Stocks hit all-time highs and Bitcoin hit roared higher. The Daily Breakdown explores why, then takes a look at Tesla stock.

Thursday’s TLDR

- A tame inflation report ignited a strong rally.

- Retail sales helped as well.

- Shares of Tesla are trying to gain momentum.

What’s happening?

Wednesday’s economic reports were a perfect storm for stocks and crypto. That’s as investors received a favorable inflation report alongside a weaker-than-expected retail sales report.

The ensuing reaction sent the S&P 500 and Nasdaq 100 to new all-time highs, while Bitcoin and Ethereum jumped 7.6% and 5.3%, respectively.

Why did stocks and crypto respond so favorably?

The April CPI report came in pretty tame, with the month-over-month reading of 0.3% missing expectations of 0.4%, while the year-over-year figure was in-line with estimates.

As for retail sales, that report showed flat growth (0%) last month vs. expectations of 0.4% growth. Last month’s numbers were revised lower, too.

For the Fed to cut rates, they need to see lower inflation or a weakening economy (with an obvious preference for the former rather than the latter). However, these reports threaded the needle, with tame inflation and soft economic numbers.

There’s still work to be done on inflation — and we don’t want to see the economy weaken too much — but stocks and crypto reacted so favorably for the simple reason that rate-cut odds have gone up after these reports.

Want to receive these insights straight to your inbox?

The setup — TSLA

One notable stock absent from Wednesday’s rally? Tesla.

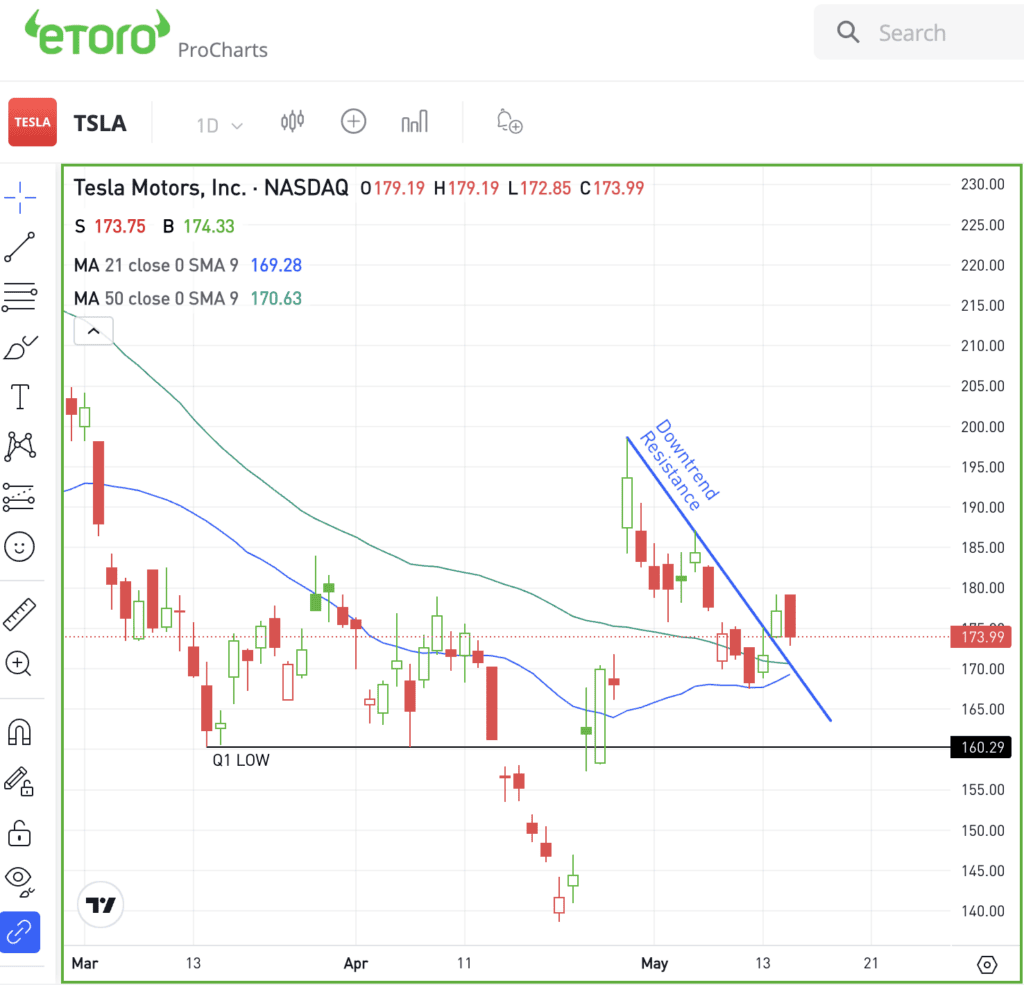

The stock fell 2% on the day and was the worst performer in the Magnificent Seven — even after a strong move on Tuesday sent shares over downtrend resistance.

Although Tesla stock is still down on the year, it has been trading pretty well since it reported earnings in April. After a recent pullback from the $200 area, shares found support near the 21-day and 50-day moving averages.

After clearing downtrend resistance, I want to see if Tesla can regain momentum, potentially putting the $190 to $200 zone back in play.

On the flip side, active bulls could consider using a stop-loss if Tesla breaks below this month’s low near $167. That would also put shares below the key moving averages mentioned above.

Options

For some investors, options could be one way to trade Tesla. Remember the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on shares trading lower.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

SMH — It was an impressive day for semiconductor stocks, as the SMH ETF rallied 3% and is nearing its all-time high up at $239.14. Driving the gains? Broadcom hit an all-time high on Wednesday and Super Micro Computer soared 15.8%, while Nvidia and Advanced Micro Devices each climbed 3.6% and 4.3%, respectively.

WMT — Shares of Walmart are hitting all-time highs in Thursday’s pre-market trading session. Earnings of 60 cents a share beat expectations of 52 cents a share, while revenue of $161.5 billion grew 6% year over year and topped estimates by $3.4 billion. Global e-commerce sales grew 21%, while global advertising revenue grew 24%.

MNDY — Monday.com soared after the firm’s Q1 results beat analysts’ expectations for earnings and revenue, with the latter growing more than 33% year over year. Management also increased its full-year forecast, attributing the optimistic outlook to robust demand and improved customer engagement after a recent price hike.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.