The Daily Breakdown looks at the profit-taking in large- and mega-cap stocks and the rotation into small-cap stocks as the Russell booms.

Friday’s TLDR

- Investors are taking profit in large- and mega-cap stocks…

- And reallocating money into small-cap stocks.

- Eli Lilly is down over 10% in the last three days.

The Bottom Line + Daily Breakdown

Rotation, rotation, rotation. That’s all investors have been talking about this week (and something we have touched on a few times too). But what is it and why is it happening?

“Rotation” simply refers to investors moving from one group of stocks to another. Put another way, they are rotating out of one group (typically the winners) and into groups that have underperformed with the belief that they can start outperforming.

The great rotation

Oftentimes we hear this term as it relates to sector rotation — for example, selling out of healthcare and tech stocks and moving money into utilities and financials. In this case though, the rotation is referring to large cap stocks vs. small caps.

Investors are taking profits on their big winners — whether that’s in mega-cap favorites like Nvidia, Meta and Amazon, or in index ETFs like the SPY and QQQ — and rotating into underperforming assets like the IWM ETF.

From last week’s low to this week’s high, the Russell 2000 rallied about 12.5%. At the same time, the S&P 500 mustered a rally of just 1.9%, while Nasdaq 100 climbed just 2.1%.

Why are we seeing this rotation?

At least part of the reason can be explained by interest rates. The idea is that certain asset groups benefit from lower rates more than others. For example, the utilities and real estate sectors, automakers and homebuilders, bonds and — you guessed it — small caps.

When the most recent CPI report came out on Thursday July 11, it came in below expectations. In other words, inflation is cooling faster than economists’ expectations, bolstering the odds that the Fed will cut rates. As confidence grows in a Fed rate cut, confidence is also growing in the assets that would benefit most.

Case in point: From Wednesday’s close (the last trading session before the CPI report), the Russell is up over 7.1%. In the same span, the S&P 500 and Nasdaq 100 are down 1.6% and 4.7%, respectively.

It’s also worth pointing out that the Russell 2000 rallied about 25% from late-October to late-December on hopes of several Fed rate cuts starting in Q1 2024. Obviously, we didn’t get those cuts — we’re already in Q3 without one — and small caps have lagged all year as a result.

The bottom line

Unfortunately, we don’t know how long this rotation will last or how well small caps will perform down the stretch. This current rotation would suggest that investors expect small caps to perform well for the next several months, if not the next several quarters.

However, those same investors were wrong in Q4 2023 and could be wrong again — especially if the rate-cutting narrative loses momentum. So keep that in mind before going all-in on this group.

Earlier this week, I outlined the key level to watch in small caps. So long as it remains above that mark — that’s ~2,100 in the Russell and $210 in the IWM — it’s hard to get too bearish on this group.

Want to receive these insights straight to your inbox?

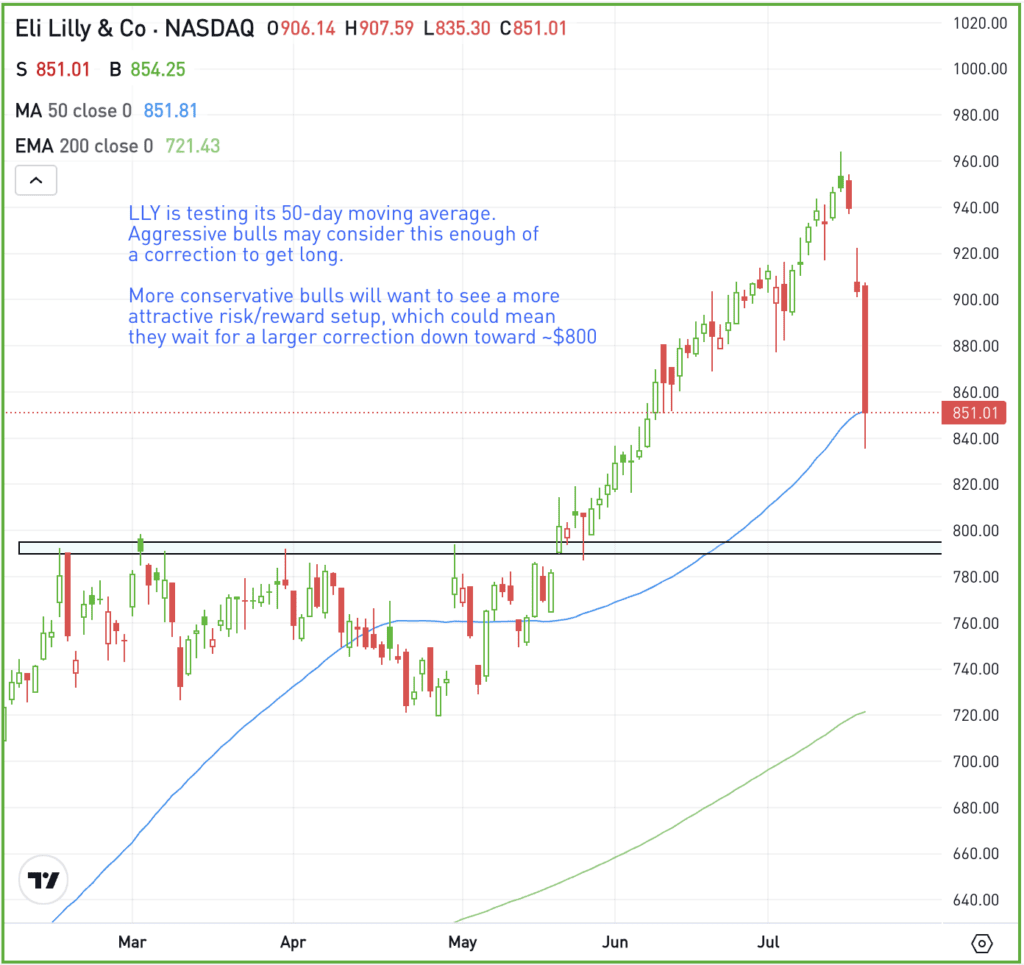

The setup — LLY

We’re seeing profit-taking in the big winners, but does that mean they’ll be big losers forever? Of course not!

While that doesn’t mean Eli Lilly will find support outlined at the area below, it’s a reminder to keep an eye on the recent winners and look at logical areas where support could come into play.

As long as the fundamental story is unaltered, investors will likely return to the businesses that continue to do well. Keep in mind though, that doesn’t mean support is guaranteed to come into play where investors think it will.

In the case of LLY, I’m adding this one on my watchlist and keeping an eye on the $800 to $810 zone. This was a major breakout level in late-May and it would be reasonable for investors to speculate that this area could be support if it’s tested.

If it’s tested and it fails as support, bulls can contain their losses and stop out of their position.

Options

One downside to LLY is its share price. Because the stock price is so high, the options prices are incredibly high, too. This can make it difficult for investors to approach these companies with options.

In that case, many traders may opt to just trade a few shares of the common stock — and that’s fine. However, one alternative is spreads.

Call spreads and put spreads allow traders to take options trades with a much lower premium than buying the calls outright. In these cases, the maximum risk is the premium paid.

Options aren’t for everyone — especially in these scenarios — but spreads make them more accessible. For those looking to learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.