The Daily Breakdown looks at the earnings-inspired dip in Visa stock, as well as the rout taking place in mega-cap tech stocks.

Thursday’s TLDR

- Nasdaq 100 had its worst day since October 2022.

- Tesla, Alphabet and Ford fall on earnings.

- Visa stock looks for support.

What’s happening?

After a painful end to last week, stocks enjoyed a modest bounce on Monday and Tuesday. However, the sellers were back out in force yesterday.

The S&P 500 fell 2.3%, snapping a streak of 356 sessions without a 2% fall. The Nasdaq 100 tumbled 3.7%, its worst day since October 2022. Both indices closed near the lows of the day.

It’s been a tough stretch. The Nasdaq 100 is now down 8% from its all-time high two weeks ago, while the S&P 500 is down 4.2%.

Now feels like a good time to remind investors that pullbacks — even when they’re sharp and fast — are routine events in the stock market. Remember, over the last 50 years, the S&P 500 has averaged three pullbacks of 5% or more during the year.

We had one correction of that magnitude in April and who knows, maybe another one is brewing now. But despite the selloff, remember that — at least for now — we’re still in the midst of a bull market with a backdrop of strong earnings growth.

Want to receive these insights straight to your inbox?

The setup — V

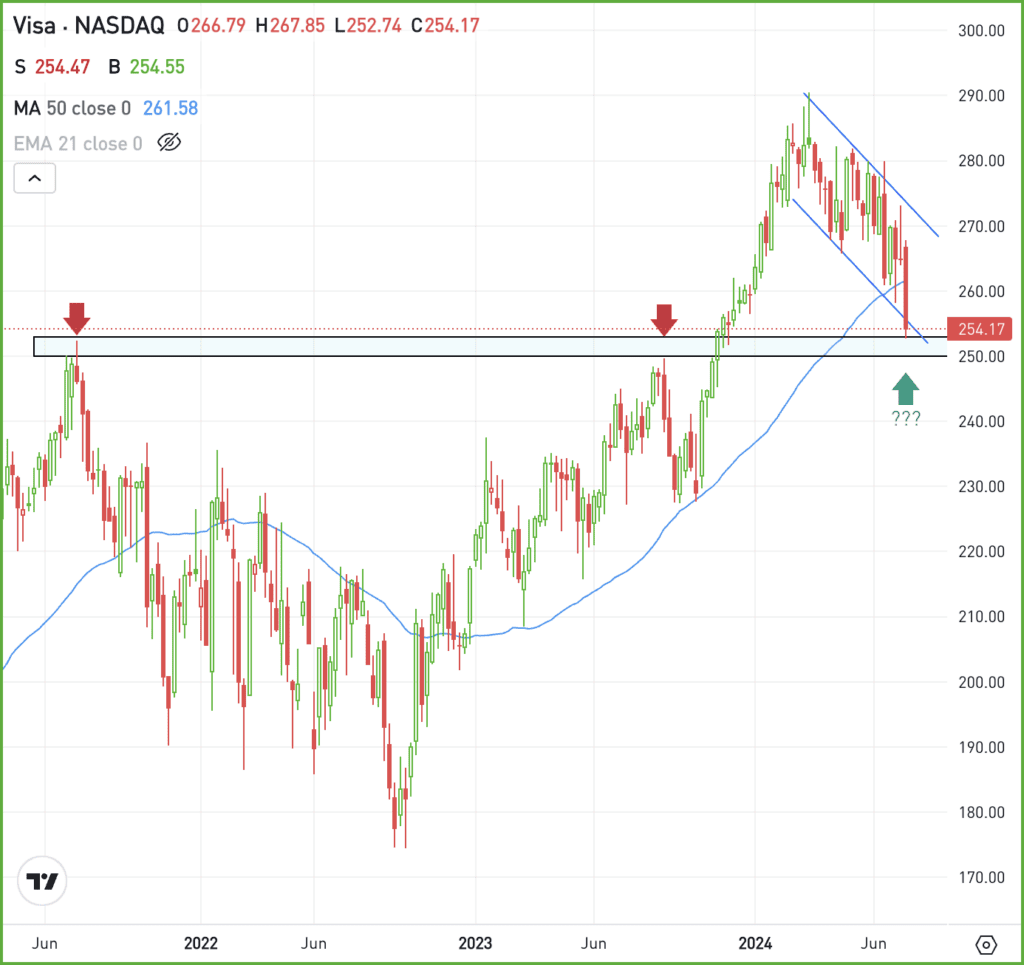

An in-line earnings result on Tuesday evening sent Visa shares lower by 4% on Wednesday. With the decline, shares hit their lowest level since mid-December but dipped into a key level on the charts.

Now down about 13% from the highs, is the dip enough to attract long-term investors?

Can Visa sink further? Absolutely. But the stock has done well over the years, beating the S&P 500 in eight of the last 10 years. Consensus expectations call for 12% to 13% earnings growth in 2024 and 2025 on revenue growth of 8% to 8.5%.

Ideally, the stock will find support in the low-$250s. However, if the selling pressure continues in the indices, it wouldn’t be surprising for it to weigh on V stock.

Options

For options traders, calls or bull call spreads could be one way to speculate on support holding. In this scenario, options buyers limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

GOOG GOOGL — Alphabet beat earnings expectations but missed on YouTube ad revenue estimates, posting $8.66 billion vs. the expected $8.93 billion. Overall revenue was $84.74 billion, beating estimates by $450 million.

TSLA — Tesla shares fell over 12% after reporting weaker-than-expected Q2 earnings. Automotive revenue dropped 7% to $19.9 billion and margins shrank. Facing increased competition and slowing sales, Tesla cut prices globally. Investors now await new vehicle launches and robotaxi announcements.

F — Ford shares dove in after-hours trading as Q2 earnings missed estimates, with management citing warranty issues. Adjusted EPS was 47 cents vs. 68 cents expected, while revenue of $44.81 billion beat estimates of $44.02 billion.

CMG — Chipotle shares jumped in after-hours trading as quarterly earnings and revenue exceeded expectations, driven by a significant increase in restaurant traffic. Net sales rose to $2.97 billion, surpassing analysts’ forecasts.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.