The Daily Breakdown previews the two biggest reports we have this week: The PCE report and the Q3 GDP report. Here’s what they’ll mean.

Tuesday’s TLDR

- GDP and PCE reports on deck

- Lowe’s stock breaks out

- Retail earnings flow in

What’s happening?

It won’t be long before America is eating a Thanksgiving meal after watching their new favorite team — the Detroit Lions — kick off the festivities.

Before we get there, we have a deluge of retail earnings this morning and a few notable tech names reporting tonight (like Dell and Crowdstrike). However, the bigger pieces of the puzzle start tomorrow morning.

(Sorry to bait you with football, then switch it to economics).

First, let’s talk about the PCE report at 10 a.m. ET. This is the Fed’s preferred inflation gauge. While the CPI report earlier this month had some positives, it highlighted some of the stickier inflation components — like shelter — that continue to keep core prices elevated.

The bond market is currently pricing in another rate cut next month, the final Fed meeting of 2024. Those odds stand at about 60/40 right now in favor of that cut. However, if tomorrow’s PCE report comes in higher than expected, it could have investors rethinking — and lowering — those odds.

We’re not done.

We also have the Q3 GDP revision at 8:30 a.m ET. We already got the initial GDP report last month, which showed that the economy grew at an annualized rate of 2.8%. This is steady growth even though it was lower than the 3% figure in Q2 and below consensus estimates between 3% and 3.1%.

Tomorrow will mark the second revision and there will be a final reading next month. In this report, we’re looking for confirmation that the economy remains on solid footing.

Want to receive these insights straight to your inbox?

The setup — Lowe’s

We haven’t talked about Lowe’s too much, but that changes today. The company beat on earnings and revenue estimates when it reported last week, but Wall Street didn’t love the results as shares fell over 4% that day.

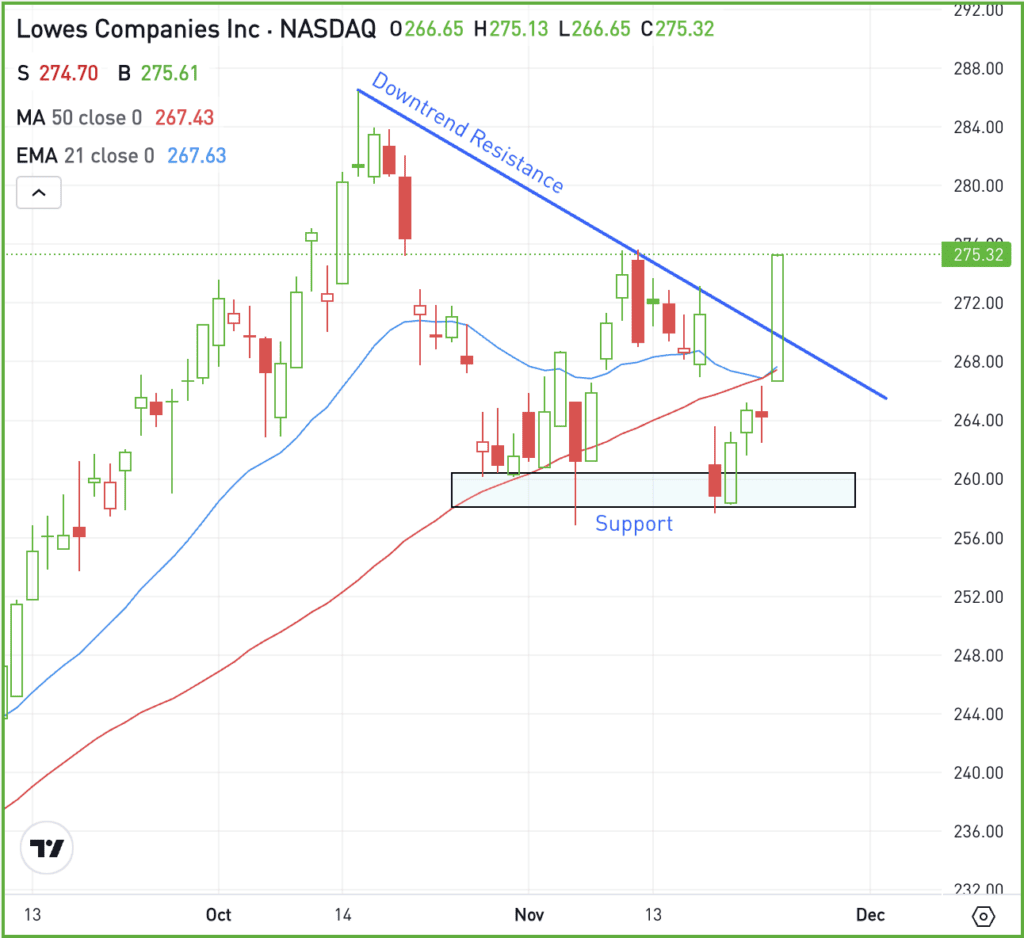

Now though, the stock has found some momentum, using yesterday’s rally to send shares over the 50-day and 21-day moving averages while breaking out over downtrend resistance. Have a look:

As long as Lowe’s can stay above the $265 area — thus keeping it above all of the measures I just mentioned — bulls may be able to maintain momentum and look for higher prices. For what it’s worth, the all-time high for LOW came last month near $287.

However, if shares break back below $265, then that bullish momentum could wane, potentially putting recent support between $256 and $260 back in play.

Options

For some investors, options could be one alternative to speculate on LOW. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and LOW rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

XHB – Recently, we talked about KBH Home and the homebuilders having potential upside. We’re now seeing this group move higher, as the Homebuilders ETF — the XHB — hits new 52-week highs. That’s as Treasury yields come down, so do mortgage rates, helping boost housing demand.

DKS – Shares of Dick’s Sporting Goods are rallying this morning, up almost 10%. The stock is set to open just below the prior all-time high after the firm delivered another solid quarter, as earnings and revenue beat analysts’ expectations. Check out the chart now.

KSS – Kohl’s is at the opposite end of the spectrum, with shares tumbling in pre-market trading, down over 15%. The retailer missed on earnings and revenue expectations and delivered disappointing guidance for its holiday quarter.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.