The Daily Breakdown previews the monthly jobs report and explains why — either good or bad — it’s so important to markets right now.

Thursday’s TLDR

- Friday’s jobs report is key

- Clorox’s clean chart

- Tesla misses delivery estimates

What’s happening?

Geopolitical worries have sparked recent volatility in the markets, but it seems as though US investors are biding their time until tomorrow’s jobs report.

The monthly labor report will tell investors how many jobs were added (or lost) last month and provide a revised figure for the August report. It will also tell us the unemployment rate. Consensus estimates are calling for 144,000 jobs to be added last month and for the unemployment rate to come in at 4.2%.

Because the US is so dependent on consumer spending, the jobs market is incredibly important. It’s also why so much attention is placed on this report (even if many investors have seemingly only focused on inflation over the past few years).

If the jobs report is solid, investors will likely breathe a sigh of relief. There are a lot of things to focus over the next few weeks, but one less thing to worry about would be a positive development.

On the flip side, a worse-than-expected report may fuel worries that the Fed waited too long to cut rates and that the economy could suffer as consumer spending takes a hit.

Admittedly, that’s a lot of read-through for just one report, and in reality, we’ll need several reports to feel truly confident in either development (good or bad). But it’s important to remember that there are more considerations to the economy than just inflation — and the jobs report is among one of the most important measures.

Want to receive these insights straight to your inbox?

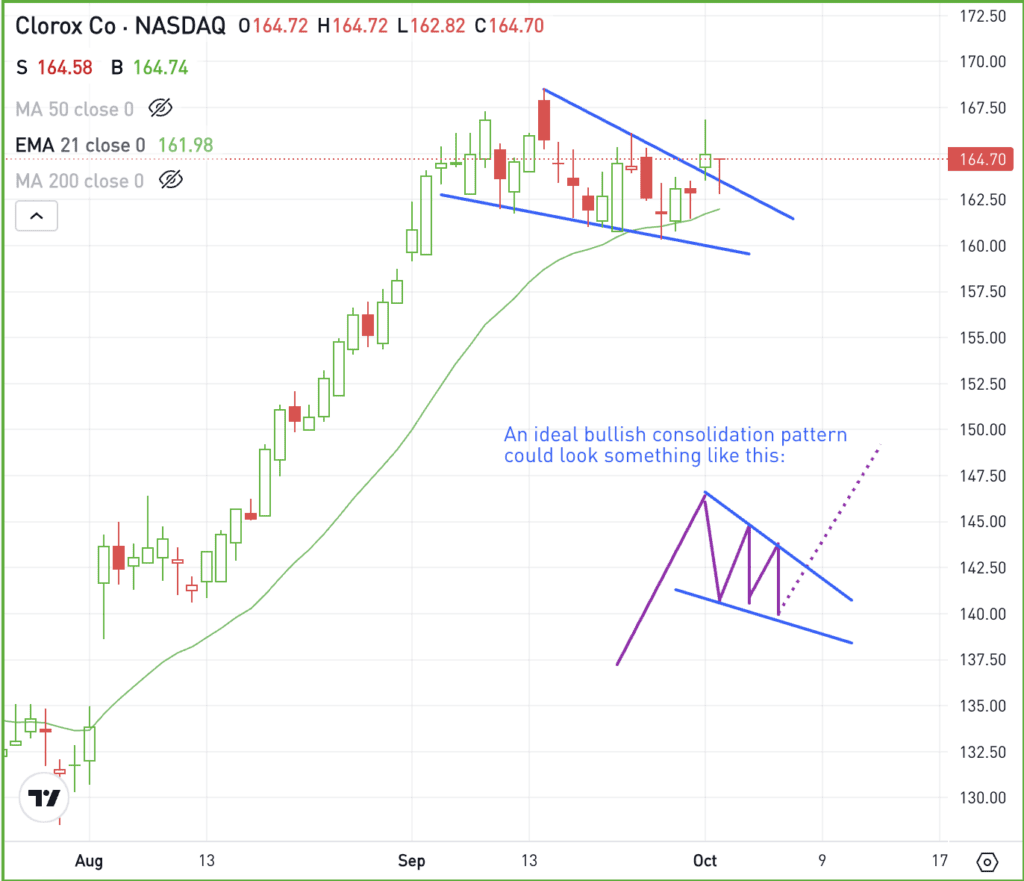

The setup — CLX

While Clorox is not normally a stock that active traders have on their radar, it’s hard to deny how well this name has been trading lately. Since August 1, CLX is up about 25%.

Despite the recent rally to one-year highs, shares still pay a dividend yield of roughly 3% and the company has increased that dividend for 22 consecutive years.

When we look at the chart, the current rally is clear. Now investors are wondering if it can continue higher after a recent consolidation phase:

Bulls are hoping that Clorox continues to find support in the low-$160s and from the 21-day moving average. Further, they’re hoping shares can resolve out of this consolidation pattern and move higher in the coming weeks.

On the flip side, bulls are hoping the above support levels fail, which could usher in more selling pressure and send CLX lower.

Options

Buying calls or call spreads may be one way to take advantage of a further rally. For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

TSLA – Tesla stock slipped 3.5% yesterday after the automaker reported its Q3 delivery results. The company delivered 462,890 vehicles last quarter, slightly missing expectations of 463,897 vehicles. Despite the slight miss, Tesla’s Q3 2024 delivery figures were up from roughly 444,000 in Q2 2024 and up from roughly 435,000 units in Q3 2023.

LEVI – Shares of Levi Strauss are under pressure in Thursday’s pre-market trading session, down more than 10%. The decline comes after the company beat on earnings, but missed on revenue, reporting earnings of 33 cents a share on revenue of $1.52 billion vs. expectations of 33 cents a share and $1.55 billion.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.