The Daily Breakdown looks at what Chinese stocks are rallying and what’s behind the move. Bristol-Myers breaks out too.

Wednesday’s TLDR

- New stimulus has sent Chinese stocks higher

- Bristol-Myers bucks the selling pressure

- Apple iPhone reports disappoint

What’s happening?

Chinese equities like Alibaba, JD.com, Baidu, PDD Holdings, Nio, and many others have been ripping higher over the past week.

The China Large-Cap ETF (FXI) and the China Internet ETF (KWEB) have also been on the move, rising 30.8% and 43.5% from their lows in September, respectively.

Even with the recent rally, the FXI remains about 40% off its 2021 high. Despite rallying roughly 23.5% amid a nine-day win streak, the Shanghai Composite is only up 7.3% over the past 12 months.

All this to say that, while these stocks have done well lately, the same cannot be said over the longer term. Despite being the No. 2 economy in the world, China has been struggling and its situation is…complicated.

So what’s going on and why are these stocks rallying so much?

Recent sentiment has shifted as the Chinese central bank took stimulative measures to rejuvenate its beleaguered economy. As eToro analyst Bogdan Maioreanu recently wrote, the stimulus includes a “combination of monetary easing and capital market support” and “is the largest stimulus package since the pandemic.”

While these stocks have been on a tear lately and may be overheated in the short term, longer term bulls are speculating that the situation in China will begin to improve and believe that the stock prices will reflect that down the road.

Want to receive these insights straight to your inbox?

The setup — BMY

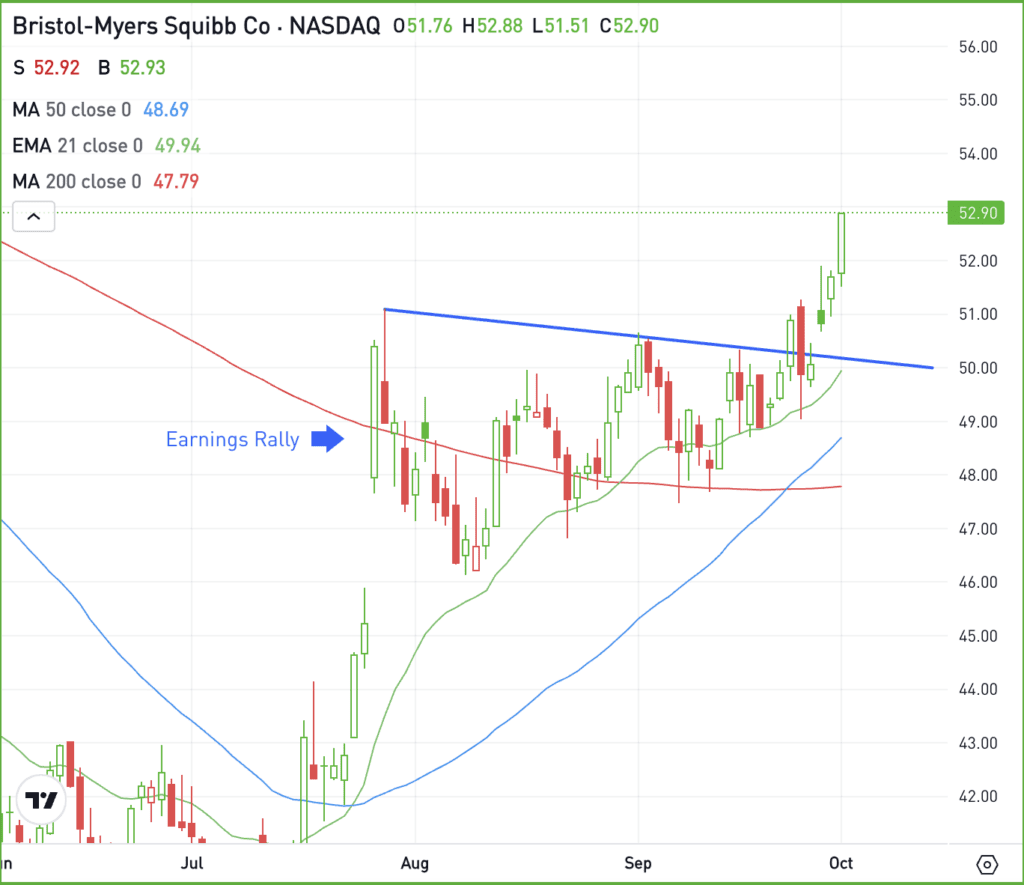

Stocks did not get off to a good start in Q4, as geopolitical worries took US stocks lower. One stock that stood up to the selling pressure? Bristol-Myers Squibb.

Shares are riding a four-day win streak and recently cleared a technical measure of resistance. The current rally comes after a strong earnings reaction in July, where BMY rallied more than 11% in a single day.

The move helped send shares back above all of its major moving averages.

Ideally, bulls would like to see the stock stay above $50. However, so long as it stays above the $47.50 area, the technicals appear supportive. Below this area and more selling pressure could ensue.

Fundamentally, Bristol-Myers’ earnings appear back on track after a bumpy couple of quarters. The stock trades at less than 10 times the next four quarters of estimated earnings and pays a 4.6% dividend yield. As a high-yield dividend stock, it may be getting a boost from the Fed’s recent rate cut.

Options

For some investors, options could be one alternative to speculate on BMY. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and BMY rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

AAPL – After a strong finish to Q3, shares of Apple fell on Tuesday. Helping fuel that decline was a report that said Apple may have cut its iPhone 16 production based on recent supply channel checks. It’s important to remember that Apple’s iPhone garners a lot of reports — both good and bad — and they don’t always pan out to be correct.

OIL – Oil prices spiked on Tuesday amid geopolitical tensions and worries from the Middle East. As tensions rise, investors were flocking to gold, which is often considered a safe-haven asset, as well as oil, which could experience supply disruptions.

PEP – PepsiCo announced that it will acquire Siete Foods for $1.2 billion, which produces tortillas, salsas, seasonings, sauces, cookies, snacks and more. PepsiCo will look to add the brand to its foods group, which includes a broad offering from Frito Lay, Quaker, Sabra, and others.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.