The Daily Breakdown talks about the S&P 500’s push for 5,000, as well as the breakout in Palantir after it reported earnings.

Thursday’s TLDR

- S&P 500 hits another all-time high.

- Palantir stock is up 41% in two days.

- Disney jumps on earnings beat.

What’s happening?

Active investors have their focus on the S&P 500 hitting 5,000, a major milestone that’s garnering a lot of attention.

The index came this close to hitting the mark yesterday, topping out at 4,999.89.

Can we get there today? That’s the bulls’ hope. While it will be an exciting milestone to hit — whenever that may be — it’s also hard to imagine stocks blowing through this level without looking back.

Going for its 14th weekly gain in the last 15 weeks is incredibly impressive for the S&P 500, it’s just not a sustainable pace.

The 5,000 level is a key focus from a psychological perspective, but it’s also in focus for the options market. When big levels attract a lot of options activity, it can act as a magnet. While that’s great when we’re looking for more upside to a key level — like the S&P hitting 5,000 — it can also limit the upside once we get there.

That doesn’t mean it’s guaranteed to act as a wall of resistance, but it’s something for investors to keep in mind as we approach a major milestone.

Want to receive these insights straight to your inbox?

The setup

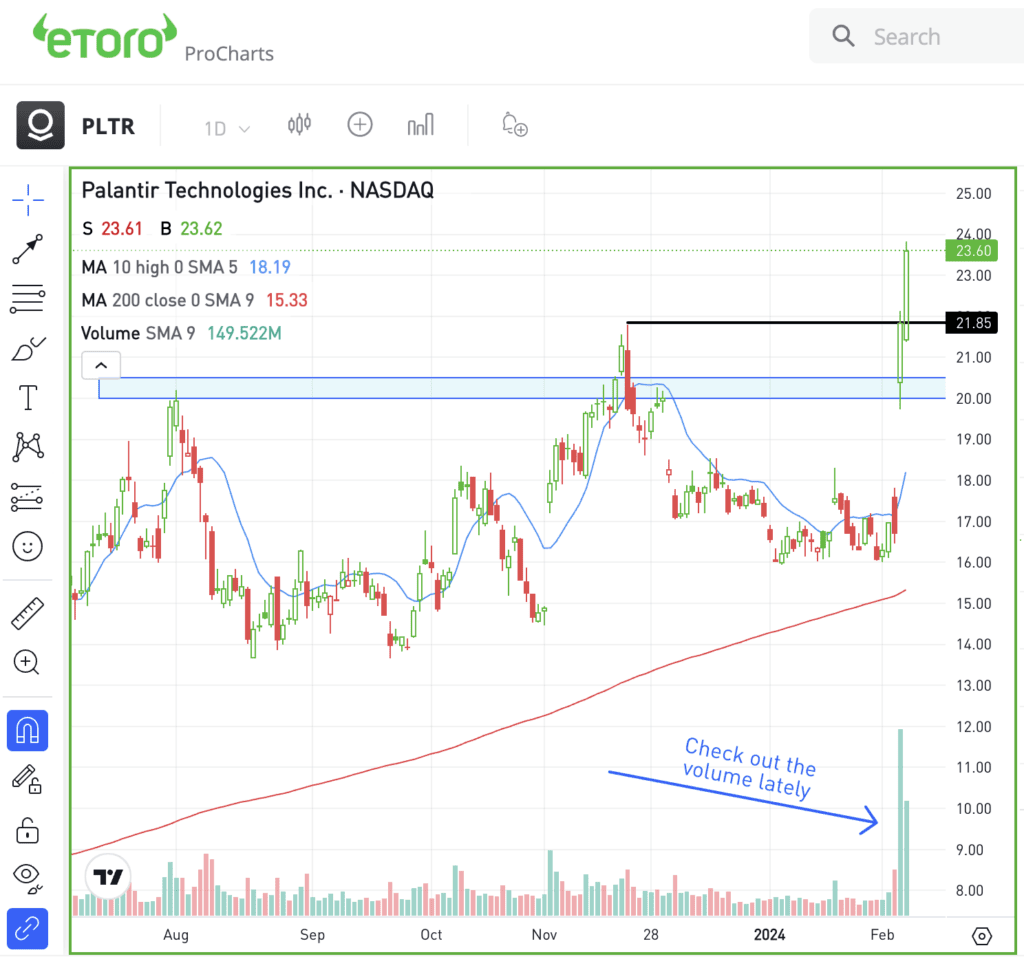

Palantir stock has enjoyed a huge post-earnings rally, up more than 40% over the past two days.

After rallying 30.8% on Tuesday, shares paused at the November high of $21.85. Admittedly, I was keeping an eye on this mark for a potential breakout, but I didn’t expect Palantir to blow through this level on heavy volume just a day later.

If Palantir holds up above $20, it’s hard to get too bearish on the name, and if it holds above the Q4 high at $21.85, it’s even harder.

However, if that happens and Palantir breaks below these levels, it could be vulnerable to a larger correction.

Ideally, the stock will consolidate above last quarter’s high, allowing some of its short-term moving averages to catch up while it recharges for more potential upside.

If it can maintain its bullish momentum, investors will quickly turn their attention to $25 to see if Palantir can get to that mark.

What Wall Street is watching

DIS: Disney shares rose 6% in after-hours trading after beating Q1 earnings expectations, forecasting a 20% earnings increase to $4.60 per share in 2024, and unveiling a stock buyback plan and dividend reinstatement. The firm also noted a $1.5 billion investment in Epic Games.

PYPL: Despite beating Q4 earnings and revenue expectations, PayPal shares fell 8% due to a cautious full-year outlook for 2024, as management aims to rebuild trust amid the company’s ongoing leadership transition.

ARM: Arm Holdings stock jumped more than 20% in after-hours trading as the company beat earnings expectations and raised its full-year guidance. Enhanced royalty rates and gains in the cloud-server and automotive sectors are contributing to its positive trajectory. The stock is prepped to open at all-time highs today.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.