The Daily Breakdown takes a look at the rebound in Bitcoin after its “sell the news” reaction to the SEC’s approval of 11 Bitcoin ETFs.

Friday’s TLDR:

- The S&P 500 finally eclipsed 5,000.

- Disney hits a 52-week high on earnings.

- Bitcoin seems to be waking up from its slumber.

What’s happening?

Yesterday around 3:30 p.m. ET, the S&P 500 made a charge up toward the 5,000 level, but fell short when it hit a high of 4,999.68 and began to retreat.

That’s after the index hit 4,999.89 on Wednesday.

It looked like it was going to be back-to-back sessions where the index came within a whisper of that all-too-difficult 5,000 level.

And then the S&P 500 did it.

The index came to life in the final 30 seconds of yesterday’s session, jumping to a high of 5,000.40 before fading back down to close near 4,998.

Okay, okay. So it’s not the most impressive way to surpass the 5,000 mark, but we finally did it!

In the days and weeks ahead, investors will still focus on this level and it will likely remain a key figure for now. Until the index either declines or rallies significantly from here, it will likely remain a key battleground for bulls and bears — particularly into next week’s monthly options expiration.

Want to receive these insights straight to your inbox?

The setup — Bitcoin

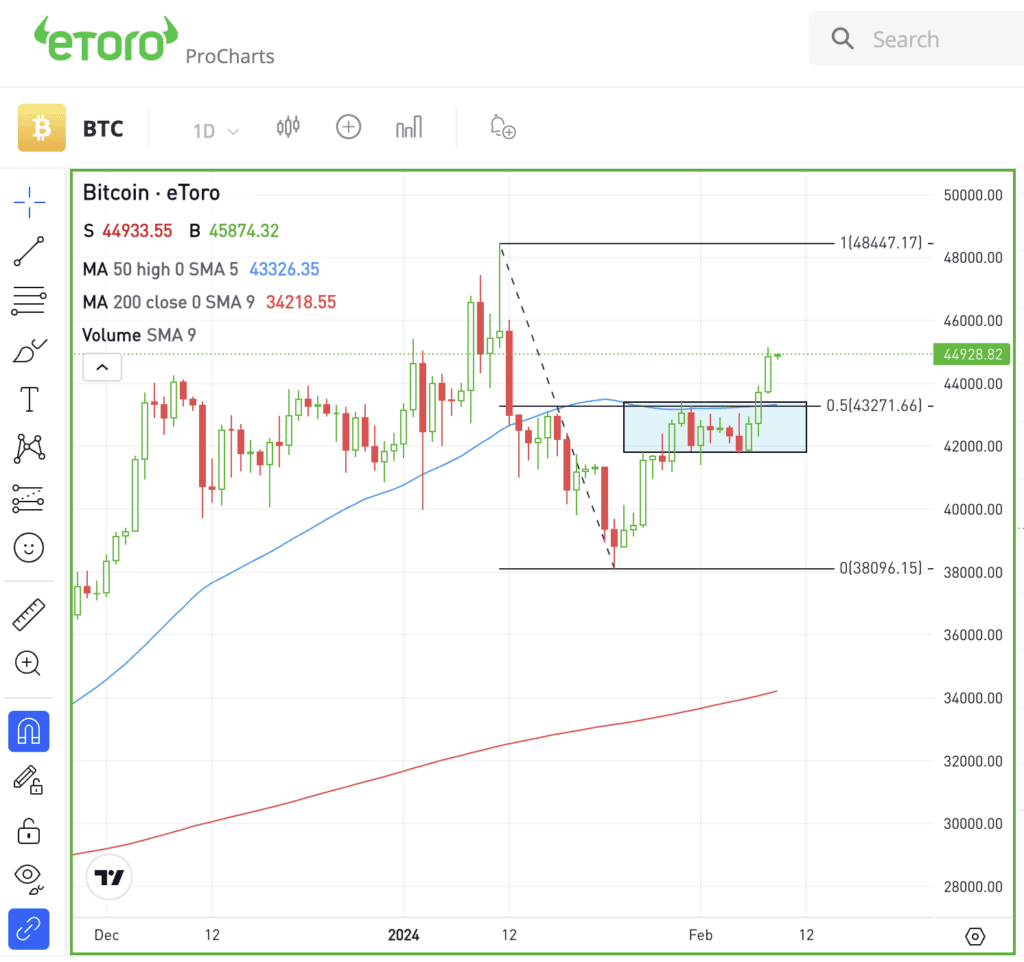

We’ve kept a close eye on Bitcoin since its unsurprising “sell the news” reaction last month after the SEC approved 11 Bitcoin ETFs.

At the time, I wanted to see if Bitcoin could hold above the $40,000 level. Despite a few probes below this mark, it held pretty well and now we’re seeing Bitcoin turn higher.

Notice how it rebounded off the lows, then consolidated by chopping sideways for almost two weeks just below the 50-day moving average.

Bitcoin was biding its time right below the $43,271 mark — which was the 50% retracement of the decline. In other words, it had made back 50% of the losses from its sell-the-news reaction earlier this year.

Now rallying higher, bulls will want to see this consolidation area — call it $42,000 to $44,000 — hold as support. Further, they’ll want to see if Bitcoin can push through $46,000 and attempt to make new highs on the year above $48,447.

Bulls are excited about the Bitcoin halving event coming in April, so on the plus side, at least they have a potential catalyst to work with.

With that being said, keep an eye on that $42,000 to $44,000 zone. If it fails to hold as support, Bitcoin could lose short-term momentum and be looking at a further decline.

What Wall Street is watching

DIS: Disney stock roared to new 52-week highs on Thursday, rallying on better-than-expected earnings. Shares broke out in January, but accelerated higher once management unveiled a buyback plan, reinstated the dividend, and provided solid guidance.

PINS: Shares of Pinterest sank about 10% in after-hours trading after the firm delivered mixed Q4 results. Pinterest beat on earnings and slightly missed revenue estimates. However, the company guided to Q1 revenue of $690 million to $705 million, with the $697.5 million midpoint missing consensus estimates of $702.5 million.

EXPE: Expedia delivered a top- and bottom-line beat for its Q4 results, yet shares slipped 13% in after-hours trading. In fact, the company reported its highest-ever full-year revenue and GAAP net income. However, the departure of its CEO spooked investors.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.