The Daily Breakdown looks at the rally to all-time highs in the S&P 500 and Nasdaq 100. After HPE setup nicely, we’re looking to HPQ.

Wednesday’s TLDR

- Record highs remind long-term investors to stay invested.

- But they’re an opportunity for traders to take profit and adjust.

- Tesla racks up 10th straight daily gain.

What’s happening?

The S&P 500 is riding a six-day win streak, although the last two days worth of gains — up 0.12% and 0.10%, respectively — have been much more limited. The Nasdaq 100 is in a similar boat, and yet, they both continue to grind out all-time highs.

For long-term investors, this is a reminder on why we need to stay involved with equity markets over long stretches of time. They can defy expectations and go higher than many investors expect.

From the October low, the S&P 500 is up almost 36%. Since the start of 2023 — or roughly a year and half — it’s up 45.3%. The Nasdaq has done even better, up 45.5% and 87%, respectively, while Bitcoin has even more impressive results.

At the same time, slow grinds to new highs — like we’re seeing now — is an opportunity for short-term traders to consider booking some profits, raising their stop-losses on remaining positions, and looking for areas to redeploy that capital.

As it relates to today’s lineup, it’s another quiet session.

Fed Chair Powell will wrap up his two-day testimony with Congress, and at 1 pm ET, there will be a 10-year Treasury note auction. (Remember the role that the 10-year yield has played with stocks).

The real fireworks start Thursday, with the CPI report due up in the morning, alongside earnings from PepsiCo and Delta Air Lines.

Want to receive these insights straight to your inbox?

The setup — HPQ

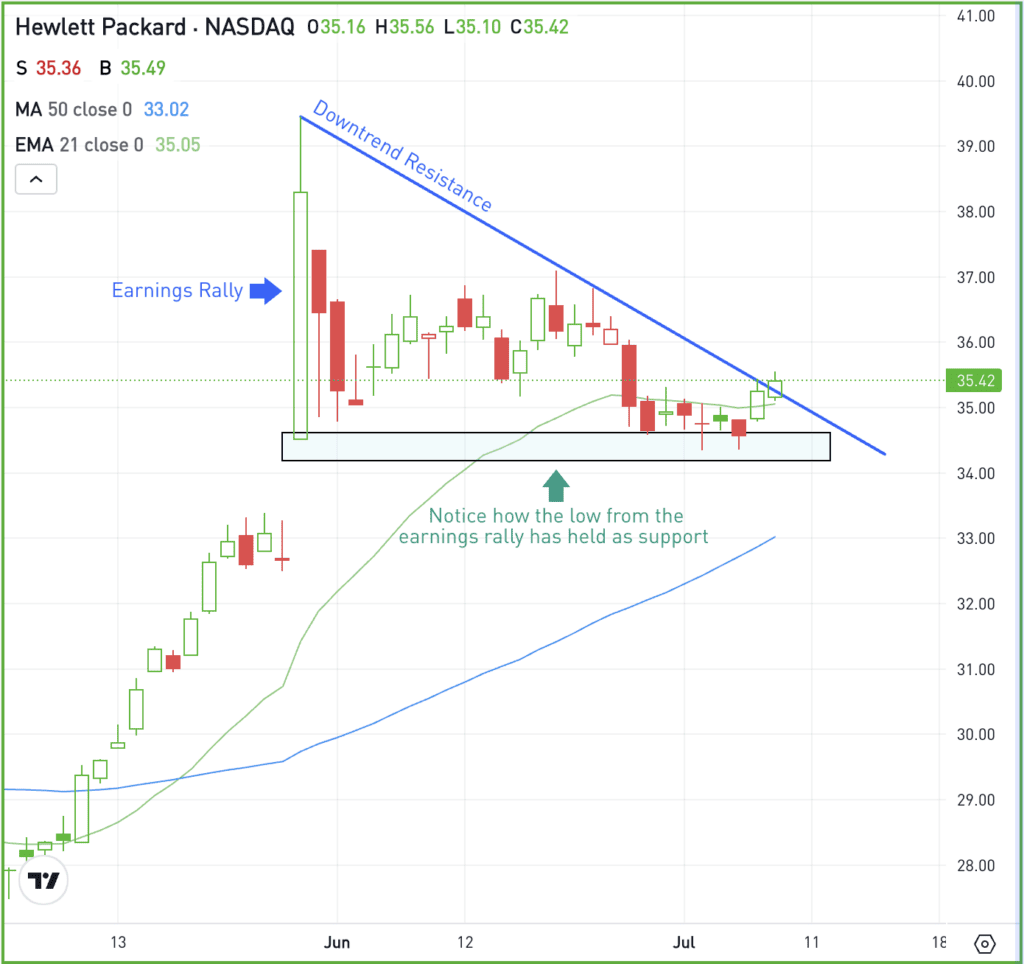

BODY: Yesterday we looked at Hewlett Packard Enterprise (HPE) and today we’re looking at HP Inc (HPQ).

Like HPE, HP Inc. had a great reaction to its earnings report in May, jumping about 17% in a single session after the report. The move sent shares to a multi-year high.

Now following some much-needed consolidation, shares are trying to regain momentum.

The earnings-day low was at $34.40 — an area which has been support in recent trading. Now HPQ is trying to clear current downtrend resistance. If it can do so, it may resume its rally, potentially pushing back up toward the recent highs above $39.

On the downside, a break of $34 may force the stock to consolidate for more time, potentially putting the 50-day moving average in play.

Options

Options could be an alternative for investors who want exposure to HPQ. Remember the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and HPQ rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

MMM — Shares of 3M Co are down slightly this morning after announcing that CFO Monish Patolawala will step down. He joined in July 2020 and the announcement comes just shortly after the firm named Bill Brown the new CEO on May 1.

TSLA — Tesla shares keep hitting the gas, rallying almost 4% for its 10th straight daily gain. The stock is up over 43% in that stretch and is now up 5.6% so far in 2024. It’s the best-performing Magnificent 7 holding over the last three months, up 52.7%, narrowly edging out Nvidia’s 50.9% gain.

JMIA — Jumia shares surged on Tuesday, up almost 30% and hit a fresh 52-week high after Benchmark initiated coverage with a buy rating. Their $14 price target suggests approximately 65% upside from Monday’s close and 28% upside after yesterday’s rally.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.