The Daily Breakdown looks at the upcoming US election as stocks continue to push toward all-time highs. What does this mean for you portfolio?

Friday’s TLDR

- The election is in full focus now

- Amazon beats on earnings

- But can the stock break out?

The Bottom Line + Daily Breakdown

The S&P 500 had been on a five-month winning streak (and had climbed in 10 of the last 11 months). It was set to extend its monthly win streak until Thursday’s action, where the index declined 2% and pushed the monthly return into the red.

That’s okay, though. Monthly win-streaks are fun to talk about, but they’re not necessarily relevant — particularly as we navigate a tricky stretch of time. Luckily, the rally into this week’s events (Q3 GDP, PCE, and the jobs report) alongside earnings and next week’s events (the election and the Fed meeting) had us on guard for some potential turbulence.

Well, here it is.

And now all the focus is turning to an election that is brimming with division and heightened emotions. As we’ve talked about at times over the past year, heightened emotions rarely make for good financial decisions.

Do politics matter to markets?

To some extent, they do.

You might be surprised to hear me say that, but the reality is, the federal government does have some impact on stocks, bonds and crypto. However, that can vary quite a bit and the overall impact can be less than people think.

Administrations can impact certain industries via strict or favorable regulatory environments — think renewable energy or cannabis, for instance — while tariffs can affect inflation, as well as a number of specific industries and sectors.

While certain areas can feel an impact, the bigger picture isn’t driven by politics — it’s driven by the fundamentals. That is, stocks will most likely trade based on the trend of the economy and earnings. If the economy continues to chug along and earnings continue to grow at an impressive pace, then stocks are likely to continue going higher.

Election volatility

Although the political climate is tense right now, stocks tend to do pretty well regardless of which party is in office. You have to go back a long time before finding a presidential term where the S&P 500 didn’t hit all-time highs under their leadership. The last time was Gerald Ford, and even then, there’s an asterisk as he only served as president from August 1974 to January 1977 after stepping in for Richard Nixon, who resigned.

The last few elections have been hotly debated and despite volatility in the days ahead of, during, and shortly after the election, the market quickly adjusts to the newly elected administration and moves on.

So even though many citizens will be in a heightened emotional state, it will be (mostly) all business on Wall Street.

One potential snag? If they can’t certify an outcome — for instance, if ballot counting takes a long time in one or two states and the winner hinges on those results — then we could see a more pronounced pullback in stocks until we have more clarity.

Remember, markets love certainty — even if the result isn’t what some people want!

Want to receive these insights straight to your inbox?

The setup — Amazon

After the close, Amazon reported its Q3 results. The company beat on earnings and revenue estimates, delivered strong cloud results from its AWS division, and guided for Q4 operating profit above analysts’ expectations.

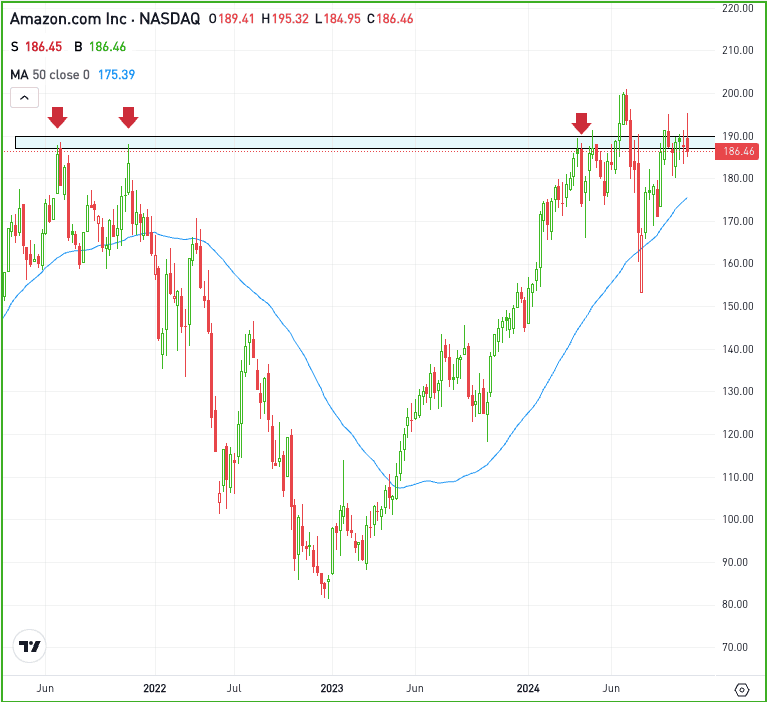

Initially, shares popped on the news. However, investors are wondering if the stock can finally clear resistance and enjoy a sustained rally above $200.

As the chart below shows, the $190 area has been a difficult zone for the stock. It marked the prior bull-market high from 2021 and has been resistance throughout 2024.

Getting above this level is the first step for bulls. The second step is clearing the highs near $200. If AMZN can make a sustained rally above the $200 level, bullish momentum could accelerate.

However, if the stock fails to break above $200, then investors will have to see if it can stay above the $190 area.

Options

Investors who believe shares will break out — or those who are waiting for the potential breakout to happen first — can participate with calls or call spreads. If speculating on the breakout, investors might consider using adequate time until expiration.

For investors who would rather speculate on resistance holding, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.