The Daily Breakdown takes a closer look Tesla and Alphabet, with both stocks pulling back after they reported earnings.

Wednesday’s TLDR

- Magnificent 7 earnings fail to lift stocks.

- Ethereum ETFs begin trading in the US.

- Caterpillar bulls are hoping for a bounce.

What’s happening?

The next two weeks will be one of the busiest stretches of earnings season, and with so many stock-market favorites reporting, it’s easy to see why.

Two recent favorites include Tesla and Alphabet, both of which reported last night. As of 8:00 a.m. this morning, both names are lower in pre-market trading, which is weighing the S&P 500 and the Nasdaq 100.

Alphabet beat on earnings and revenue estimates, and initially traded higher on the results. However, the pre-market dip seems to be associated with the company’s high capex spending. Tesla — which missed earnings estimates — also talked about its capex spend.

In either scenario, one might expect chip stocks to trade higher upon hearing a reiteration of capex spending from large-cap tech, but that’s not the reaction at the moment — at least in pre-market trading.

Tonight, we’ll hear from Chipotle Mexican Grill, Ford, International Business Machines, and others. Maybe they can help turn around sentiment. And don’t forget, tomorrow morning we’ll get the Q2 GDP report as well. That will give us the latest update on the growth of the US economy.

Want to receive these insights straight to your inbox?

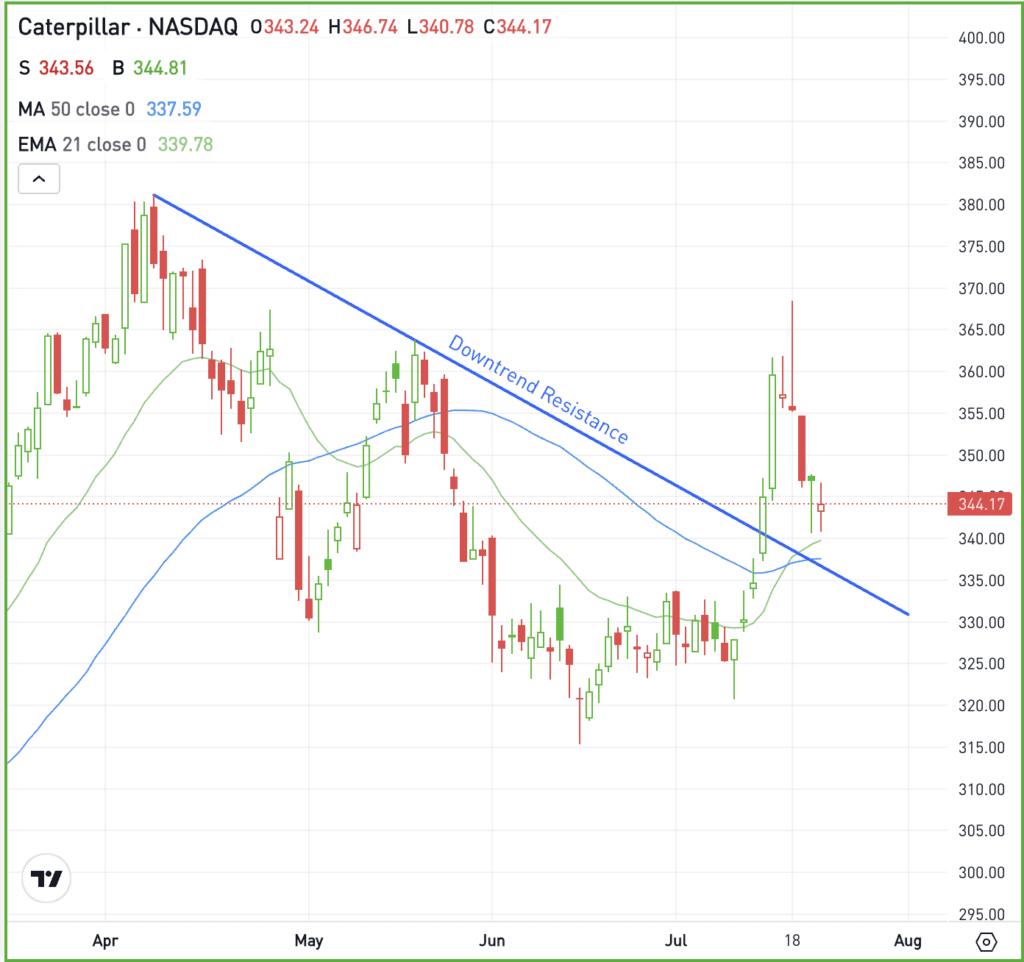

The setup — CAT

Shares of Caterpillar enjoyed a large but short-lived rally earlier this month. The stock cleared downtrend resistance, rallying about 9% in just a few days and climbing almost 15% off the recent low.

However, the stock has quickly given back a bulk of those gains, pulling back in four of the last five days.

Short-term, active bulls want to see Caterpillar hold up above the $330 to $335 area. A break of this level would put the stock back below prior downtrend resistance, nullifying the breakout. It would also drop CAT below the 21-day and 50-day moving averages.

If it can hold these levels though, a bounce back up to the recent highs in the $360s is possible.

Caterpillar reports earnings on August 6 and investors will want to keep that in mind if they are holding CAT stock at that time.

Options

Caterpillar may trade at less than 16 times earnings, but its stock price is high. Because of that, the options prices are high too. This can make it difficult for investors to approach these companies with options.

In that case, many traders may opt to just trade a few shares of the common stock — and that’s fine. However, one alternative is spreads.

Call spreads and put spreads allow traders to take options trades with a much lower premium than buying the calls outright. In these cases, the maximum risk is the premium paid.

Options aren’t for everyone — especially in these scenarios — but spreads make them more accessible.

If you want to upgrade your investing knowledge this summer, make sure to join our eToro Academy Learn & Earn Challenge, where you can take courses, pass quizzes, and earn up to $18 in rewards. Terms and conditions apply.

What Wall Street is watching

LVMH — China’s economic slowdown is significantly impacting European profits. Luxury retailers like Hugo Boss, Burberry, and Daimler Truck have already reported declines in their earnings due to decreased demand. LVMH also joined this list yesterday, highlighting the widespread effects of the slowdown in European businesses.

ETH — On their debut yesterday, the first-ever US-listed spot Ethereum ETFs began trading. The SEC approved these funds on Monday, granting access to institutional and retail traders. Potential net inflows into Ethereum ETFs are estimated at $1.65 billion within three months, lower than the inflow for Bitcoin ETFs. Ethereum climbed 1.2% yesterday, while Bitcoin dipped 2.4%.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.