Shares of General Motors are breaking out after reporting earnings. The Daily Breakdown look at that — and more — with Tesla on deck.

Wednesday’s TLDR

- GM hits multi-year high

- Tesla earnings on deck

- McDonald’s tumbles on E. coli outbreak

What’s happening?

While earnings season has begun and about 20% of the S&P 500 has reported, many investors are still waiting for things to get interesting. Well, that day could be today.

This morning, we’ll hear from Coca-Cola, AT&T, and Boeing, the last of which has been wrapped in controversy throughout 2024.

Meanwhile, General Electric, Lockheed Martin, and Philip Morris made big earnings-related moves yesterday, while Starbucks surprised investors by reporting its preliminary results on Tuesday evening.

After the close, we’ll hear from a few big tech companies like IBM, ServiceNow, and Lam Research. But the one everyone is seemingly waiting for is Tesla.

Tesla recently held its “We, Robot” event less than two weeks ago. While it showed promise for the future, investors may return their focus back to the company’s current business and results.

Regardless of the outcome, Tesla is the first Magnificent 7 stock to report this earnings season, and it will attract plenty of attention tonight and tomorrow.

Want to receive these insights straight to your inbox?

The setup — General Motors

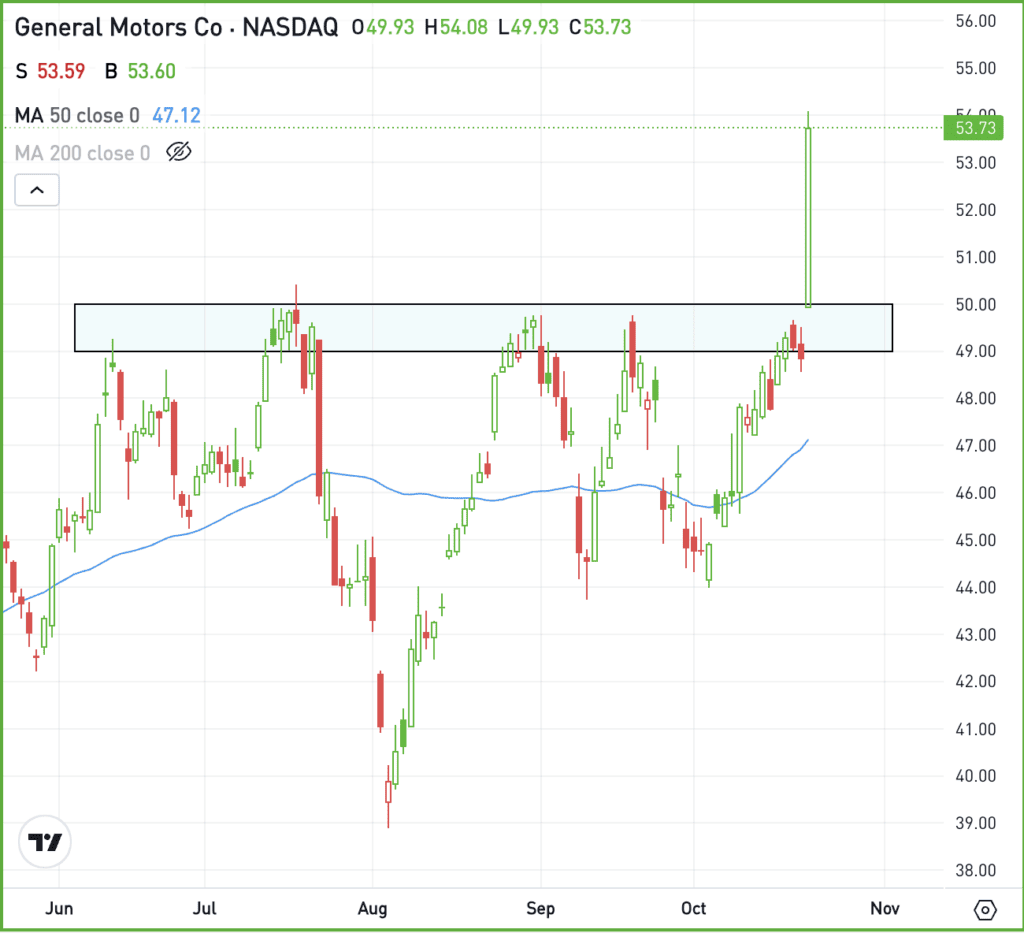

Shares of General Motors surged on Tuesday, climbing almost 10% after reporting its Q3 results. Earnings beat expectations, while revenue of $48.8 billion soared past estimates of $44.4 billion.

The report triggered a massive breakout, with GM soaring over the $49 to $50 resistance zone that has kept a lid on this stock this year.

Breakouts like this can be tough because the stock has already moved so far. However, as long as the stock remains above prior resistance — in this case, $49 to $50 — it often shifts investor sentiment into a “buy the dip” mentality. We’ll see if that’s the case with GM moving forward.

Fundamentally, the company just delivered 29% year-over-year earnings growth for this quarter. In Q4, estimates call for 47.8% growth, and for the full-year, analysts expect earnings growth of 33.3%. However, estimates for fiscal 2025 are currently calling for flat growth.

GM stock trades at just 5.2 times this year’s expected earnings. While automakers like GM and Ford generally fail to attract high valuations on a price-to-earnings basis, ~5 times earnings is considerably lower than the S&P 500, which trades near 21 times.

What Wall Street is watching

PM – Philip Morris stock flew higher on Tuesday, rallying more than 10% on strong quarterly results. The rally was enough to send shares to new all-time highs, after the stock recently took out its prior high from 2017 in September.

T – Verizon shares fell 5% on Tuesday after reporting earnings, but that didn’t weigh on AT&T all that much. While shares dipped slightly yesterday, the stock is rallying in Wednesday’s pre-market session after reporting its own Q3 results.

MCD – Shares of McDonald’s are tumbling this morning, down about 7% after reports of an E. coli outbreak. According to the CDC, “Most sick people are reporting eating Quarter Pounder hamburgers from McDonald’s and investigators are working quickly to confirm which food ingredient is contaminated.”

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.