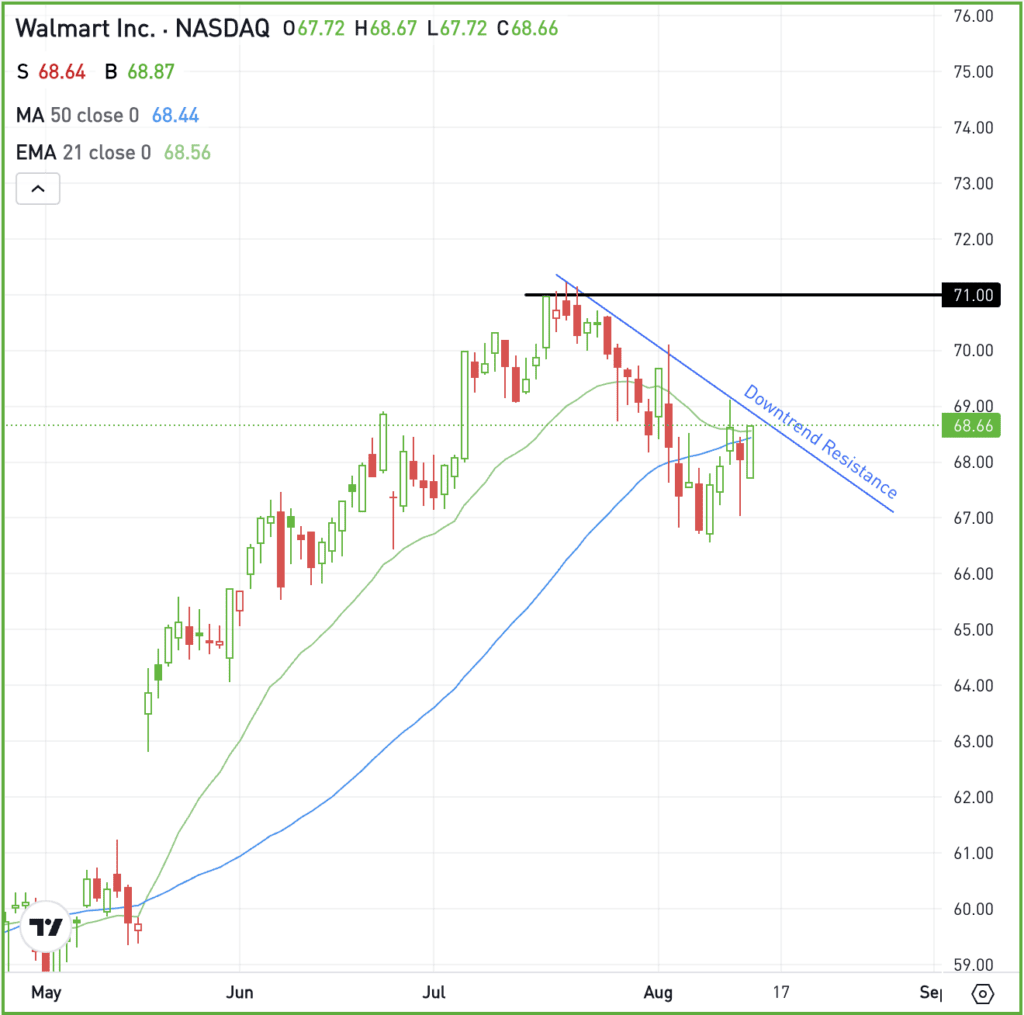

WMT stock hit its most recent high in late July, then pulled back for several weeks. Today’s rally will likely vault the stock over downtrend resistance and potentially over recent resistance near $71.

It’s trading above $71 in the pre-market, but bulls will want to see WMT hold above that level in today’s regular session. If it can do so, it could help fuel more gains down the road.

If Walmart opens above $71 but can’t hold onto its gains, we may see it lose that bullish momentum in the days and weeks ahead.

Options

For some investors, options could be one alternative to speculate on WMT. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out in WMT.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

BRK.B — Warren Buffett’s Berkshire Hathaway took new stakes in Ulta Beauty and Heico in Q2, while reducing positions in Apple and Chevron. Berkshire also exited Paramount Global and Snowflake.

CSCO — Cisco shares are rallying in after-hours trading after its Q4 earnings results exceeded expectations. Further, the company reported $13.64 billion in revenue, beating expectations by $100 million, and plans to cut 7% of its workforce. The recent Splunk acquisition added nearly $1 billion in revenue.

BABA — Shares of Alibaba are dipping in pre-market trading after the company beat on earnings, but missed on revenue expectations. Sales of $33.47 billion grew 4% year over year, but missed expectations by more than $1 billion.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.