With the jobs report being released on Friday morning, The Daily Breakdown takes a look at the recent change in rate-hike odds.

Friday’s TLDR

- Stocks dip again and are now down four days in a row.

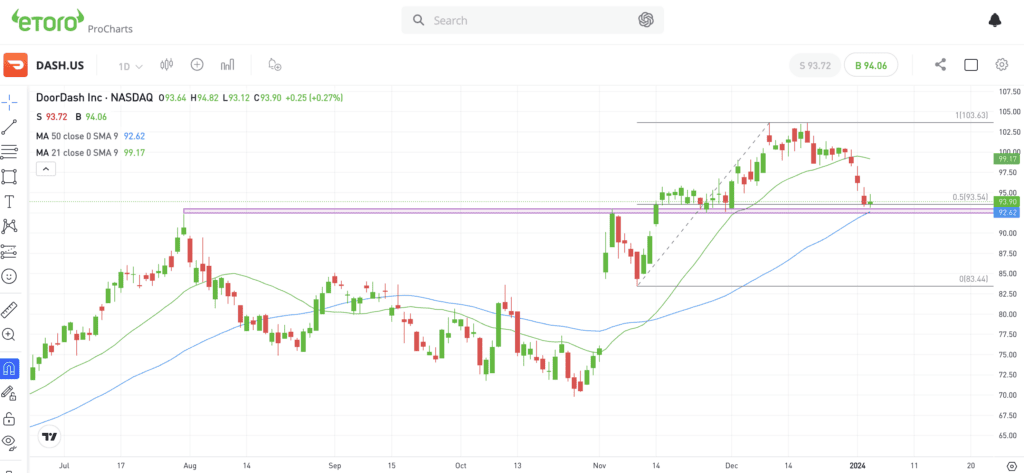

- DoorDash stock pulls back toward potential support.

- AMC Entertainment hits a 52-week low.

What’s happening?

Investors are still digesting the comments from the Federal Reserve’s FOMC Minutes release on Wednesday afternoon. They’re also preparing themselves for tomorrow’s jobs report, which was released before the open.

In December, the Fed said it’s forecasting roughly 75 basis points worth of interest-rate cuts in 2024.

A few months ago, the bond market was pricing in the first rate cut in May or June, and was expecting about 75 to 100 basis points worth of cuts for the year. Now, the market is pricing in March for the first rate cut, along with a total of 150 basis points worth of cuts in 2024 — double the Fed’s prior update.

Currently, the bond market is still pricing in those outcomes, although the odds of those probabilities have decreased slightly in the last 24 hours.

In other words, a little doubt — or uncertainty — is starting to creep in. Given the market’s penchant for certainty, it’s not surprising that this uncertainty, however small it may be, has stocks dipping lower and the VIX perking up.

A pullback here made even more sense when we consider the nine-week rally that the markets have enjoyed. It was an excuse to take some profits off the table and let stocks reset.

The setup

DoorDash has traded really well over the past few months, and it’s one that readers likely remember, as we highlighted it in November and again in December.

Now, DoorDash stock is down about 10% from its recent high and is pulling back into the low-$90s. This area was previous resistance in July and again in November — even after the firm reported strong earnings results.

However, a breakout mid-November vaulted DoorDash over the key $92.50 level, which then turned into support before shares ran to a recent high near $104.

Now pulling back to the low-$90s, bulls may be looking for potential support to emerge once again. It could help that the 10-week and 50-day moving averages are in this area as well.

On the options front, we’ve seen quiet but interesting action. The big holder in the February $70 calls rolled their position into the March $90 calls, which still has more than 40,000 contracts in open interest. There was also some solid flow in the March $95 calls yesterday.

On its own, options positions are never a reason to blindly jump in or out of a specific stock. However, they can offer some interesting perspectives.

Further, it’s worth considering that if the market remains in correction mode, then DoorDash stock may have trouble garnering much upside momentum. And just because it’s nearing potential support, doesn’t mean it will hold.

Want to receive these insights straight to your inbox?

What Wall Street is watching

XLV: US stocks have been under pressure to start the year, but healthcare stocks and the XLV have been one of the few bright spots. Only four of the 11 S&P 500 sectors are higher so far this year, with healthcare performing the best. The XLV is up 2.1% so far in 2024 — although it’s still early.

AMC: AMC Entertainment quietly dropped to a new 52-week low on Thursday. While US stocks have been busy rallying since late October, it’s been the opposite situation for AMC. Shares are down about 50% since Halloween, and look prepped to post a weekly loss for the seventh time in the last nine weeks.

AAPL: Given that it’s the biggest company in the US stock market, Apple’s recent dip isn’t helping the recent pullback in the stock market. Shares are down four days in a row, falling about 6% in that span, and are down more than 8% from the recent highs. Reports about the iPhone 17 camera recently surfaced, but investors don’t seem too concerned, given that the iPhone 15 was only released a few months ago.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.