The Daily Breakdown looks at the strength in the energy sector, as well as what risks exists to weigh on US stocks after a strong 2024 start.

Tuesday’s TLDR

- The S&P 500 faces a new set of headwinds.

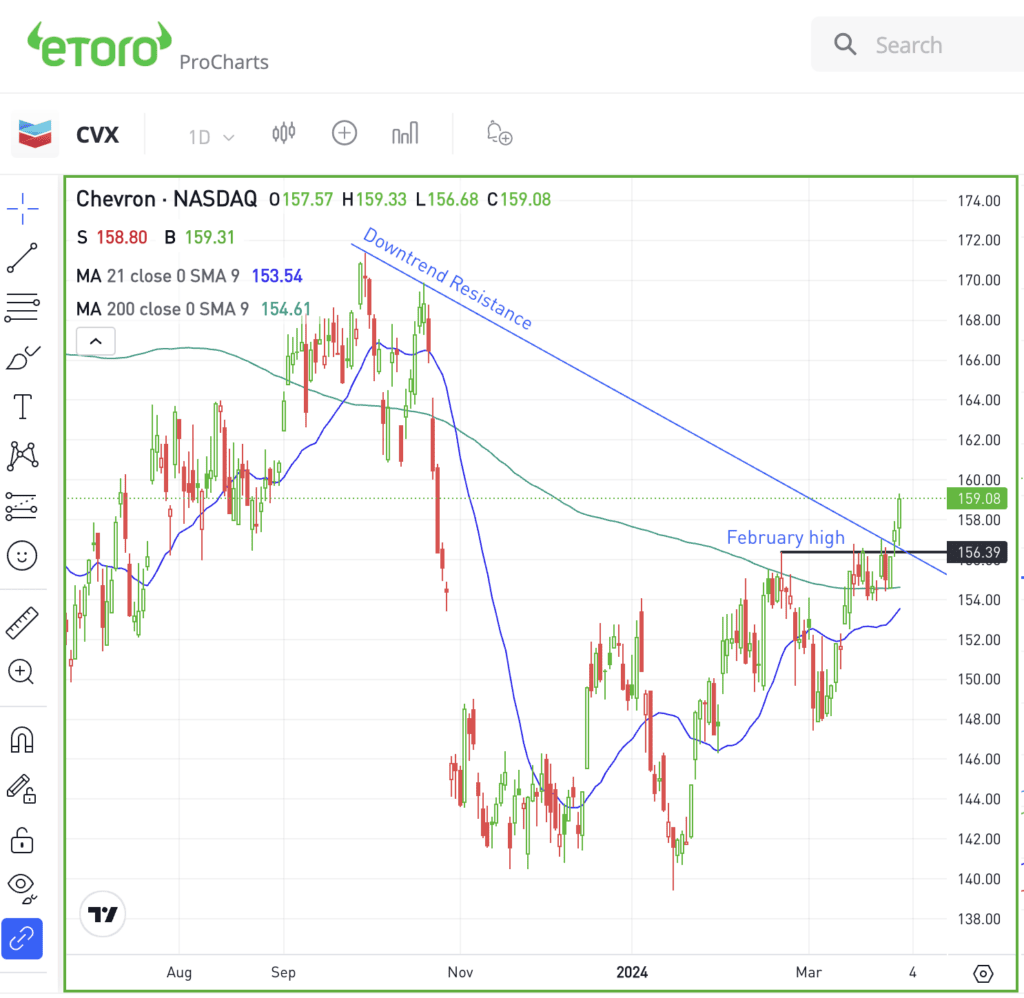

- Chevron breaks out to 2024 highs.

- Shareholders vote on Disney vs. Peltz.

What’s happening?

The S&P 500 rallied more than 10% in Q4 and Q1, the first time it’s had back-to-back quarterly gains in excess of 10% in more than a decade.

Naturally, that has us optimistic — because after all, this has been a strong bull market — but also realistic, knowing that we can’t enjoy 10% quarterly gains forever.

So where does that leave us?

This market looks much healthier than the one we had a year ago, as we limped away from what seemed like a car wreck with the regional banking scare. We had strong leadership from the Magnificent Seven and Eli Lilly, but not much else.

Now we have strong sector participation and plenty of stocks at or near new highs. At some point, we have to expect a dip — the main question is by how much?

Keep an eye on the US dollar index, which just hit a six-month high, and on Treasury yields, which are trying to break out. For the latter, many charting platforms will use the ticker “TNX.”

Keep an eye on both since the US dollar and Treasury yields can act as headwinds to stocks. If these continue to trade higher and it does put pressure on stocks, that could give us a much-needed pullback — and an opportunity to buy the dip.

Want to receive these insights straight to your inbox?

The setup — CVX

Energy was the best-performing S&P 500 sector in Q1. Who would have thought that? It was somewhat of a stealth rally, even though we were looking for a breakout last week.

Now, another is on that list too: Chevron.

On the last trading day of March, Chevron stock broke out over the $156 area, clearing the February high in the process. It helped send Chevron to its highest level since October.

The rally also sent Chevron over downtrend resistance. While that measure is shown on the daily chart, investors who zoom out to the weekly chart will notice this has been in effect for a long time.

I don’t know how long the energy sector can go without a pullback, but as long as Chevron stock can stay above the mid-$150s, bulls could maintain momentum.

For options traders, calls or bull call spreads could be one way to speculate on a continued rally. In this scenario, buyers of calls or call spreads limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect a breakout failure could speculate with puts or put spreads.

For non-options traders, it’s worth pointing out that Chevron has a dividend yield of about 4%.

For both investors, other fundamental points can be found right here.

What Wall Street is watching

DIS — As the Disney-Peltz proxy battle approaches its climax, stakeholders gear up for a decisive shareholder vote. This strategic confrontation could reshape Disney’s governance and strategic direction, marking a critical juncture for the entertainment giant.

DJT — Shares of Trump Media tumbled over 20% as its “meme-like” qualities start to fade. DJT and other recently hot stocks have been under pressure lately, as the fundamentals struggle to support such lofty gains. Shares are now down almost 40% from the recent high as investors gauge how much momentum could be left.

GE — General Electric led Q1 gains among large-cap industrials with a 38% increase, ahead of its energy business spinoff into GE Vernova. The surge reflects broader market optimism and GE’s strong aerospace sector performance.

LI — Li Auto shares jumped as Q1 deliveries soared to 80,400 vehicles, surpassing estimates and marking year-over-year growth of 52.9%. March dazzled with 28,984 deliveries, a 39.2% increase, while Li Auto has now topped more than 700,000 cumulative deliveries.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.