The Daily Breakdown looks at Tesla after the stock’s big rally ahead of its second-quarter delivery results.

Tuesday’s TLDR

- Tesla stock is at its highest level since January…

- And the automaker will report its Q2 deliveries today.

- Cruise stocks sink as Hurricane Beryl strengthens.

What’s happening?

It’s the last full trading session until Friday and many investors are already planning their multi-day getaway. As we near the Fourth of July holiday though, a few key updates are still on the calendar.

For one, Tesla’s quarterly auto deliveries will be released today.

According to Bloomberg, “Analysts project Tesla will hand over 439,302 EVs in the second quarter, marking a 5.8% drop from a year ago and a second consecutive quarterly decline.”

We’ll see how the final tally comes in. In fact, we’ll see how the final tally comes in for a number of automakers, including Ford and General Motors, among others. For Nio, the firm reported that Q2 deliveries jumped 143.9% year over year to 57,373 vehicles. That led to a 6.4% jump in its stock price yesterday.

Elsewhere, the JOLTs report — which measures job openings — will be released at 10 a.m. ET. From December through April, job openings held steady between 8.75 million and 8.95 million. However, the report showed a decline in May and June, with the tally for the latter coming in at 8.06 million.

Will this report show a rebound, stabilization, or a continuation in the trend?

Want to receive these insights straight to your inbox?

The setup — TSLA

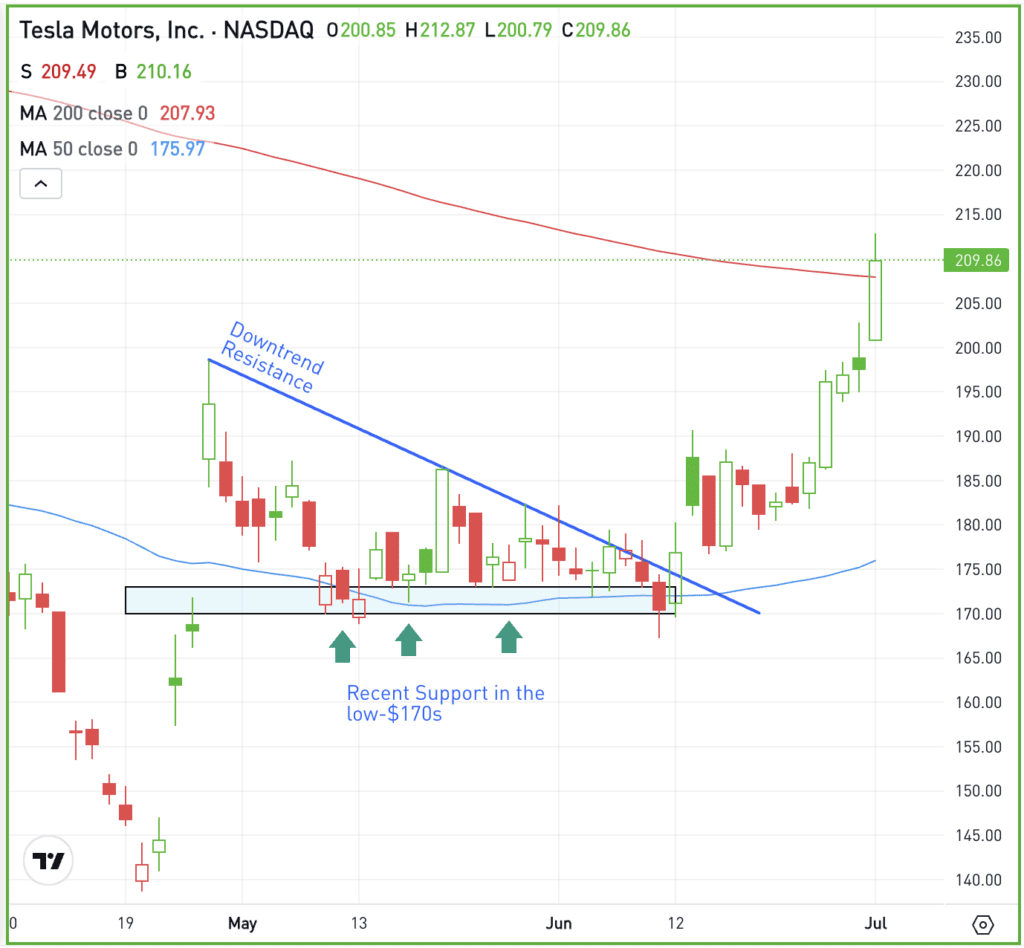

We last looked at Tesla in mid-June, just after the stock had broken out over downtrend resistance. Following the breakout, shares consolidated until last week when the bulls mustered up some strong momentum.

Shares surged ahead on Monday, hitting the 200-day moving average for the first time since January. Now, its Q2 delivery results could go a long way into determining how the stock performs from here.

This breakout and rally has covered a 15% to 20% move. For traders and short-term investors, that likely means trimming their position and taking some profit. For long-term investors, they may decide to keep holding.

If you’re involved with Tesla, know which group you fall into.

The automaker’s delivery result likely isn’t an end-all, be-all event. After all, the company reports earnings in a couple of weeks. But events like this have the potential to stomp on the gas pedal or tap on the brakes in the short term.

What Wall Street is watching

CHWY — After rallying as much as 10.1% in Monday’s session, Chewy shares ended lower by 6.6% on the day. The volatility comes as Keith Gill — known as “Roaring Kitty” — disclosed a 6.6% stake in the firm with more than 9 million shares. This comes after he was involved with GameStop in June.

NCLH — Cruise stocks took a hit as Hurricane Beryl — now a Category 5 storm — struck Grenada. Norwegian Cruise Line and Carnival each plummeted over 5%, while Royal Caribbean dipped by roughly 2%.

TSLA — Shares of Tesla rallied 6.1% on Monday, the stock’s best one-day performance since May 21. The stock also hit its highest level since January, as investors bid the name higher ahead of its Q2 deliveries report. The automaker will report earnings in mid-July and is holding a robotaxi event in early August.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.