The Daily Breakdown looks at the sluggish action in stocks as investors await the monthly inflation report, as well as the dip in Merck.

Tuesday’s TLDR

- Investors are waiting for the CPI report.

- Gold prices continue to shine.

- Merck dips after hitting all-time high.

What’s happening?

The S&P 500 bounced around on Monday, ending the day higher by less than 0.1%. If you can believe it, the Nasdaq 100 was even closer to flat on the day.

It wasn’t quite a “nothing day” necessarily — small caps, as measured via the Russell 2000 climbed 0.5% — but it was clear that investors are biding their time until later this week.

Remember, on Wednesday we get the monthly inflation report in the morning and the FOMC Minutes in the afternoon. All of that’s followed up with the start of earnings season on Friday.

Traders are waiting to see how the inflation report comes in and how that could impact rate-cut expectations for June.

As the economy continues to hum along, we’ve seen a few of this year’s CPI reports come in above economists’ expectations. That has delayed rate-cut expectations and explains why investors have been so focused on these reports.

Remember, we’re “optimistic but realistic.” If inflation comes in hot again, we could be looking at more delays to rate cuts, which could be a bearish catalyst to the stock market in the short term.

That said, we’re still in a bull market. Until that changes, we’re looking at pullbacks as an opportunity.

Want to receive these insights straight to your inbox?

The setup — MRK

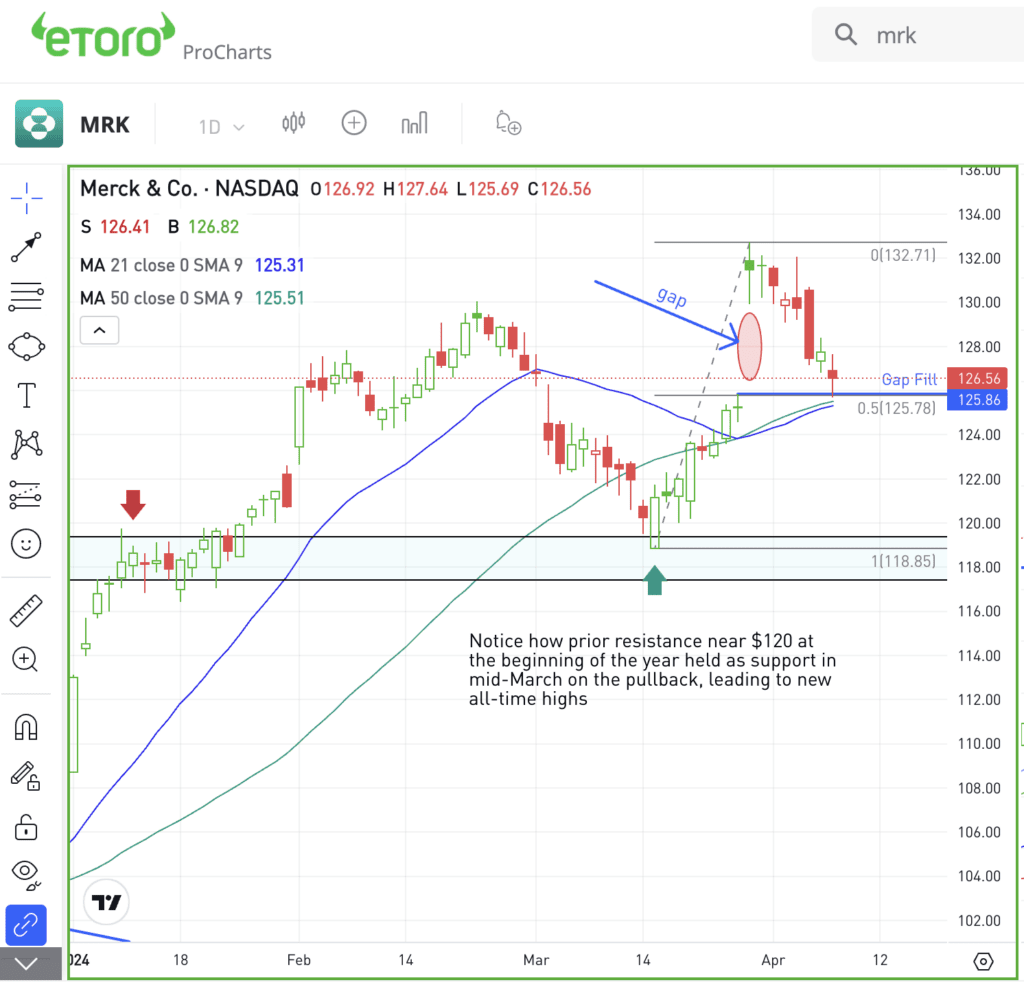

We talked about Merck about a month ago on March 7, wondering if prior resistance in the $118 to $120 area would hold as support. Luckily for bulls, it did — and that led to a rebound in Merck stock that sent shares to all-time highs.

Now the stock is pulling back and bulls are again looking for potential support.

This time, they’re looking for the $125 to $126 area to hold. As shown below, there are a number of technical levels to take note of in this area.

Near $126, Merck stock finds the gap-fill from the big rally in March. A gap-fill is when the stock jumps significantly from its prior closing price, leaving an unfilled area on the chart — the “gap.” I’ve illustrated this on the chart above.

Near this level, we also find the 50% retracement, which marks when the stock has “retraced” half of the trading range of its recent move. Finally, the stock also finds the 21-day and 50-day moving averages in this area.

If all of this sounds like mumbo jumbo to you…that’s okay.

It’s all just to say that technical traders have a reason to be watching Merck. It doesn’t mean support will hold, but if it fails, active traders will know relatively soon. Until then, active traders are leaning on the trend.

For options traders, calls or bull call spreads could be one way to speculate on support holding on a pullback. In this scenario, buyers of calls or call spreads limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

GOLD — Gold prices continue to shine in 2024, with the yellow metal up 13.5% so far this year. Precious metals have been in high demand lately, with gold prices up five of the last seven weeks — however, the two “down” weeks were dips of just 1.1% and 0.1%. Lastly, gold has hit a new high in seven straight trading sessions.

AMZN — Wall Street is also buying into Amazon. With Monday’s rally to $187.29, the stock set new 52-week highs. That’s great for bulls, but they have their eye on something else: Record highs. The stock is almost there, with Amazon’s all-time high sitting at $188.11, which was set in 2021.

DJT — After falling more than 34% last week, Trump Media shares plummeted another 8.4% on Monday. Now valued at just over $5 billion, the stock has been cut in half from the recent high, while the company behind Truth Social faces volatility as it navigates public trading amid Trump’s political spotlight.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.