Markets are bouncing, helping to quiet down some of the fears on Wall Street. The Daily Breakdown takes a closer look at the homebuilders.

Wednesday’s TLDR

- Investors bought the dip, quieting volatility concerns.

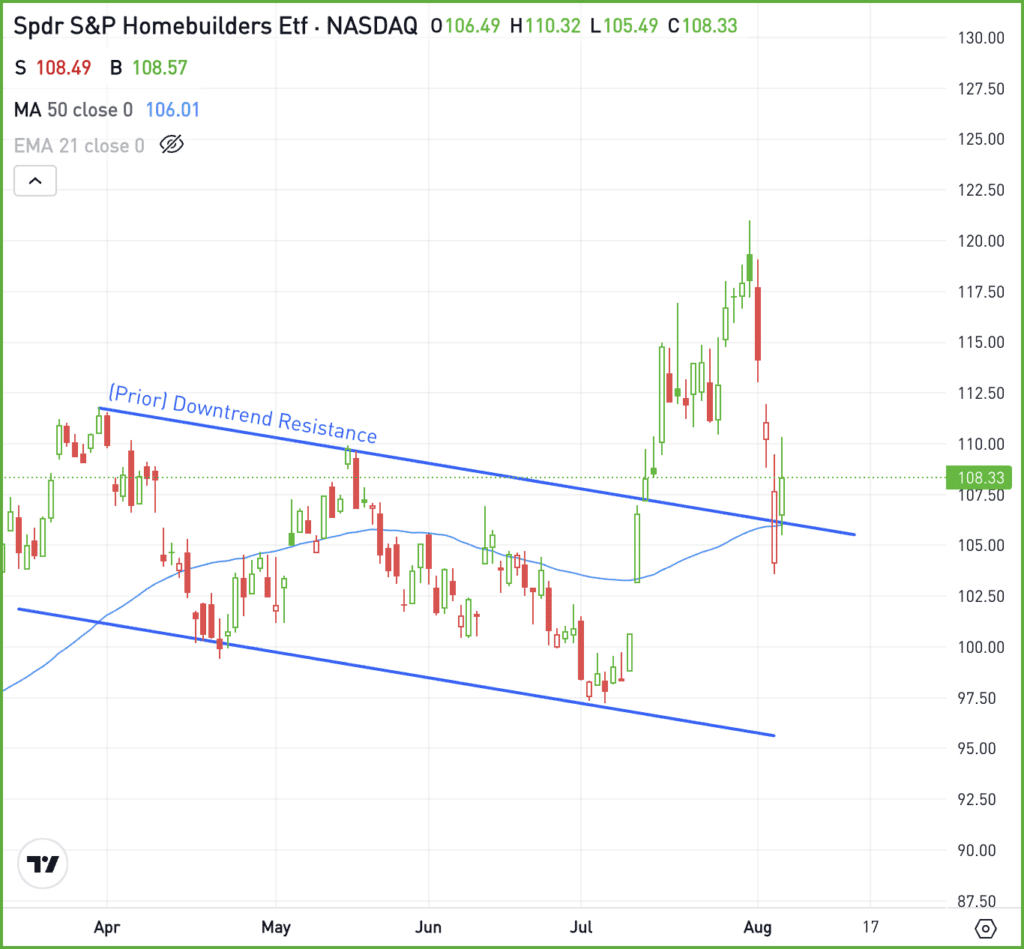

- Homebuilder stocks try to hold key support.

- Shopify rallies hard on earnings beat.

What’s happening?

We’re seeing rapid movements in all directions. In fact, at yesterday’s high, the S&P 500 and Nasdaq 100 were only down about 0.5% from Friday’s close — not exactly “flat,” but a far cry from how the situation looked on Monday morning.

Yesterday I said that the selloff “was due to market mechanics, not some worrisome breakdown in the economy.” Let’s dig into that.

To be clear, there has been some softness in the economy and in particular, the labor market. Jobs feed the consumer and consumption is the lifeblood of the US economy, accounting for roughly 70% of US GDP.

Friday’s weak jobs report looked like the catalyst for Friday’s dip — and to some extent, it was — but something else was breaking down under the hood. That’s as the carry trade with the Japanese yen was unraveling.

Without getting too into the weeds, a carry trade involves borrowing in one currency and buying assets with another currency. When that trade is forcefully unwound, volatility can explode as funds are forced to liquidate all sorts of assets.

We were seeing the first effects of this late last week, but it accelerated meaningfully on Monday. That’s why we saw so much volatility — and not just here in the US, but everywhere. Global stocks, bonds, and crypto were undergoing massive moves!

This highlights how risk can seemingly come out of nowhere, but it also serves as a reminder that — at least for now — things here in the US are still okay provided the jobs market doesn’t slow down too much.

Want to receive these insights straight to your inbox?

The setup — XHB

US 30-year mortgage rates dropped to 6.55%, the lowest since May 2023, as rates come under pressure. One would hope that that’s promising news for prospective home-buyers, as well as the homebuilders.

That has us looking at the homebuilders ETF — the XHB — which like most assets, experienced increased volatility this week.

However, the ETF is holding a key area on the charts and has the fundamental backdrop of building houses at a time where there’s still a housing shortage.

Notice the prior channel that XHB was stuck in before breaking out of it in July. Now pulling back, the ETF is holding that prior downtrend level, as well as the 50-day moving average.

If XHB can regain the $110 level, perhaps it can make a push back toward the recent highs. On the downside, a break of the $103 area could usher in more weakness.

Options

Buying calls or call spreads may be one way to take advantage of a bounce. For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

In either scenario, it may be advantageous to make sure they have adequate time until the option’s expiration. Remember, option buyers limit their risk to the price paid for the option.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

SHOP — Shares of Shopify are ripping higher this morning after the company beat on earnings and revenue expectations for Q2. Sales climbed 21.3% year over year, while Gross Merchandise Volume (GMV) increased 22% to $67.2 billion.

DIS — Disney stock is basically flat this morning despite solid quarterly results. Earnings of $1.39 a share easily topped expectations for $1.19 per share, while revenue of $23.16 billion grew 3.7% year over year and topped estimates by $70 million. CEO Bob Iger noted that the company “achieved profitability across our combined streaming businesses for the first time and a quarter ahead of our previous guidance.”

BTC — Bitcoin rebounded on Tuesday, climbing 3.7% and closing back above $56,000. Given that it dipped below $50,000 at one point this week, BTC was able to close more than 12% above its recent low and is attempting to rebound even further today, up 2% at the time of this writing.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.