The Federal Reserve again lowered interest rates, but yields continue higher. The Daily Breakdown investigates this unexpected reaction.

Friday’s TLDR

- Bond yields jump despite rate cuts

- But stocks ignore the rise in rates

- Costco breaks out

The Bottom Line + Daily Breakdown

The Fed continues to lower interest rates and yet…bond yields continue to go higher?

On September 19, the Fed cut rates by 50 basis points, making it the first rate cut in more than four years and the first rate change in more than a year (with the last move being a rate hike in July 2023). Now they’ve cut rates again, reducing interest rates by 25 basis points on Thursday.

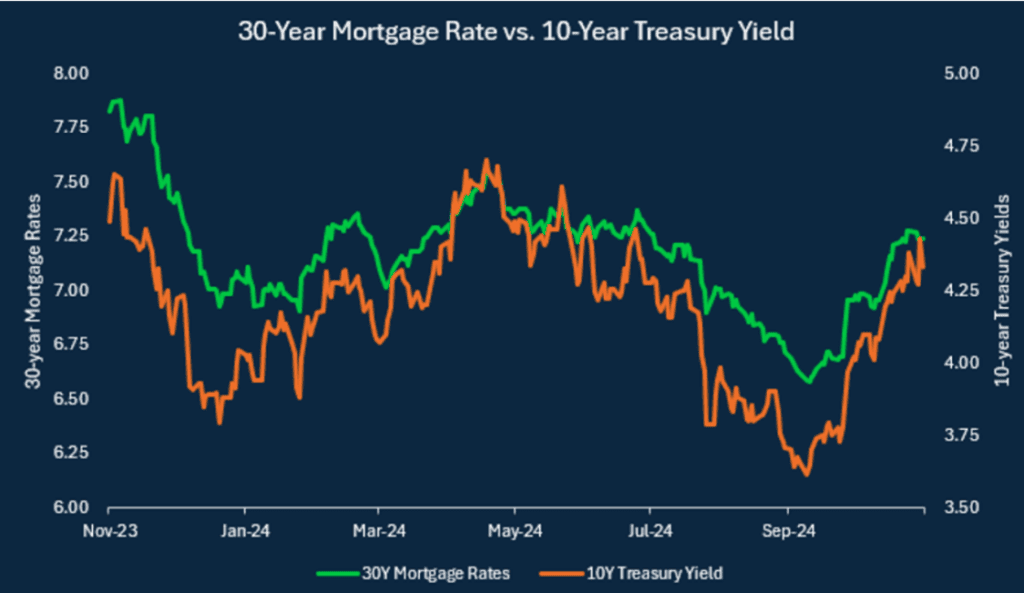

As of Wednesday’s close — the last trading session before yesterday’s Fed decision — the yield on the 10-year note had risen by almost 70 basis points. That’s got a lot of people wondering what’s going on.

How are yields rising even as the Fed is cutting interest rates?

Some may be asking the question due to intellectual curiosity. Others want to know because many loans — like auto loans and mortgage rates — are impacted by yields.

Breaking down rates (and yields)

The 10-year yield and the 30-year mortgage rate bottomed on September 17th, near 3.6% and 6.6%, respectively — and two days before the Fed officially lowered interest rates. In this case, the saying of “buy the rumor, sell the news” comes to mind.

So now what?

The assumption by many investors was that as the Fed cut rates, yields would decline. So far, that hasn’t been the case, but will it change?

Jeffrey Gundlach, a well-known institutional bond investor, argues that there’s too much supply of Treasury bonds in the mix (remember, as bond prices go down, bond yields go up). Others have argued that a more resilient and stronger-than-expected US economy has institutional investors rotating out of safe-havens like bonds and into risk-on assets like stocks.

Even Fed Chair Powell wasn’t able to pinpoint the reason, suggesting that perhaps it’s a “sense of more likelihood of stronger growth and perhaps less in the way of downside risks.”

Ultimately, it’s hard to zero in any one reason why bond yields are defying expectations. In reality, there are likely multiple reasons for the move. One thing is for certain, though: Stocks haven’t been rattled — even small caps.

The Russell 2000 is up almost 10% in the past month, while the S&P 500, Dow, and Nasdaq just hit all-time highs.

The Bottom Line: For now, let’s keep an eye on those yields. If they come back down, bonds — like the TLT ETF — will be a direct beneficiary, while sectors like utilities, consumer staples, and real estate may benefit as well.

Want to receive these insights straight to your inbox?

The setup — Costco

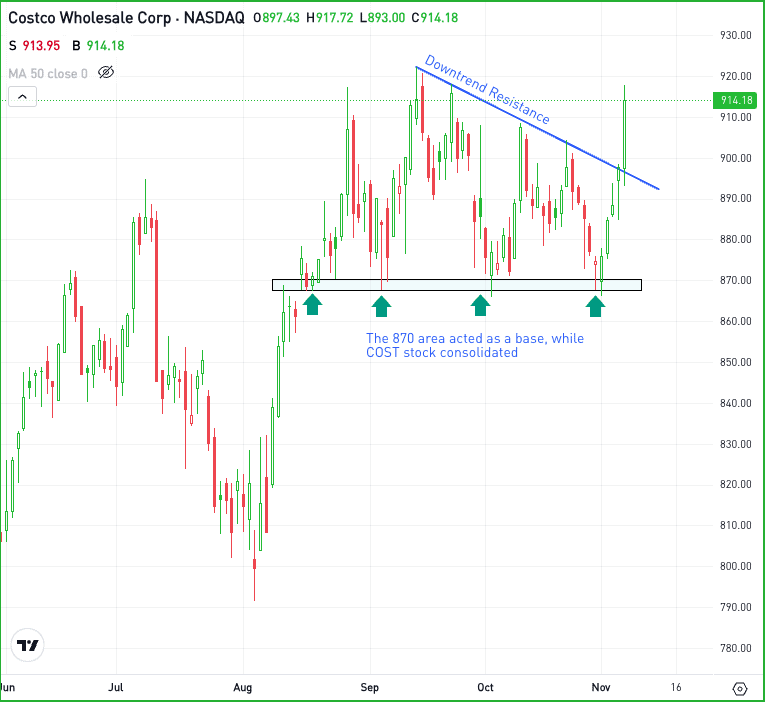

As one of the top-performing retailers this year — and really, over much longer stretches of time as well — I have kept a close eye on Costco Wholesale.

After months of consolidation, shares finally broke out over downtrend resistance on Thursday.

Thursday’s 1.6% rally has put the stock’s prior all-time high near $923 within reach. If the bullish momentum can continue, then COST could take out the highs and continue to march higher.

If the rally fades, bulls will want to see shares hold the $885 to $890 area. Below that mark and Costco stock risks losing some of the recent momentum. Below $870 and that momentum could turn bearish.

Options

One downside to COST is its share price. Because the stock price is so high, the options prices are incredibly high, too. This can make it difficult for investors to approach these companies with options.

In that case, many traders may opt to just trade a few shares of the common stock — and that’s fine. However, one alternative is spreads.

Call spreads and put spreads allow traders to take options trades with a much lower premium than buying the calls outright. In these cases, the maximum risk is the premium paid.

Options aren’t for everyone — especially in these scenarios — but spreads make them more accessible. For those looking to learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.