The Daily Breakdown asks if it’s time to be more cautious on the stock market, as the S&P 500 goes for its 12th weekly gain in the last 13 weeks.

Thursday’s TLDR

- Tesla earnings disappoint.

- Time to think about protecting gains?

- Lululemon’s buy-the-dip setup.

What’s happening?

The S&P 500 notched its fifth straight daily gain and hit an all-time high for the fourth time in the last five trading sessions. But is it time to tap the brakes?

When we look at the short-term signals, it’s hard not to see some signs that stocks could use a rest.

The market surged into 2024, riding a nine-week win streak into the new year. While we did have a minor pullback — the S&P 500 dipped about 2% — the momentum has largely favored the bulls.

The index is trying to notch its 12th weekly gain in the last 13 weeks, while a few headwinds are picking up. Yields and the US dollar are gaining strength, the VIX is nearing the low end of its range, and odds for a March rate cut are fading.

While earnings and next week’s Fed meeting could provide a spark in either direction, these two catalysts could, at the very least, lead to an increase in volatility.

Remember, we’re a bull market and, thinking long term, I’m not looking for that to change.

But it’s okay to be more flexible in the short term, and for active investors and traders, it might not be a bad idea to lock in some of the big gains we’ve enjoyed over the last few months. It’s the prudent thing to do at this stage while we wait for some of the big recent winners to reset and provide more ideal entry points.

Want to receive these insights straight to your inbox?

The setup

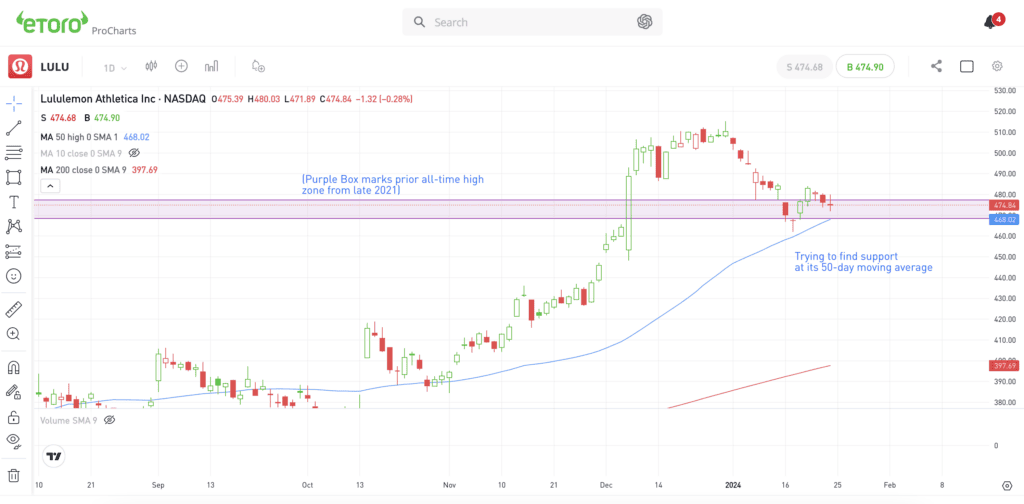

I first flagged a potential long setup in Lululemon last week when we saw a pullback into possible support.

Lululemon rallied hard into its December earnings report, then the company reported strong results that sent shares to new all-time highs previously set in late 2021.

After a strong post-earnings rally into year end, the stock ultimately dipped about 10% into last week’s lows, finding support in the $460s. Now, it’s trying to bounce.

Lululemon shares are trying to find support from the 50-day and 10-week moving averages, as the stock pulled back into the prior all-time highs from late 2021.

With its key moving averages near and as it retests a big level of prior resistance, I want to see if the stock can build on last week’s bounce and garner a larger rebound.

Specifically, let’s see if Lululemon can clear last week’s high near $485, potentially putting the $500 level in play. Above $500 and perhaps the recent highs near $510 could be within reach.

On the downside, a close below last week’s low near $463 could set up the stock for lower prices.

What Wall Street is watching

TSLA: Tesla shares struggled in after-hours trading Wednesday after the firm missed on Q4 earnings and revenue expectations. Further, the company refrained from providing specific full-year guidance, but did warn that 2024 production totals could come in below 2023.

META: Meta’s market cap exceeded $1 trillion again — a milestone it first reached in 2021. The stock has seen significant growth, up 12% this year, although earnings will be a big hurdle when it reports on February 1.

ASML: ASML stock had its best day in more than a year, surging higher after beating on earnings and revenue expectations. Sales jumped 12.5% year over year while the firm saw record orders in Q4. The rally has pushed shares within 5% of its record closing high from 2021.

T: AT&T’s stock dropped despite beating revenue expectations and gaining more subscribers than predicted. The decline followed the company’s disappointing earnings outlook for 2024.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.