The Daily Breakdown looks at the S&P 500 as it makes another record high. We also look at the pullback in Morgan Stanley.

Tuesday’s TLDR

- Stocks hit another record high as bulls remain optimistic.

- Retail sales are in focus this morning.

- Morgan Stanley stock is trying to rebound after the dip.

What’s happening?

On Monday, the S&P 500 climbed to its 30th record high of the year — which is pretty impressive when you consider that we’re not even halfway through 2024 yet.

Investors seem unbothered by the “when not if” rate-cut situation with the Fed, feeling comfortable that rate cuts will eventually come at some point this year.

While this report likely won’t have as much of an impact as the major inflation reports — like the CPI or PCE numbers — this morning’s retail sales report will be the latest consideration for when the Fed may consider lowering rates.

With the exception of a strong headline number for the monthly jobs report, the US has had some soft economic data over the last six weeks. More than two-thirds of our economy is driven by the consumer, so this retail sales report will give us a good look at what’s been going on and how strong or weak the consumer has been.

Remember: Tomorrow’s US trading session is closed!

Want to receive these insights straight to your inbox?

The setup — MS

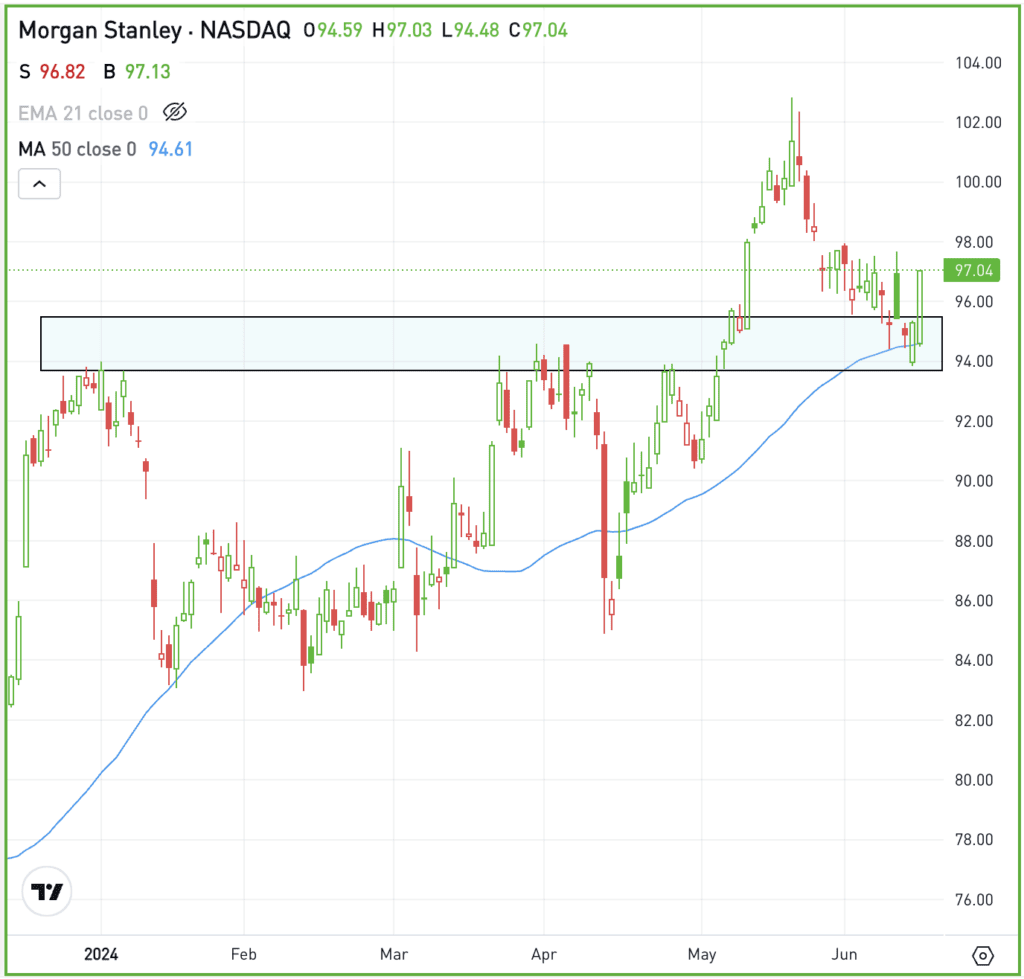

Morgan Stanley hit 52-week highs in May, but has pulled back steadily, declining in four straight weeks.

Now though, the stock is trying to find support near the 50-day moving average and the $95 area, which had been resistance until the stock broke out and ran to its recent high of $103.25.

Now rallying out of this zone, bulls want to see Morgan Stanley shares hold up above the recent low near $94. If it can continue higher and clear $98, then $100 and the recent high could be in play.

Options

For some investors, options could be one alternative to speculate on MS. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and MS rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

XLK — Major tech ETF XLK will rebalance with Microsoft and Nvidia commanding a weighting of around 21% each, while cutting Apple dramatically down to a weighting of approximately 4.5% due to diversification rules, per SPDR Americas Research head Matthew Bartolini. Despite all three having a similar market cap, this reshuffles the ETF from a prior weighting of ~22% for Microsoft and Apple, and ~6% for Nvidia.

TSLA — Investors continue to digest Tesla’s recent shareholder vote results, but the stock has been gaining. They voted on the company’s reincorporation in Texas, as well as CEO Elon Musk’s compensation package. Further, Musk has talked optimistically about Tesla’s future valuation and the company’s next “Master Plan.”

BTC — Bitcoin prices continue to consolidate. After trying to break out over a key resistance level, the top cryptocurrency by market cap continues to trade in a sideways-to-lower manner. Some argue that this will eventually lead to a stronger rally if and when it breaks out, while others speculate that Bitcoin bulls are waiting (and hoping) for good news regarding Ethereum ETFs.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.