The Daily Breakdown takes a look at AMD, which has been consolidating for several months but is trying to gain upside momentum.

Tuesday’s TLDR

- Nasdaq snaps losing streak as Nvidia leads rebound.

- Micron, Nike earnings in focus later this week.

- AMD is consolidating, but can it break out?

What’s happening?

A bounce in mega-cap tech — including solid rallies for Nvidia, Tesla, Alphabet, and Meta — helped restore momentum in the Nasdaq 100 and S&P 500, both of which snapped a three-day losing streak.

However, all eyes remain fixated on Nvidia.

The stock fell 16% in three days — shedding more than $400 billion in market cap — before finding its footing and bouncing 6.8% on Tuesday. The bounce helped give semiconductors stocks a lift, as the SMH ETF rallied 2.3% in the session.

While we tiptoe into the halfway point of the week, a lot of focus is shifting to the back-half of the week.

That’s as Micron will report earnings tonight, and Walgreens and Nike will report on Thursday. It’s also as the Q1 GDP revision will be released on Thursday morning, followed by the all-important PCE report on Friday.

We’ll also get the Russell Reconstitution on Friday, which is a giant, annual rebalance that drives a lot of volume and increases the potential for short-term volatility.

The setup — AMD

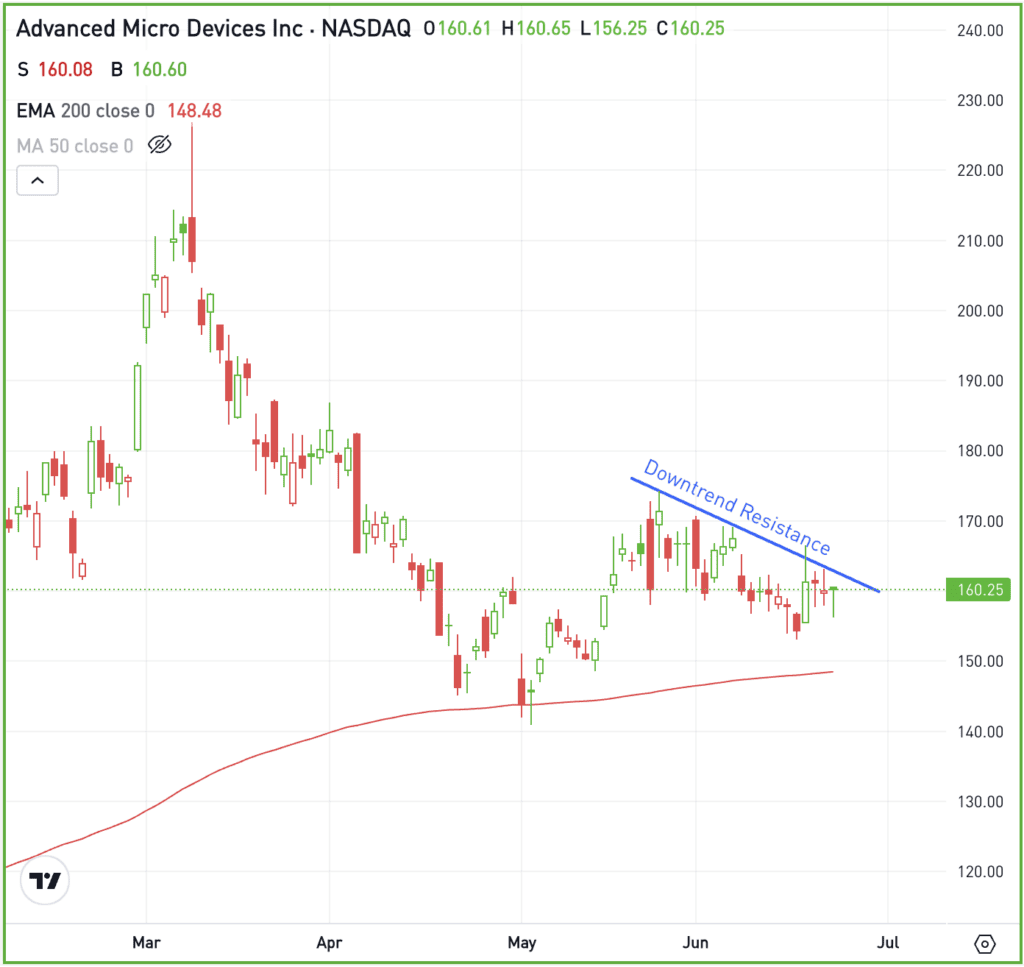

Despite the recent volatility in Nvidia and other chip stocks, AMD has actually been pretty quiet. On a weekly basis, the stock has gained or lost less than 1.2% in four of the past five weeks.

AMD has badly lagged Nvidia this year, up just 8.7% vs. a 154.6% gain for the latter. AMD may be a laggard, but I’m keeping it on my watch list.

The stock is consolidating above its 200-day moving average, which was support in May. Currently, shares are sitting just below downtrend resistance. If AMD can’t break out, it could decline back down to the 200-day moving average.

However, if shares can break out over downtrend resistance, we could see a notable upside move — especially if AMD can make further progress on its AI chips.

Options

Investors who believe shares will break out — or those who are waiting for the potential breakout to happen first — can participate with calls or call spreads. If speculating on the breakout rather than waiting for it to happen first, make sure to use enough time until expiration.

For investors who would rather speculate on resistance holding, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is Watching

CCL — Carnival Cruise stock rose nearly 9% after beating Q2 earnings and revenue expectations. Analysts had expected a loss of 2 cents per share, but Carnival reported a gain of 11 cents per share on revenue of $5.78 billion, which grew 17.7% year over year. It helped that management provided an optimistic earnings outlook.

FDX — FedEx stock will try to open near one-year highs after the company reported an earnings and revenue beat for its fiscal Q4 results. The company has struggled to grow revenue, but eked out year-over-year growth of 0.9% in Q4. Management also provided favorable guidance, helping to give the stock a lift in pre-market trading.

RIVN — Rivian shares surged nearly 40% in after-hours trading after it agreed to form a joint venture partnership with Volkswagen, which will invest $5 billion in the struggling EV maker. The partnership aims to jointly develop electric vehicle architecture and software, crucial for both companies’ growth in the competitive EV market.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.