The Daily Breakdown looks at the Fed’s conundrum on whether to cut interest rates by 25 basis points or 50 bps. We also look at Bitcoin.

Wednesday’s TLDR

- The Fed is expected to cut rates today

- But investors are unsure by how much

- Bitcoin continues to consolidate in a healthy manner

What’s happening?

We’re finally here: Rate cuts are coming.

The Fed last cut interest rates in response to the Covid-19 pandemic, then went on a record-setting rate-hiking spree to offset rampant inflation. Since the Fed last raised rates in July 2023, rates haven’t changed — until today.

At 2 pm ET today, the Federal Reserve is expected to announce a rate cut.

Last month at the Fed’s Jackson Hole symposium, Chair Powell told us that it was time for the Fed to change gears and lower interest rates. Now, the bond market is fully pricing in a rate cut at today’s announcement.

The only question is, how much?

Right now, current odds sit near 60/40 — with the bond market pricing in a ~60% chance of a 50 basis point rate cut and a ~40% chance of a 25 basis point rate cut.

It’s been a while since we’ve gone into a Fed meeting lacking clarity on what the committee will do. Today’s decision does matter, but the bigger picture is, how fast will the Fed cut rates in the ensuing months and quarters?

So long as earnings growth continues to deliver and the economy can keep itself together, then lower rates should be viewed as a positive for stocks and crypto.

Want to receive these insights straight to your inbox?

The setup — BTC

A lot of investors are growing impatient with Bitcoin lately, up 1.6% over the past month and down close to 8% over the past three months.

But investors have to remember that BTC is still up more than 40% so far this year and is up more than 120% over the past 12 months.

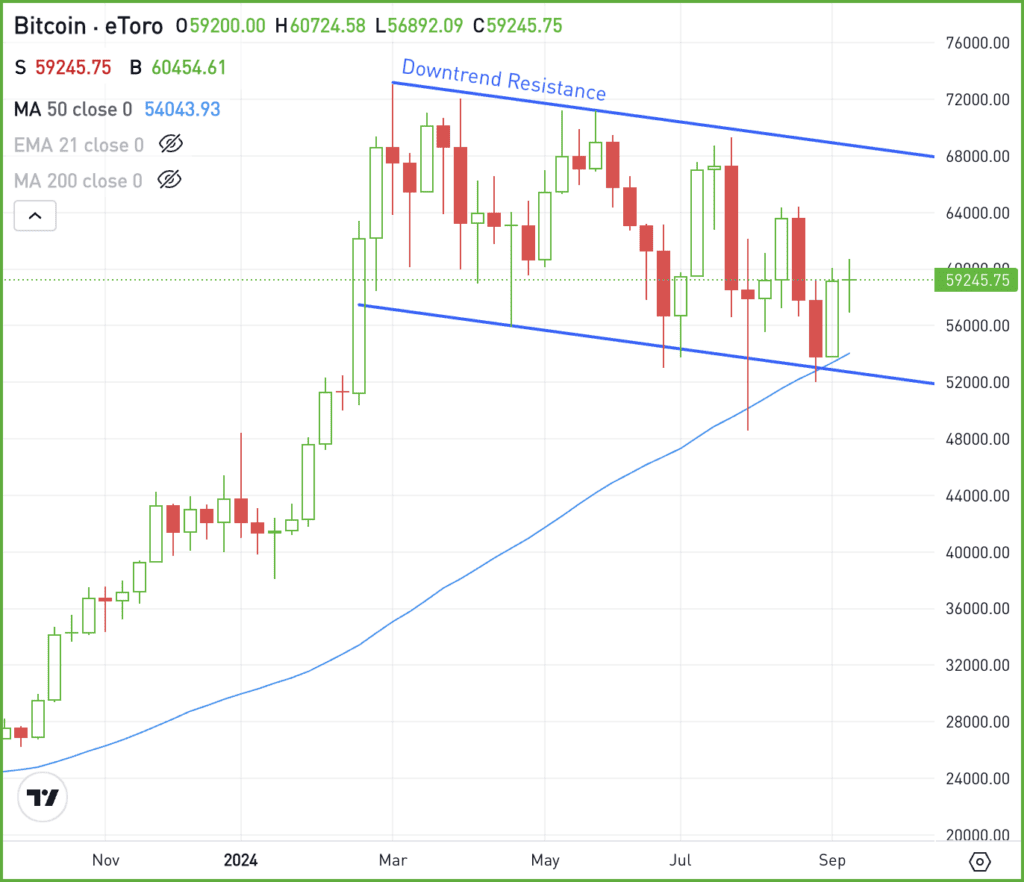

The asset has seen a tremendous move higher and now appears to be consolidating in a very healthy manner, as you can see on the weekly chart below.

Bitcoin held the 50-week moving average and continues to trade in a sideways-to-lower manner known as a “bull flag” pattern. Ultimately, bulls want this pattern to resolve higher with a strong move above downtrend resistance.

That said, there’s no telling when this move will occur — or that it will occur at all. It’s possible that Bitcoin can break support and move lower.

But from where we’re standing today, this looks like healthy consolidation.

What Wall Street is watching

GIS – General Mills stock is trading slightly lower this morning after the firm delivered an earnings and revenue beat for its fiscal first quarter results. Further, management reaffirmed its full-year outlook.

SPX500 – The S&P 500 hit a new record high on Tuesday, one day before the Fed’s expected interest rate decision. While the index only closed slightly higher on the day, it marked the seventh straight daily gain for the S&P 500. Both observations were also true for the SPY ETF.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.