Tuesday’s TL;DR

- Stocks enter 2024 on a nine-week win streak.

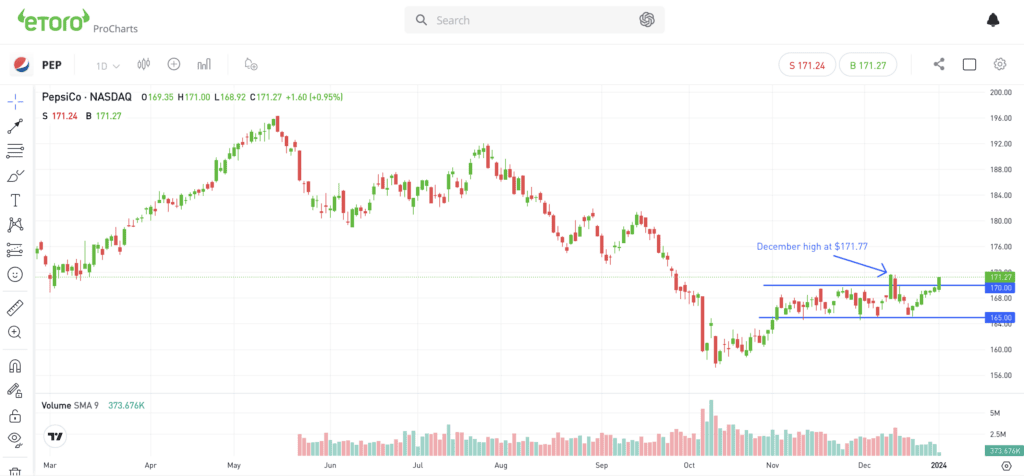

- Can PepsiCo break out of its recent trading range?

- Bitcoin starts the year with a quick 7.5% gain.

What’s happening?

Stocks may have ended lower on Friday, but they went out with a bang for the year.

The S&P 500 and Nasdaq are both riding nine week win streaks. They ended 2023 with gains of 24.2% and 53.8%, respectively.

It feels weird saying that stocks could use a rest when we’re entering the first trading week of the year, but that’s the truth. While the trend has been incredibly bullish, a consolidation period — especially ahead of earnings — would do investors a favor.

Seasonally, the first few days of the year tend to be strong as investors put fresh capital to work, although the futures market is indicating a lower open today.

These ideas — a strong trend and seasonality paired with what seems to be a tired market in the short term — are clashing with one another, leaving investors a bit complacent.

Let’s see how the market absorbs this morning’s weakness. Do investors use it as an excuse to take some profits off the table and let stocks cool off, or will they gobble up the dip like they have for the last two months?

The setup — PepsiCo

Near the end of the year, eToro US CEO Lule Demmissie, eToro analyst Callie Cox, and I sat down for our 2024 outlook webinar.

In that webinar, I explained why I thought high-quality dividend stocks could perform well this year. This group struggled in 2023, as investors dumped dividend stocks in favor of locking in higher yields in the bond market.

With interest rates expected to fall, many of these stocks could be poised for a bounce. Specifically with PepsiCo, the stock hasn’t been a big participant in the rally — at least not lately.

Many investors may forget that PepsiCo stock hit an all-time high in May, then suffered an uncharacteristic 20% fall to its October low.

After finding support near its 200-week moving average, shares bounced more than 8% going into early November. However, the stock has gained less than 1% since November 6.

In that time, the stock has been chopping between $165 and $170. Although it has technically gained for three straight weeks, shares remain stuck in this range.

I don’t know when PepsiCo will break this range, but it will hopefully do so eventually. If it’s to the upside, bulls could be looking at a rebound play in the food and beverage conglomerate — especially while its dividend yield is near 3%.

What Wall Street is watching

Bitcoin: Bitcoin soared above $45,000 on Tuesday, hitting its highest level since April 2022. Already up more than 7% for 2024, hopes for an SEC-approved spot ETF are helping to drive Bitcoin higher. The cryptocurrency is riding high after finishing 2023 with a gain of more than 150%.

USO: Crude oil prices fell over 10% in 2023, marking the first significant decline since 2020. This drop happened despite geopolitical tensions and OPEC+ production cuts, with increasing supply growth being a key factor in its decline.

ASML: ASML Holding halted shipments of high-end chipmaking machines to China, complying with a request from US administrators and ahead of new Dutch export restrictions. The decision impacts pre-scheduled deliveries and comes amid tensions between US and China.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.

Content, research, tools, and stock symbols displayed are for educational purposes only and do not imply a recommendation or solicitation to engage in any specific investment strategy. All investments involve risk, losses may exceed the amount of principal invested, and past performance does not guarantee future results.