A number of companies are set to showcase their latest developments, including AMD and Tesla. The Daily Breakdown takes a closer look.

Thursday’s TLDR

- Latest inflation report comes out today

- AMD, TSLA & HPE have big events too

- Apple bulls eye possible breakout

What’s happening?

The S&P 500 hit all-time highs yesterday, but largely, the first three days of this week were uneventful. That’s as investors gear up for this morning’s latest inflation update when the CPI report is released at 8:30 a.m. ET and when big banks like JPMorgan and Wells Fargo officially kick off earnings tomorrow morning.

However, Thursday is a big day for Tesla, Advanced Micro Devices, and Hewlett Packard Enterprise. Here’s why:

- Starting at 12 ET, AMD will host its Advancing AI 2024 Event.

- At 1:45 ET, HPE will host its AI Day Investor Event.

- Finally, at 10 p.m. ET, TSLA will host its Robotaxi “We, Robot” event.

AMD and Tesla will report earnings later this month, while Hewlett Packard Enterprise will likely report in November. While those events could be significant for these stocks, what happens today could shape the near-term trajectory for them as well.

All three have done pretty well over the past month, with AMD and HPE really shining. Keep an eye on these stocks today — and tonight — to see how these events impact them and potentially some of their peers.

Want to receive these insights straight to your inbox?

The setup — AAPL

Reports on Apple’s iPhone will continue to come out, with some having a bigger impact on the stock than others. But through the noise, the stock is still trying to break out over a notable resistance level.

Shares of AAPL have been doing pretty well this year. While shares are roughly flat over the past couple of months, the stock is up 35.3% over the last six months.

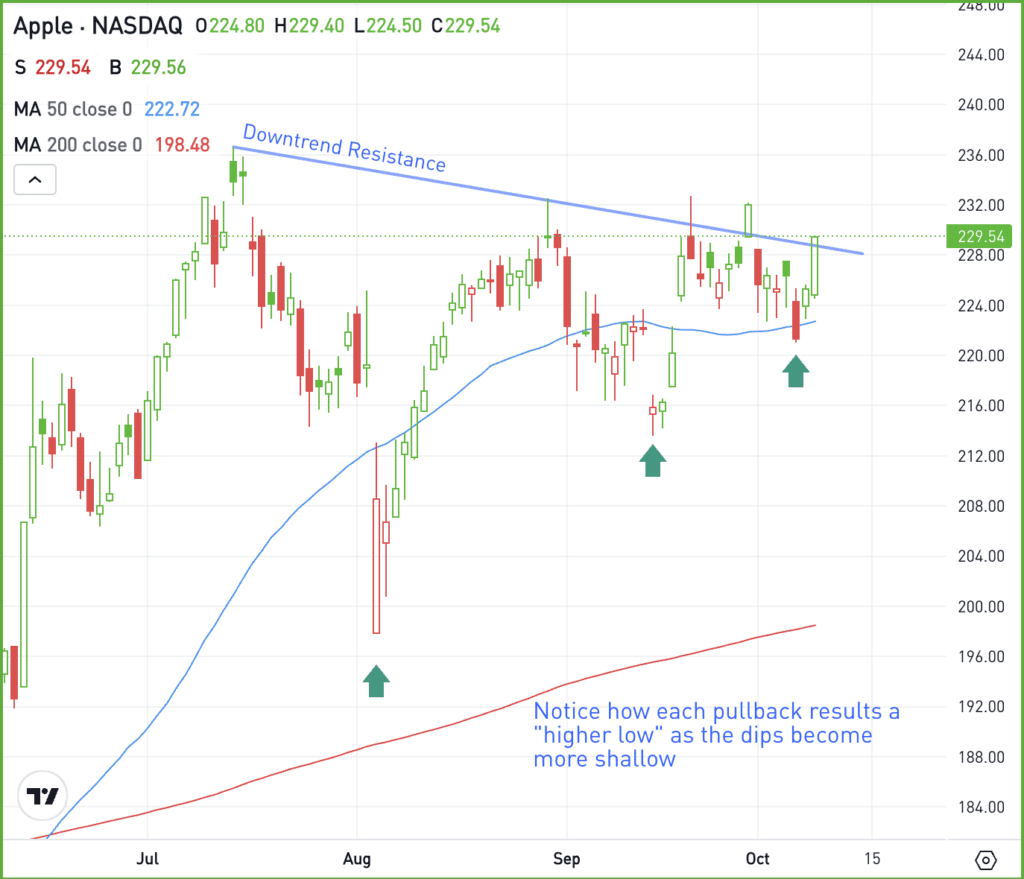

Notice how each of Apple’s more recent pullbacks have become more shallow than the previous pullback. Known as a “higher low,” technical traders like to see this pattern emerge in the stocks they are following.

Bulls will look for Apple to gain steam over the $230 level and clear downtrend resistance. If it can do so, the stock could continue to rally, potentially putting the recent high near $237 in play.

On the downside, bulls will want to see the recent low near $222 hold as support. If it does not, then more selling pressure could ensue.

With one quarter left to report, analysts expect Apple to end its fiscal year with 8.9% earnings growth. Currently estimates call for an acceleration up to 11% to 12% earnings growth in fiscal 2025 and 2026, respectively.

Options

For some investors, options could be one alternative to speculate on AAPL. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and AAPL rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

DAL – Shares of Delta Air Lines are slightly lower in pre-market trading after the firm reported a top- and bottom-line miss for its Q3 results. Earnings of $1.50 a share missed estimates of $1.55 a share, while revenue of $14.59 billion missed expectations of $15.3 billion, with CrowdStrike’s outage having an impact.

BA – Boeing made new 52-week lows on Wednesday as the beleaguered company continues to struggle. Headlines aside, the firm is looking at ways to raise capital while maintaining its investment-grade rating. Boeing is one step away from dropping into speculative territory, which would make its debt more expensive to service.

SPY – Investors will be keeping a close eye on this morning’s inflation figures. Depending on the results, it could have a big impact on the S&P 500 ETFs like SPY and VOO, as well as other market indices and Bitcoin. Year over year CPI grew at an annualized rate of 2.4% last month, ahead of estimates for 2.3%.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.