The Daily Breakdown takes a closer look at the sectors that are expected to generate the strongest earnings growth this season.

Friday’s TLDR

- Earnings season officially begins!

- Three sectors will lead the way

- Let’s look at the chart for the healthcare ETF

What’s happening?

The markets continue to chug higher as earnings season is set to officially kick off today with JPMorgan, Wells Fargo and a few others. By the way, you can see and search the full list of earnings right here.

The S&P 500 is forecast to generate just 3.2% earnings growth when it reports for the current Q3 period. That’s the lowest year over year growth in more than a year and the lowest estimate for the next six quarters (the other five quarters predict at least 10% earnings growth).

However, there are a few sectors that are expected to really stand out this quarter.

The expected stars of Q3

It might not surprise many readers to hear that the tech sector has the highest expected earnings growth for this quarter, weighing in at 14.9%. What is surprising is that tech was a major laggard in Q3, finishing the quarter just below break-even when 9 of the other 11 S&P 500 sectors climbed at least 5.8%. Further, tech is just the fifth best-performing sector so far in 2024.

For a group that generally serves as a market leader — and one that has strong earnings growth to boot — it hasn’t been much of a leader over the past few months.

Rounding out No. 2 and No. 3 are the communication and healthcare sectors, which are forecast to generate year-over-year growth of 12.6% and 11.4%, respectively.

For what it’s worth, these sectors also have the three highest earnings growth expectations next quarter, too.

The Bottom Line

Will a strong quarter of earnings growth remind investors about the potential for tech? Or will elevated expectations set the bar too high?

Of course, that’s an impossible question to actually answer — particularly when you throw in Fed meetings and a US election. We have no idea how the market — or tech specifically — will perform over the next few weeks and months.

However, I’ll offer up this thought:

If the tech sector were the best-performing sector this year, had a dominant Q3, and if the Nasdaq 100 was trouncing the S&P 500, the high-bar argument would be more concerning to me.

But the bar doesn’t seem set very high given that tech is in “middle of the pack” territory so far in 2024 and was somewhat of a stinker of Q3. Maybe this quarter will remind investors of some of the potential packed away in this group.

Want to receive these insights straight to your inbox?

The setup — XLV

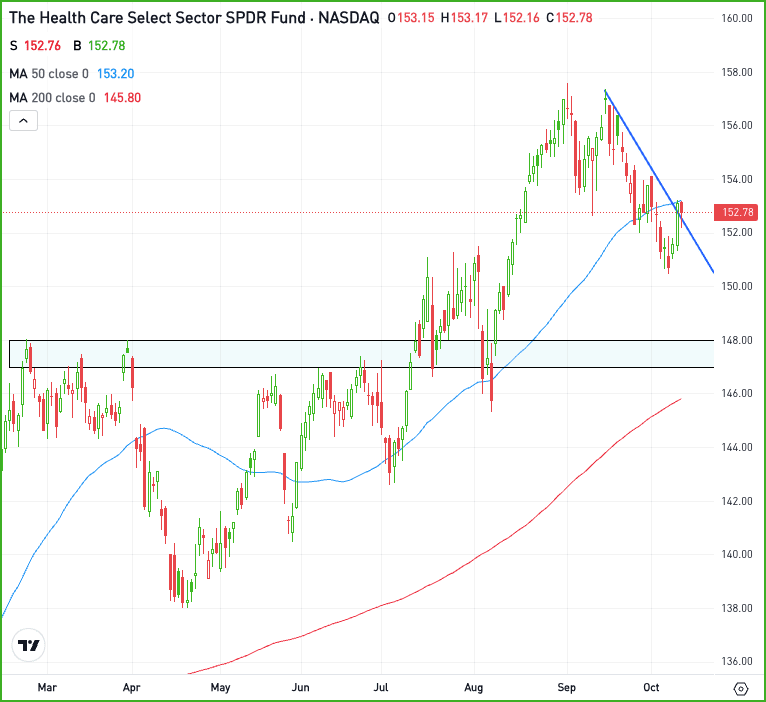

We mentioned healthcare up above — and spoiler alert: we’ll dive deeper into the group later this month — so it makes sense to take a closer look at the chart.

While the S&P 500 is hitting all-time highs, the S&P Healthcare ETF — XLV — has been pulling back. Longer term bulls may prefer a larger dip down to the 200-day moving average and the prior breakout area around $148.

However, the ETF is trying to clear a downtrend resistance level as we speak, while also trying to regain its 50-day moving average.

If XLV can get above the 50-day — call it roughly $154 — and stay above that mark, then the breakout can take hold and shares may continue higher.

However, if the ETF remains in this consolidation phase, it’s still possible for a test down into the $140s, which could put some of the larger support levels we just discussed back in play.

Fundamentally, the healthcare sector is just one of two sectors in the S&P 500 that have double-digit earnings growth forecasts in each of the next six quarters (tech is the other).

As for the ETF, the five largest holdings include: Eli Lilly, UnitedHealth, Johnson & Johnson, AbbVie, and Merck (in that order).

Options

Buying calls or call spreads may be one way to benefit from an eventual rally. As a reminder for call buyers, it may be advantageous to have adequate time until the option’s expiration.

For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.