The Daily Breakdown looks at the big selloff in the S&P 500, which had its worst day since mid-February. We also look at Palo Alto Networks.

Friday’s TLDR

- Stocks take a tumble.

- The monthly jobs report is due up this morning.

- Will support hold for Palo Alto Networks stock?

What’s happening?

Congratulations, you made it to another Friday! The first and third Fridays of the month are usually my favorites. That’s when we get the monthly jobs report and the monthly options expiration.

Today, we’ll get the jobs report for the month of March at 8:30 am ET. Let’s see how the report comes in and pay attention to whether it alters expectations for a rate cut later this quarter — more on rates in a minute.

When looking at the jobs report, I like to specifically look at average hourly earnings, as well as the revision for all metrics to the prior month. It helps paint a more accurate picture of the labor market.

For now though, I want to focus on something else: Thursday’s selloff.

The S&P 500 sank 1.2% yesterday, while the Nasdaq fell 1.6%. Both indices closed near session lows, while the S&P 500 suffered its worst one-day loss since mid-February. The selloff appeared to be triggered by some Fed speakers who spoke about the potential of “higher for longer” interest rates.

Earlier this week we spoke about being “optimistic but realistic” — embracing the idea that quarterly 10% gains were not the norm (even though we saw it in Q4 and Q1) and that at some point, a pullback was likely.

I don’t know how big of a dip we’ll get right now. Maybe it will just be a couple of percent. Perhaps it’s something larger. Either way, I think it pays to remember the trend (which has been bullish) and the fundamentals (which are strong).

Until those two things change, it’s hard to change our approach and not view a potential pullback as an opportunity.

The pullback serves as another opportunity to remind us of discipline. Investors who were being a bit too aggressive — or too relaxed with their trading rules — likely took a tough hit on Thursday. Let the decline remind you that, even though bull trends can be rewarding on the way up, the pullbacks can still sting if you’re over-leveraged.

Want to receive these insights straight to your inbox?

The setup — PANW

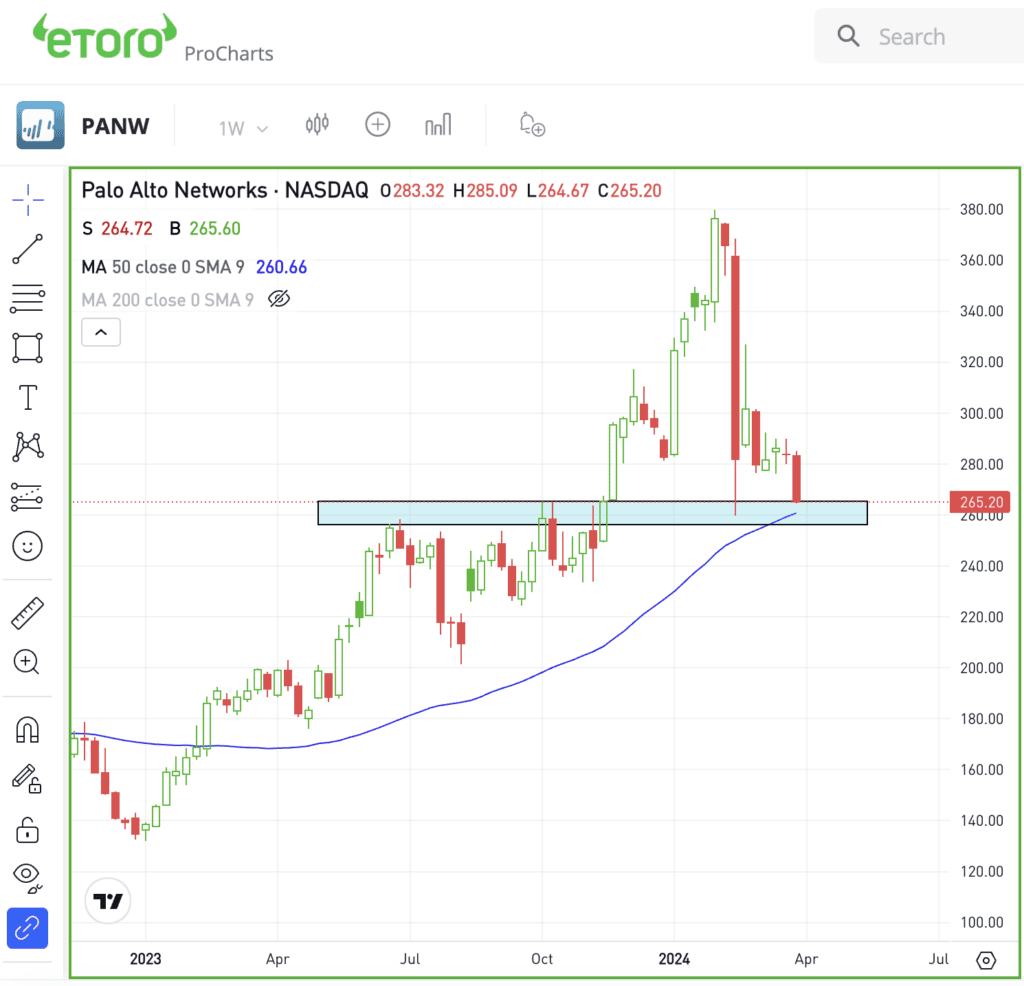

Palo Alto Networks is a premier cybersecurity stock, but the company reported disappointing earnings in February and sold off hard. Shares initially rebounded, but have since rolled back over.

The stock is now down more than 30% from its all-time high hit less than two months ago. Further, it’s coming into a key area on the chart.

That’s as Palo Alto Networks dips back into the $260 to $265 zone, which was prior resistance in 2023 and was initial support on the post-earnings dip. Within that range is also the 50-week moving average, as shown below.

There’s no way to know if this area will hold as support on another test. However, bulls who have liked this name may view the selloff as a buying opportunity.

That being said, understand that this zone could fail as support, ushering in lower prices and increased volatility.

For options traders, calls or bull call spreads could be one way to speculate on support holding. In this scenario, buyers of calls or call spreads limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.