Which is better, the S&P 500 or the Nasdaq 100? The Daily Breakdown sets to figure it out by looking at the indices’ performance.

Friday’s TLDR

- The Nasdaq 100 has topped the S&P 500 over the last decade

- But its drawdowns have been more pronounced, too

- Amazon looks to regain traction

The Bottom Line + Daily Breakdown

This has been a short week for markets due to the Labor Day holiday. However, we have spent a bulk of it talking about the general underperformance of tech stocks (and the specific underperformance of semiconductors) despite the better performance from the broader market and other sectors.

So that got me thinking: Is it really all about tech?

For a quick comparison, I kept it simple and looked at the SPY vs. the QQQ ETFs.

We’ve seen tech really balloon over the last decade. That’s thanks in part to companies like Apple, Microsoft, Alphabet, Amazon, and Meta charging toward and above the coveted $1 trillion market cap.

As such, the QQQ has climbed more than 400% over the last decade, dwarfing the roughly 230% gain in the SPY — (which is still quite respectable, by the way).

Since January 2015, the QQQ has delivered a compound annual growth rate (CAGR) of roughly 18% vs. a CAGR of “just” 13% for the SPY — again, this is still quite good.

But there’s no doubt about it: Tech has trounced the broader market over the last decade.

Taking the ups with the downs

In many ways, looking at the last 10 years or so has been somewhat cherry-picked. Not only are the biggest companies in tech, but they are some of the best performers of the last decade. So of course the Nasdaq 100 has outperformed the S&P 500!

But it’s not quite that simple.

Take 2022 for example. The QQQ ETF suffered a decline of 37.8% vs. a fall of “just” 27.5% for the S&P 500. While tech was getting clobbered — including a peak-to-trough decline of roughly 77% for Meta and a 69% tumble for AI-fave Nvidia — the S&P 500 held up notably better.

Further, if we look back since the turn of the century (from 2000 to present), the total return for the SPY and QQQ are similar, at 485% and 491%, respectively.

The Bottom Line

There’s not much of an argument to be made over the past five or ten years — tech has been dominant.

However, it’s also correct to acknowledge that the drawdowns can be more pronounce — and particularly violent for individual stocks — when looking at the tech space.

These are all factors that investors should consider when looking at their investing goals.

Want to receive these insights straight to your inbox?

The setup — AMZN

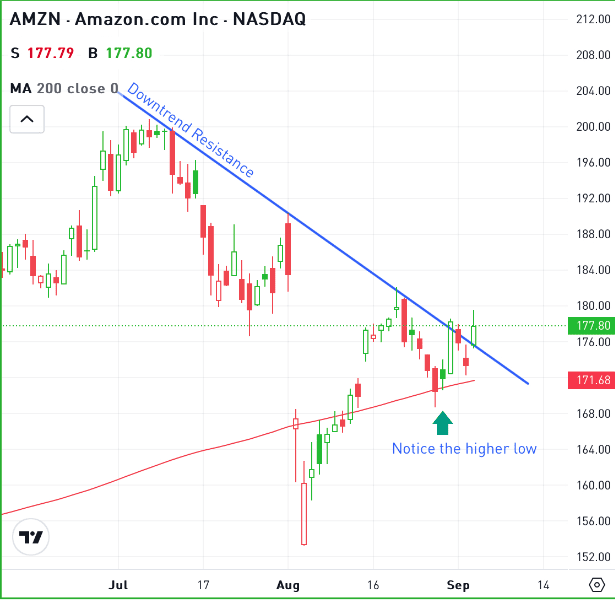

Shares of Amazon didn’t perform all that well after reporting earnings in late July. The selloff in the broader market in early August didn’t help matters.

But now, the stock is trying to find some bullish momentum. That comes after AMZN breaks out over downtrend resistance.

Also notice how Amazon shares recently pulled back and held the 200-day moving average as support before pushing through downtrend resistance.

For bullish traders, they want to see Amazon hold the $168 level. Below that mark and shares will drop back below downtrend resistance, the 200-day, and the recent low. That development could usher in more selling pressure, potentially putting the recent low back in play.

However, if AMZN can stay above this level — and preferably, above all the measures mentioned above — then a larger rebound could ensue.

Options

For some investors, options could be one alternative to speculate on AMZN. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and AMZN rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.