The Daily Breakdown looks at the stock market ahead of Hurricane Milton making landfall in Florida. Eli Lilly looks for a breakout.

Wednesday’s TLDR

- Hurricane Milton approaches Florida

- LLY bulls look for a possible breakout

- Alphabet breakup is on the table for DoJ

What’s happening?

Hurricane Milton is barreling toward Florida, threatening millions of people, homes and businesses, and could go on record as one of the worst hurricanes to hit the US.

Looking back over the years — or the weeks, with Helene’s recent toll — we’re reminded by the devastation that these storms can inflict. Harvey, Katrina, Irma, Ian and many others have wreaked havoc and claimed lives. Milton is expected to make landfall this evening and we won’t know the outcome until it passes.

As it relates to the financial aspect, some estimates suggest Milton could result in $60 billion to $75 billion in damage and losses. Although, some models predict that figure could climb as high as $150 billion.

We’re already seeing its impact on stocks too, like Allstate, Travellers, and Progressive, as well as Generac, Disney, and NextEra Energy all moving. And remember, these storms can disrupt everything from oil and crops to the jobs report.

Stay safe.

Want to receive these insights straight to your inbox?

The setup — LLY

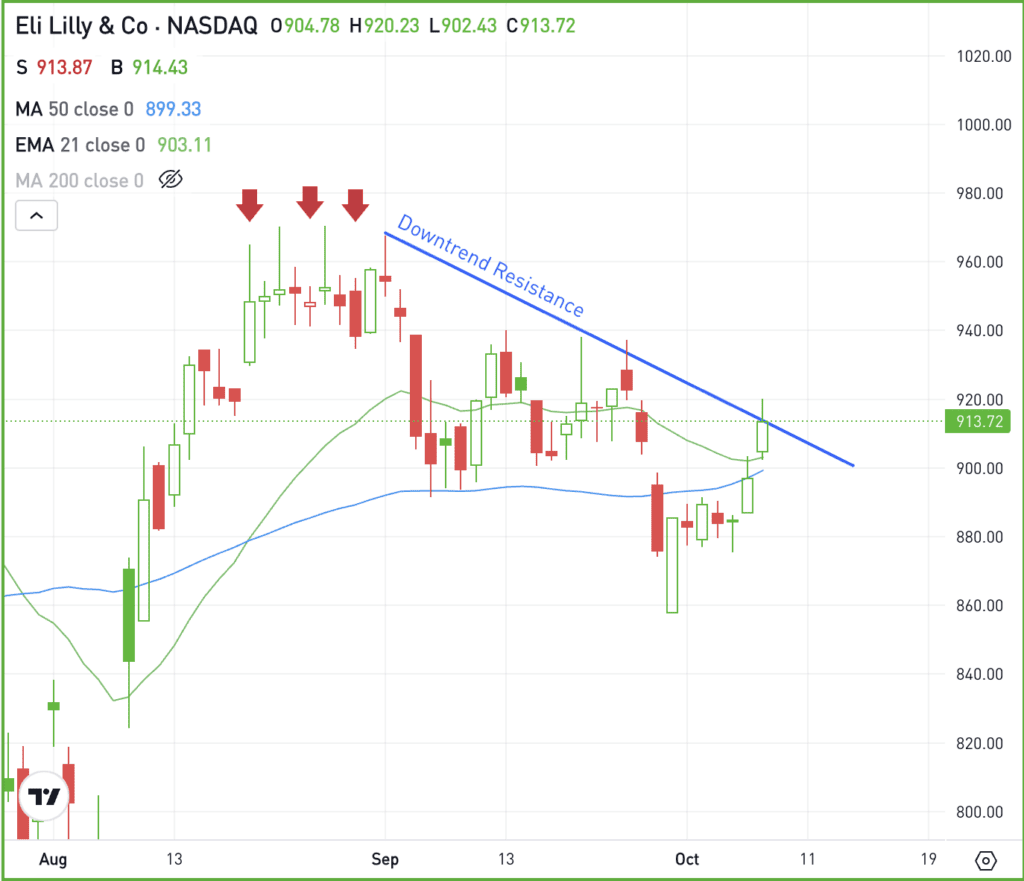

Eli Lilly has been a dominant force, with its market cap swelling to more than $850 billion.

The stock hit resistance in the $970s before pulling back over the last month. Now, bulls are looking at this name as they eye a potential breakout over downtrend resistance.

The stock recently regained its 21-day and 50-day moving averages, but remains below downtrend resistance. If it can clear this mark, a larger rally could ensue — potentially putting recent resistance near $970 back in play.

If the stock fails to break out, the recent lows in the $860 to $880 area could be retested.

What Wall Street is watching

GOOG – Shares of Alphabet are in focus this morning on reports that the DoJ may seek some sort of breakup as a possible antitrust remedy. That’s one of several reported options, which could also include providing “access to the underlying data it uses to build its search results and artificial intelligence products,” according to Bloomberg. All of this stems from an early August ruling where Judge Amit Mehta ruled that Google illegally held a monopoly over online search services.

FXI – The China Large-Cap ETF tumbled yesterday, falling over 9% as some of the recent excitement waned around Chinese equities. Stimulus measures from China’s central bank had investors piling into these stocks, highlighted by the fact that the FXI is still up more than 30% over the past month despite Tuesday’s decline.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.