The Daily Breakdown examines the huge run in the stock market, as well as the recent breakout in the XLF ETF.

Tuesday’s TLDR

- Up in 13 of 14 weeks, stocks will eventually need a break.

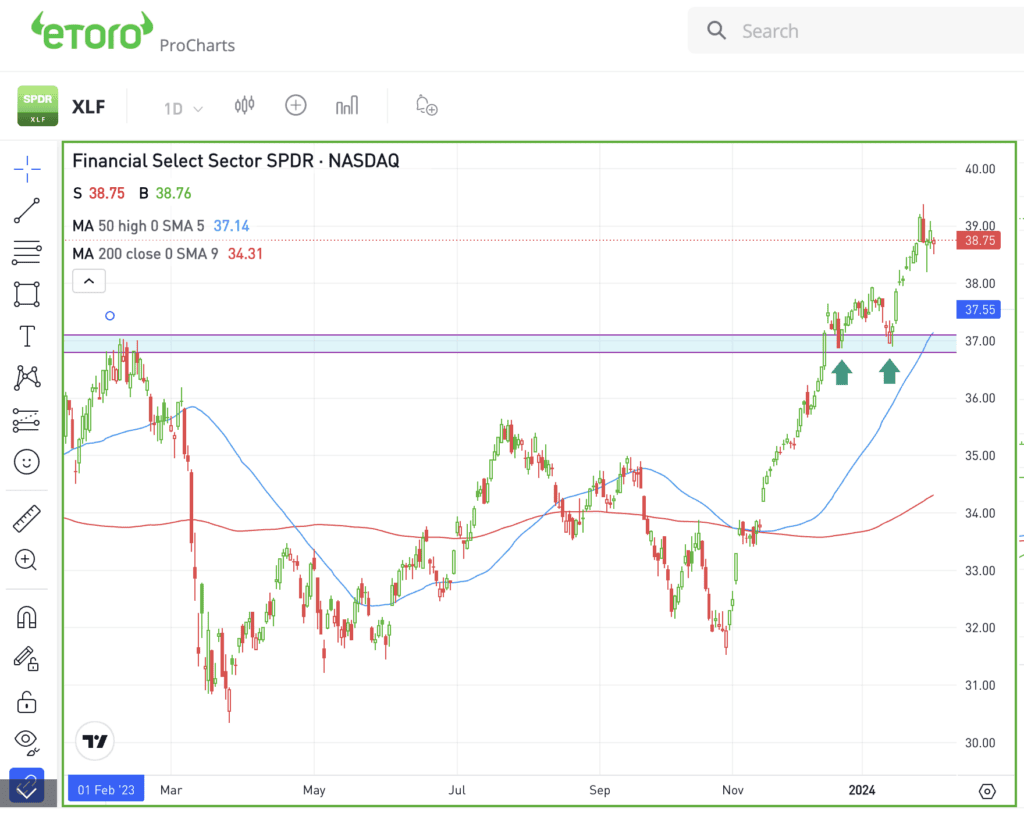

- The XLF recently broke out over resistance.

- Eli Lilly hits all-time highs.

What’s happening?

After a hot run in the markets — with the S&P 500, Nasdaq 100, and Dow up 13 of the last 14 weeks — we have to keep our expectations aligned with reality.

These indices have rallied a tremendous amount in about three months and have all gone on to hit new all-time highs.

As a reminder, that’s bullish and it bodes well for the future. But it would be unrealistic to expect the market to rally in 13 of the next 14 weeks from here.

So far, earnings have yielded a positive reaction. And the economy has churned out some solid data to start the new year. But it wouldn’t be unusual for the markets to pump the brakes at some point.

What will that look like?

I’m not sure exactly. We could trade sideways for a few weeks or possibly a couple of months. It’s possible that the markets could also pull back from here. Anywhere from 3% to 5% would be reasonable after this kind of run.

Remember, equities tend to correct through time (consolidating in a sideways manner) or price (pulling back). Instead of thinking of doom or boom, think of it as the market needing to rest before it has the potential to keep running.

Want to receive these insights straight to your inbox?

The setup

It’s always a positive sign to see financials participating in the rally. Up in 11 of the last 14 weeks and the XLF, arguably the most popular financial sector ETF, has climbed more than 24% from the Q4 low to the recent high.

In doing so, the stock was able to break out over $37. Even better, it began using this level as support, helping to push the ETF to its current 52-week high near $39.50.

If XLF pulls back into its 50-day moving average and recent support near $37, we’ll want to see how it reacts. More specifically, we’ll want to know if buyers step in to keep it afloat or if the stock breaks lower, nullifying this zone.

Financials account for 12.9% of the S&P 500, the second largest weighting in the index, according to FactSet.

If the banks can keep trading well, that bodes well for stock market bulls too.

What Wall Street is watching

TSLA: Tesla stock hit an eight-month low, reflecting investor concerns amid lowered earnings projections. Market challenges — like reduced demand in key markets like Germany — aren’t helping matters. Tesla faces a potential drop in growth this year, with earnings forecasts falling below 2023 levels.

PLTR: Palantir soared 19% in after-hours trading after the company delivered strong revenue results. Sales jumped 20% year over year to $608.4 million, with AI helping drive the beat. CEO Alex Karp highlighted unrelenting US demand for large language models as a key growth factor.

LLY: Shares of Eli Lilly jumped 5.8% on Monday and hit new all-time highs ahead of its earnings report on Tuesday morning. The buyers are back in pre-market trading, with shares trading higher following a top- and bottom-line beat and better-than-expected guidance.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.