The Daily Breakdown takes a closer look at Halloween stocks to see how they stack up against the broader market.

Thursday’s TLDR

- Candy stocks have struggled

- A closer look at the S&P 500

- Earnings weigh on big tech

What’s happening?

Today, macro investors are eying the PCE inflation report, while kids are focused on trick-or-treating. That got us wondering: How are Halloween stocks doing?

Unfortunately, not great.

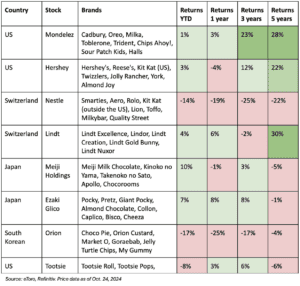

eToro created an equal-weighted basket of eight of the largest confectionery stocks in the world (based on 2023 sales) and the analysis shows that the world’s leading confectionery stocks have returned just 5% over five years. Further, the value of these companies has dropped 4% over the past year.

That’s compared to the S&P 500, which is up more than 38% over the past 12 months.

Why have these stocks underperformed so much? Like walking up to a candy basket on someone’s front porch during trick-or-treating, investors can take their pick when it comes to an explanation.

Soaring cocoa and sugar prices put a squeeze on company profits, while higher inflation has made it harder on consumers — and thus, more difficult for candy companies to pass their costs onto shoppers. Let’s not forget the push toward healthier, more natural foods and ingredients too, which certainly doesn’t include many of these candy brands.

Some of these stocks have been able to stay afloat, but even the so-called strong performers of this group have badly lagged the indices.

Want to receive these insights straight to your inbox?

The setup — S&P 500

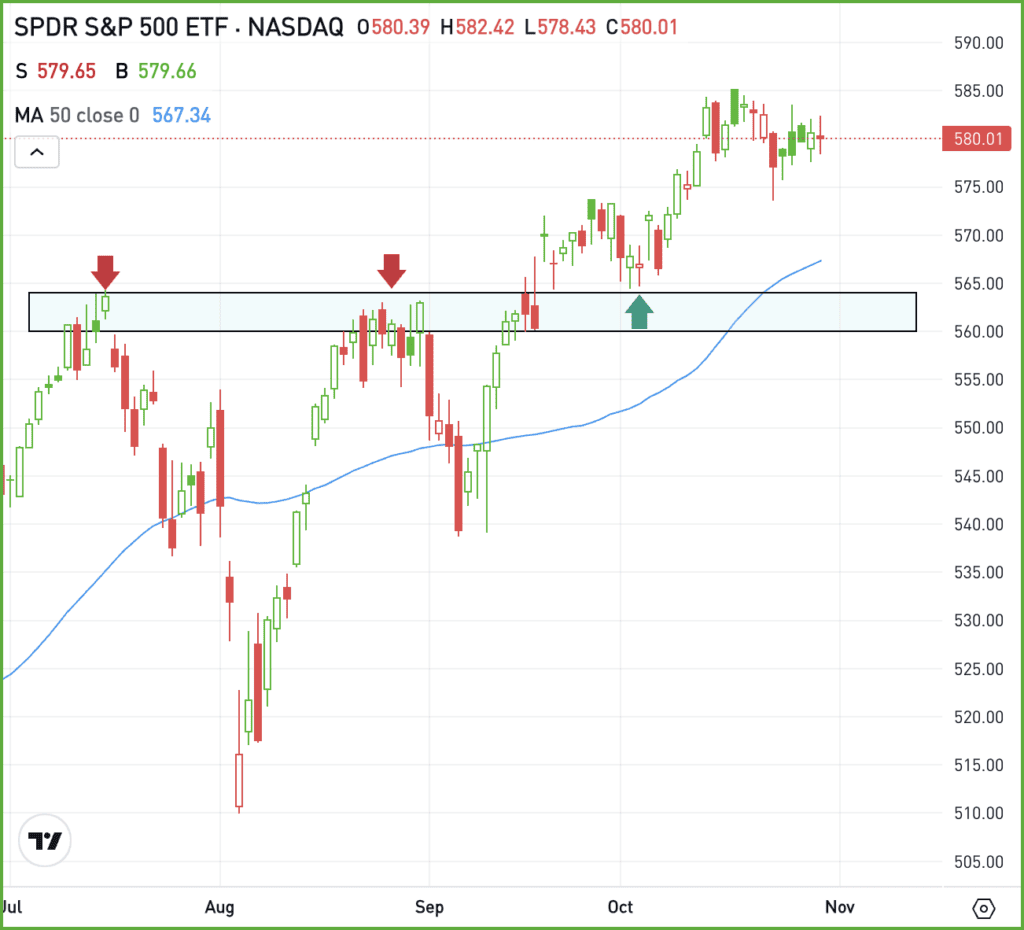

Earlier this week, we talked about how hot the S&P 500 has been — and subsequently, S&P 500 ETFs like VOO and SPY — and why investors should be open-minded about potential bumpiness.

Again, that’s not some sort of bearish prediction, just a willingness to accept that stocks go up and down. We’re in a busy stretch of time with big economic reports, the Fed, an election, and earnings all swirling around.

Remember, the market averages roughly three 5% corrections a year and we’ve already had two. But even more mild dips — like in the 3% to 4.99% range — can change short-term sentiment.

The SPY has been trading sideways for a couple of weeks now, digesting the current news well and trading with some caution ahead of next week’s big events.

If we were to see a 3% to 4% dip, it would land the SPY near its 50-day moving average and the $560 to $565 zone, which was previous resistance in the summer and most recently acted as support in early October.

If this pullback materializes and if this area holds as support, it could prove to be an ideal dip-buying opportunity. If support fails, then we may be on our way to a standard 5% to 10% correction.

Being patient, open-minded, and prepared for these possibilities can help investors weather the psychological and financial impact of market dips — both big and small — even if an investor doesn’t alter their portfolio.

What Wall Street is watching

UBER – Shares of Uber are falling in premarket trading, despite beating on earnings and revenue expectations. Management said it’s not looking at any “transformational” deals right now — presumably referencing the reported M&A talks for Expedia — although a cautious outlook appears to be hindering the stock price.

MSFT – Shares of Microsoft are also moving lower in premarket trade, down about 3% despite the company’s strong quarter. Earnings of $3.30 a share beat expectations of $3.11 a share, while revenue of $65.6 billion topped estimates of $64.5 billion. The closely watched cloud business reported revenue of $38.9 billion, beating analysts’ expectations of $38.1 billion.

META – Meta has been the best-performing Magnificent 7 holding over the past three months and the second-best performer year to date (lagging only Nvidia). However, shares are slightly lower this morning, despite a strong top- and bottom-line beat and an outlook that topped analysts’ expectations. Check out the chart now.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.