The Daily Breakdown looks at the earnings dip in Nvidia, the rip in Snowflake, and the general state of the US stock market.

Thursday’s TLDR

- Nvidia’s impressive quarter

- BTC hits $98K

- Stocks hold support on dip

What’s happening?

The reaction to Nvidia’s earnings has been muted so far, with shares flipping between slight gains and slight losses in pre-market trading. If you think there’s been a lot of focus on Nvidia for the last two days, there’s a good reason for that.

First, there’s a lack of major economic reports this week, so NVDA’s earnings are the highlight. Second, NVDA casts a large shadow with a market cap of more than $3.6 trillion.

Not only does it make up noteworthy portions of the S&P 500 and Nasdaq 100, but it dominates the semiconductor space…and that’s a big group!

For what it’s worth, the market cap of the five largest semiconductor firms in the SMH ETF — Nvidia, Taiwan Semi, Broadcom, Qualcomm, and Advanced Micro Devices — weighs in at a whopping $5.75 trillion.

The other focus this week? Bitcoin.

BTC prices continue to edge higher, helping to elevate other cryptoassets like Ethereum and Bitcoin Cash as well. BTC has continued its ascent, briefly clearing the $98,000 level this morning, with all eyes on the key $100K mark.

Want to receive these insights straight to your inbox?

The setup — S&P 500

We’ve discussed some market ETFs lately — like the QQQ and IWM — but we haven’t focused on the S&P 500 since the election.

Last week we talked about being ready for a pullback. With a dip arriving on time, it looks like the SPY ETF is handling it quite well.

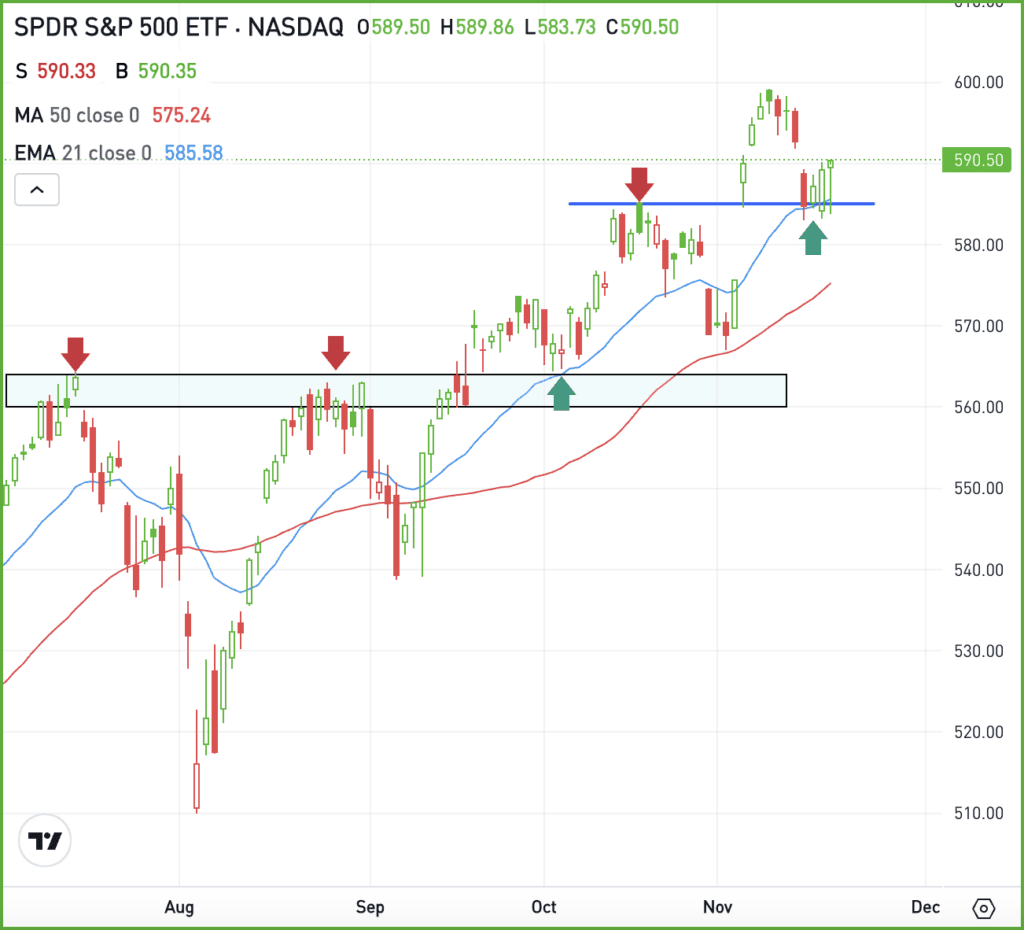

Notice how the SPY pulled back to the 21-day moving average — a short-term measure of the recent trend — and the $585 level, which was previously resistance in October, but is currently acting as support:

If $585 continues to act as support, bulls will look for another rally back toward $600 — and potentially beyond this figure. To my eye, the bullish trend is still intact and not only was the pullback reasonable, but the SPY has acted very well amid the dip.

On the flip side, a break below $585 could be a short-term negative. While it wouldn’t be the worst thing to happen for the bulls, it would sap some of the recent momentum and put lower prices in play — potentially down to ~$576 and then possibly ~$565.

But that would all start with a break of $585, so let’s keep an eye on that level.

Options

For options traders, calls or bull call spreads could be one way to speculate on support holding. In this scenario, options buyers limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

NVDA – Shares of NVDA are turning positive in pre-market trading, but have spent most of the morning down less than 1%. That’s after the firm beat on earnings and revenue estimates, reported in-line margin expectations, and guided for revenue of $37.5 billion next quarter. That beat expectations of $37.1 billion, but some are wondering if the report is good enough to deliver a further rally in the stock given that shares are up almost 200% so far on the year. At the very least, it was a strong quarter.

SNOW – Unlike NVDA, Snowflake shares are roaring higher this morning, up more than 20% in pre-market trading — although the stock is not up anywhere near 200% on the year. The company delivered a top- and bottom-line beat and an impressive outlook.

PANW – Palo Alto Networks shares initially fell last night, but are only down slightly this morning after delivering strong earnings results and a solid full-year outlook. Further, the company announced a 2-for-1 stock split. The stock is expected to begin trading on a split-adjusted basis on December 16.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.